In the ever-evolving world of global finance, the Chinese and US stock markets stand as two of the most significant and influential. Understanding the key differences and similarities between these two markets is crucial for investors and traders looking to diversify their portfolios. This article provides a detailed comparison of the Chinese and US stock markets, focusing on key aspects such as market structure, performance, and investment opportunities.

Market Structure

The Chinese stock market operates under a different regulatory framework compared to the US stock market. The Shanghai and Shenzhen stock exchanges, the two major bourses in China, are state-controlled and regulated by the China Securities Regulatory Commission (CSRC). The US stock market, on the other hand, is regulated by the Securities and Exchange Commission (SEC) and operates with a more decentralized structure.

Performance

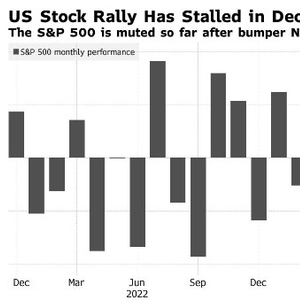

When it comes to performance, both markets have experienced significant growth over the years. The Chinese stock market has been on an upward trajectory, with the Shanghai Stock Exchange Composite Index (SSE) and the Shenzhen Stock Exchange Composite Index (SZSE) posting strong gains. The US stock market, particularly the S&P 500, has also seen substantial growth, making it one of the most profitable markets globally.

Investment Opportunities

Investors looking to invest in the Chinese stock market should be aware of the unique opportunities and challenges. The Chinese market offers exposure to a wide range of industries, including technology, consumer goods, and healthcare. Companies like Alibaba, Tencent, and Huawei are some of the key players in the Chinese market.

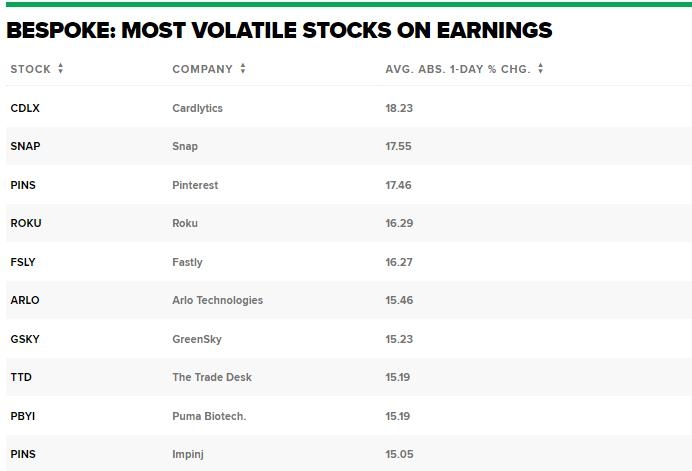

Similarly, the US stock market offers a diverse range of investment opportunities, with sectors like technology, healthcare, and energy leading the charge. Companies like Apple, Microsoft, and Amazon are some of the major players in the US market.

Case Studies

To better understand the differences between the two markets, let's consider a few case studies. The Alibaba Group Holding Limited (BABA), a Chinese e-commerce giant, offers investors exposure to the rapid growth of the Chinese online retail sector. On the other hand, Apple Inc. (AAPL), an American technology company, represents the strength and stability of the US stock market.

Conclusion

In conclusion, both the Chinese and US stock markets offer unique investment opportunities and challenges. Investors should conduct thorough research and consider their risk tolerance before deciding where to invest. By understanding the key differences and similarities between these two markets, investors can make informed decisions and potentially maximize their returns.

Keywords: Chinese stock market, US stock market, Shanghai Stock Exchange, Shenzhen Stock Exchange, Securities and Exchange Commission, investment opportunities, Alibaba Group Holding Limited, Apple Inc.