The United States stock market, often regarded as the world's most robust and dynamic, is home to several key players known as "big market makers." These entities play a pivotal role in the day-to-day operations of the stock market, ensuring liquidity, facilitating trading, and influencing stock prices. In this article, we will delve into the world of big market makers, their significance, and some of the most prominent players in the US stock market.

Understanding the Role of Market Makers

Market makers are financial institutions that provide liquidity to the stock market by constantly buying and selling securities. They offer bid and ask prices for shares, allowing investors to buy or sell quickly and efficiently. These prices are typically slightly different to account for the market maker's profit margin.

The primary role of market makers is to ensure that there is a market for shares at all times, even in thinly traded stocks. This is crucial for the smooth functioning of the stock market, as it enables investors to execute trades promptly without the fear of being stuck with an unsellable asset.

Significance of Big Market Makers

Big market makers are the backbone of the stock market. They have a significant impact on the market by:

- Enhancing Market Liquidity: By providing continuous bid and ask prices, they ensure that there is always a market for shares, making it easier for investors to buy and sell securities.

- Facilitating Trading: They execute trades on behalf of investors, enabling them to buy or sell shares without the need to search for a buyer or seller.

- Influencing Stock Prices: As they buy and sell large volumes of stocks, their actions can influence stock prices.

Prominent Big Market Makers

Several financial institutions stand out as big market makers in the US stock market. Some of the most prominent ones include:

- J.P. Morgan Chase & Co.: One of the largest banks in the United States, J.P. Morgan Chase & Co. is a leading market maker in various sectors, including financials, technology, and healthcare.

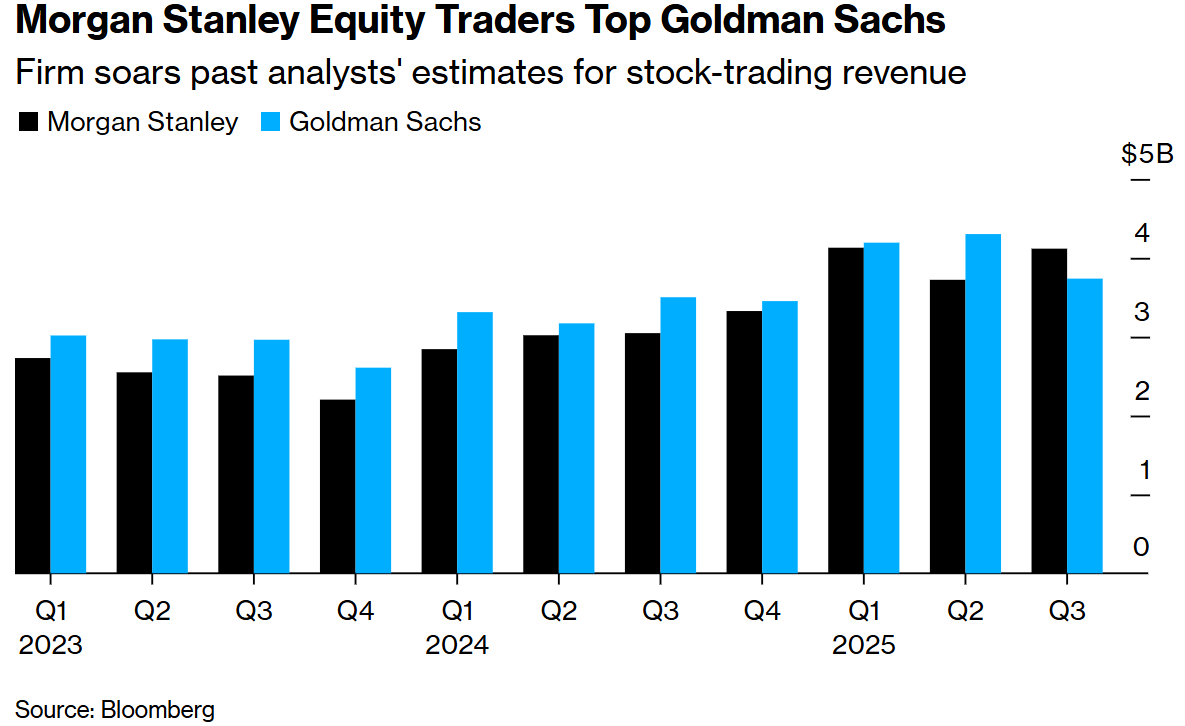

- Goldman Sachs: This investment bank is renowned for its market-making activities, particularly in the technology and healthcare sectors.

- Morgan Stanley: Another major investment bank, Morgan Stanley is active in market-making across various sectors, including financials, consumer discretionary, and technology.

- Bank of America Corporation: As one of the largest banks in the country, Bank of America Corporation is a key player in the market-making space, particularly in the financials and technology sectors.

- Citigroup Inc.: This financial services giant is active in market-making across various sectors, including financials, technology, and consumer discretionary.

Case Studies

One notable case study involving big market makers is the "Flash Crash" of May 2010. This sudden and massive drop in the stock market was attributed, in part, to the actions of large market makers. These institutions faced technical issues, causing them to sell off large positions in a short period, which, in turn, triggered further selling and panic in the market.

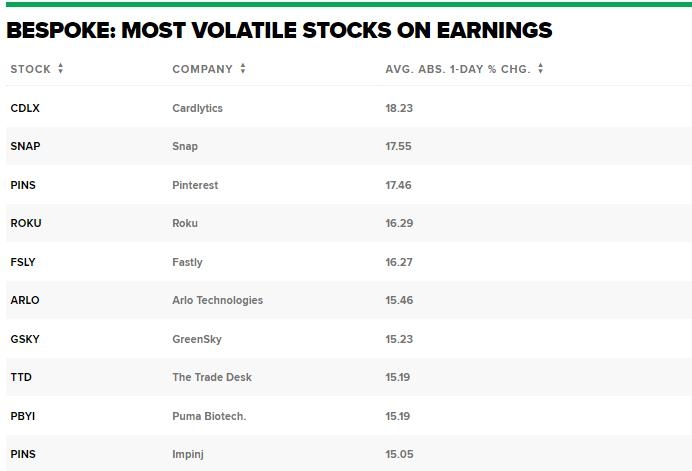

Another example is the "Reddit Effect," where retail investors, fueled by platforms like Reddit, drove up the stock prices of several companies, including GameStop and AMC Entertainment. Big market makers had to adapt to the sudden surge in trading volume and volatility, ensuring that the market remained functional.

Conclusion

Big market makers play a crucial role in the US stock market, providing liquidity, facilitating trading, and influencing stock prices. Their presence ensures the smooth functioning of the market, enabling investors to buy and sell securities efficiently. By understanding the significance of these key players, investors can gain valuable insights into the workings of the stock market.