Introduction:

The price-to-earnings (P/E) ratio is a crucial metric for investors to gauge the valuation of a company. It is often used as a benchmark to determine if a stock is overvalued or undervalued. In this article, we will delve into the average P/E ratio of US stocks, exploring its significance and factors that influence it. Additionally, we will discuss some notable cases to provide a clearer understanding of this vital financial indicator.

Understanding the Average P/E Ratio:

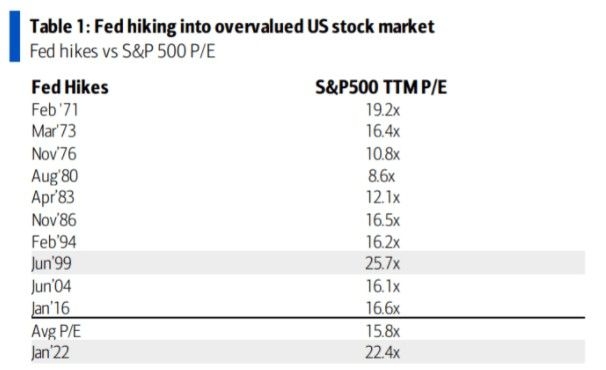

The average P/E ratio of US stocks is a calculated figure that represents the overall valuation of the stock market. It is obtained by dividing the total market capitalization of all stocks by the total earnings of all companies within the market. The resulting figure provides a snapshot of the market's overall value in relation to its earnings.

Significance of the Average P/E Ratio:

The average P/E ratio plays a vital role in the investment community for several reasons:

Market Valuation: It helps investors assess whether the stock market is overvalued or undervalued. A higher P/E ratio indicates that stocks are expensive relative to their earnings, suggesting caution may be warranted. Conversely, a lower P/E ratio implies that stocks are relatively cheap.

Comparative Analysis: Investors can compare the average P/E ratio of the US stock market with other markets or sectors to identify potential investment opportunities.

Economic Indicators: The average P/E ratio can act as an economic indicator, providing insights into the market's expectations for future growth or contraction.

Factors Influencing the Average P/E Ratio:

Several factors contribute to the average P/E ratio of US stocks:

Interest Rates: Lower interest rates tend to drive up the P/E ratio as investors seek higher returns in riskier assets.

Economic Growth: A strong economy with robust earnings growth can lead to a higher P/E ratio.

Market Sentiment: Optimism in the market can cause the P/E ratio to rise, while pessimism can drive it down.

Inflation: Higher inflation can erode earnings and, subsequently, lead to a lower P/E ratio.

Notable Cases:

To illustrate the impact of the average P/E ratio, let's examine two notable cases:

Dot-com Bubble (2000): The average P/E ratio of US stocks skyrocketed during the dot-com bubble, reaching an all-time high of around 44. This excessive valuation led to a dramatic correction in the stock market, with the P/E ratio falling to around 19 by 2003.

Financial Crisis (2008): The average P/E ratio dropped sharply during the financial crisis, falling from approximately 22 in 2007 to around 13 in 2009. This decrease reflected the market's cautious stance and the expectation of a slow recovery.

Conclusion:

The average P/E ratio of US stocks is a vital metric for investors to evaluate the market's valuation. Understanding its significance and the factors that influence it can help investors make informed decisions. By analyzing notable cases, we can gain a clearer perspective on how the average P/E ratio can impact the stock market.