In the vast and dynamic world of finance, understanding the total US stock market indices is crucial for investors, traders, and financial analysts alike. These indices serve as a snapshot of the broader market, reflecting the performance of thousands of stocks across various sectors. This article aims to provide a comprehensive guide to the total US stock market indices, including their significance, composition, and how they can be used to make informed investment decisions.

Understanding the Total US Stock Market Indices

The total US stock market indices are a collection of indexes that track the performance of the entire US stock market. The most well-known of these indices include the S&P 500, the Dow Jones Industrial Average, and the NASDAQ Composite. Each index serves a different purpose and provides unique insights into the market.

The S&P 500

The S&P 500, or Standard & Poor's 500, is one of the most widely followed stock market indices in the world. It consists of 500 large-cap companies from various sectors, representing approximately 80% of the total market capitalization of all US stocks. The S&P 500 is often used as a benchmark for the overall health of the US stock market and is considered a reliable indicator of market trends.

The Dow Jones Industrial Average

The Dow Jones Industrial Average, or simply the Dow, is another iconic stock market index. It includes 30 large-cap companies across various sectors, such as technology, finance, and healthcare. The Dow is known for its historical significance and is often used to track the performance of the blue-chip companies in the US stock market.

The NASDAQ Composite

The NASDAQ Composite is the largest stock market index in the world, tracking the performance of more than 3,000 companies listed on the NASDAQ exchange. It is particularly known for its heavy representation of technology companies, making it a key indicator of the tech sector's performance.

Using Total US Stock Market Indices for Investment Decisions

Understanding the total US stock market indices can help investors and traders make informed decisions. Here are a few ways these indices can be used:

Market Trend Analysis: By analyzing the performance of the total US stock market indices, investors can gain insights into market trends and make predictions about future market movements.

Sector Rotation: Investors can use the total US stock market indices to identify sectors that are performing well and rotate their investments accordingly.

Portfolio Diversification: By investing in a mix of total US stock market indices, investors can achieve portfolio diversification and reduce risk.

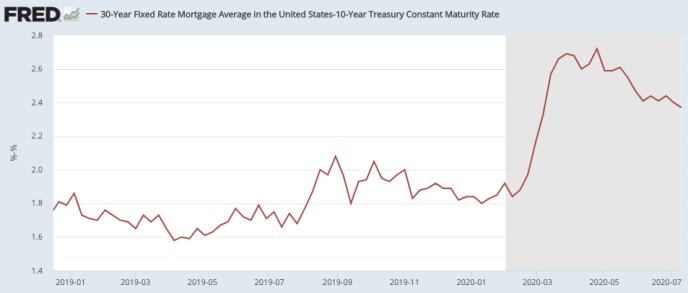

Case Study: The 2020 Stock Market Crash

One notable example of how total US stock market indices can impact the market is the 2020 stock market crash. In March 2020, the COVID-19 pandemic caused a significant downturn in the stock market, leading to a sharp decline in the S&P 500, Dow, and NASDAQ Composite. This event highlighted the importance of understanding these indices and being prepared for market volatility.

In conclusion, the total US stock market indices are essential tools for investors and traders looking to navigate the complex world of finance. By understanding the significance and composition of these indices, investors can make informed decisions and achieve their financial goals.