In the ever-evolving tech industry, NVIDIA stands as a leading force in the development of graphics processing units (GPUs) and artificial intelligence (AI). As such, the stock price of NVIDIA has been a hot topic among investors and tech enthusiasts alike. In this article, we will delve into the factors that influence NVIDIA's stock price and provide an overview of its performance in US dollars.

Understanding the Stock Price Dynamics

The stock price of NVIDIA, like any other publicly-traded company, is influenced by a variety of factors. These include the company's financial performance, market trends, industry developments, and investor sentiment. To better understand the dynamics at play, let's explore some key factors:

1. Financial Performance

NVIDIA's financial performance is a primary driver of its stock price. The company's revenue and earnings reports are closely monitored by investors, as they provide insights into the company's profitability and growth potential. Over the years, NVIDIA has consistently delivered strong financial results, leading to a steady increase in its stock price.

2. Market Trends

The tech industry is subject to rapid changes, and market trends can significantly impact NVIDIA's stock price. For instance, the rise of AI and deep learning has been a major catalyst for NVIDIA's growth, as its GPUs are widely used in these applications. Additionally, the increasing demand for high-performance GPUs in gaming and cryptocurrency mining has also contributed to the company's success.

3. Industry Developments

Industry developments, such as the launch of new products or partnerships, can have a significant impact on NVIDIA's stock price. For example, the introduction of the NVIDIA GeForce RTX 30 series GPUs in 2020 received widespread acclaim and contributed to a surge in the company's stock price.

4. Investor Sentiment

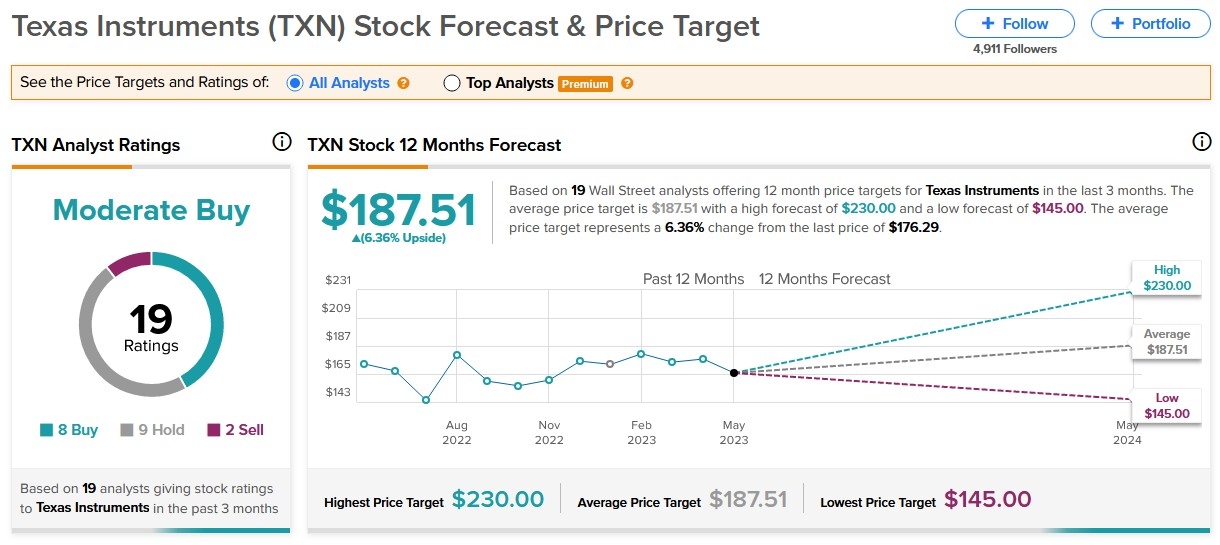

Investor sentiment plays a crucial role in determining the stock price of NVIDIA. Factors such as market speculation, analyst ratings, and news about the company can all influence investor sentiment. In recent years, NVIDIA has been well-received by investors, leading to a steady increase in its stock price.

Analyzing NVIDIA's Stock Price Performance

To get a clearer picture of NVIDIA's stock price performance, let's take a look at some historical data. As of the time of writing, NVIDIA's stock price has experienced several notable trends:

- 2019: NVIDIA's stock price began the year at around

130 per share and ended at approximately 180 per share, reflecting a significant increase of nearly 40%. - 2020: The stock price continued its upward trend, starting at around

200 per share and ending the year at approximately 450 per share, marking a substantial increase of over 125%. - 2021: NVIDIA's stock price maintained its growth momentum, starting the year at around

450 per share and reaching a high of over 500 per share in early 2021.

These trends demonstrate the strong performance of NVIDIA's stock price over the past few years, driven by the company's impressive financial results and market positioning.

Conclusion

In conclusion, the NVIDIA stock price in US dollars has been influenced by a variety of factors, including the company's financial performance, market trends, industry developments, and investor sentiment. By understanding these factors, investors can gain valuable insights into the potential future performance of NVIDIA's stock. As the tech industry continues to evolve, NVIDIA remains a compelling investment opportunity for those looking to capitalize on the growth of AI and high-performance computing.