In the ever-evolving world of investments, the choice between multinational stocks and US stocks in the same industry can be a daunting task. Both options come with their own set of advantages and disadvantages, making it crucial for investors to conduct a thorough analysis. This article delves into a comparative study of multinational stocks and US stocks in the same industry, providing valuable insights to aid investors in making informed decisions.

Understanding Multinational Stocks

Multinational stocks refer to shares of companies that operate in multiple countries. These companies benefit from the diversification of risks and rewards associated with operating in different markets. Some key advantages of multinational stocks include:

Global Presence: Multinational companies often have a strong presence in emerging markets, where growth potential is substantial. This allows investors to tap into these markets without directly investing in them.

Diversification: By investing in multinational stocks, investors can diversify their portfolios across different geographies, industries, and currencies.

Economic Stability: Multinational companies may have more stable earnings due to their diversified operations and exposure to various economic environments.

Understanding US Stocks

On the other hand, US stocks refer to shares of companies listed on American exchanges, such as the New York Stock Exchange (NYSE) and the NASDAQ. Here are some key features of US stocks:

Economic Stability: The US economy is generally considered to be the most stable and mature in the world. This can be beneficial for investors looking for long-term, consistent returns.

Strong Corporate Governance: The US has stringent regulations and strict corporate governance standards, which can enhance the transparency and accountability of companies.

Access to Technology and Innovation: The US is a leader in technology and innovation, with many successful tech companies listed on American exchanges.

Comparative Analysis

When comparing multinational stocks and US stocks in the same industry, several factors should be considered:

Market Growth: Emerging markets often offer higher growth potential than developed markets. Investors should analyze the growth trajectory of both multinational and US companies in their respective industries.

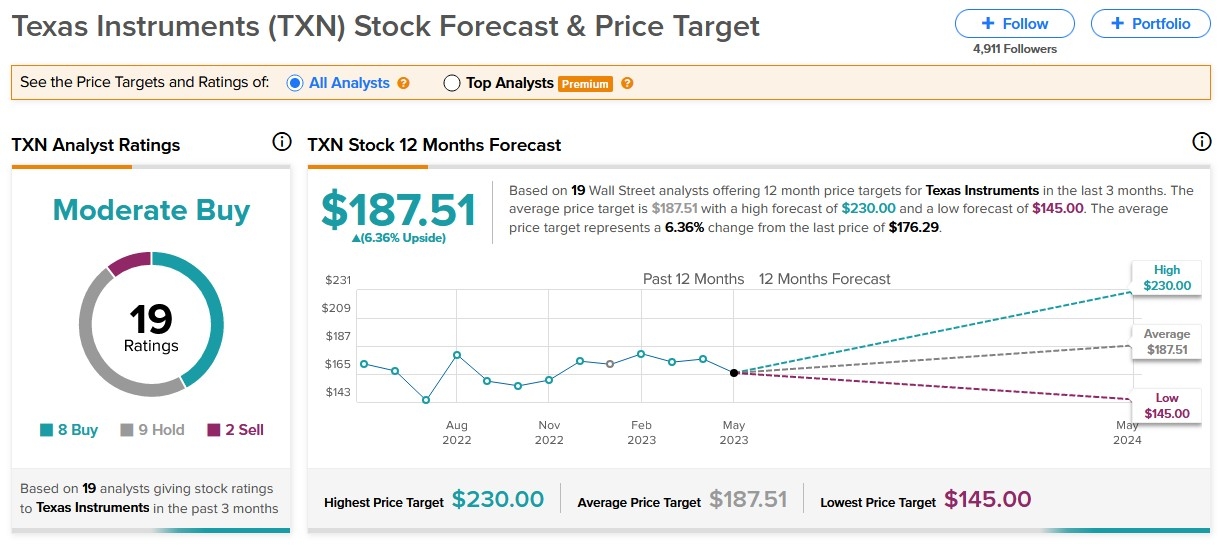

Valuation: Evaluate the valuation metrics of both companies, such as price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and earnings growth rate.

Cultural and Political Risks: Multinational stocks are subject to political and cultural risks associated with operating in foreign countries. Investors should be aware of these risks before making investments.

Dividends: Companies with a strong dividend policy can provide stable income to investors. Compare the dividend yields of both multinational and US companies.

Case Studies

Let's take a look at a couple of case studies to better understand the differences between multinational stocks and US stocks in the same industry:

Apple Inc.: Apple is a leading multinational technology company, with a significant presence in both developed and emerging markets. While its growth potential is substantial, investors should be mindful of the risks associated with operating in various countries.

Intel Corporation: Intel is a well-established US tech company known for its innovation and strong corporate governance. Its valuation and dividend yield may be more attractive to some investors compared to multinational competitors.

In conclusion, the choice between multinational stocks and US stocks in the same industry depends on various factors, including market growth, valuation, and risk tolerance. Investors should conduct thorough research and analysis to make informed decisions based on their individual investment goals and preferences.