Are you considering investing in US stocks, but unsure if now is the right time? The stock market is a dynamic environment that can be unpredictable at times. However, by understanding the current market trends and factors, you can make an informed decision. In this article, we will explore the key factors to consider before investing in US stocks.

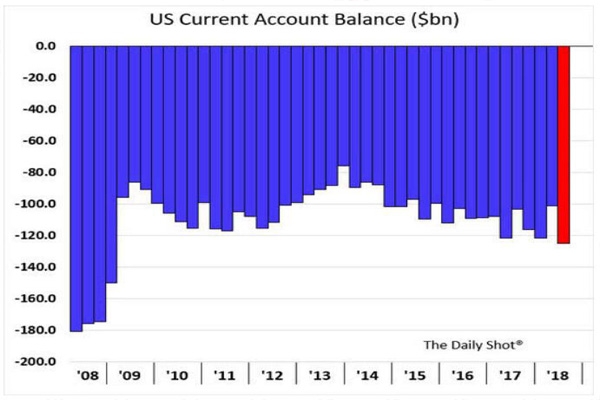

Economic Indicators

One of the most crucial factors to consider when deciding whether it's the right time to invest in US stocks is the current state of the economy. Economic indicators such as unemployment rates, inflation, and GDP growth can provide valuable insights into the market's direction.

Historical Performance

Looking at the historical performance of the US stock market can give you an idea of whether it's a good time to invest. Over the long term, the stock market has shown a strong upward trend, but it's essential to consider the short-term fluctuations.

Dividend Yields

Dividend yields can be a good indicator of whether a stock is undervalued or overvalued. A higher dividend yield suggests that a stock may be undervalued, while a lower yield may indicate that the stock is overvalued.

Market Sentiment

Market sentiment plays a significant role in the stock market. When investors are optimistic, the market tends to rise, and vice versa. It's essential to stay informed about market sentiment and adjust your investment strategy accordingly.

Diversification

Diversification is a key strategy for managing risk in your investment portfolio. By investing in a variety of stocks across different sectors and industries, you can reduce the impact of market fluctuations on your portfolio.

Sector Analysis

Analyzing different sectors can help you identify potential opportunities and risks. For example, technology and healthcare have been strong sectors in recent years, while energy and financials may have more volatile performance.

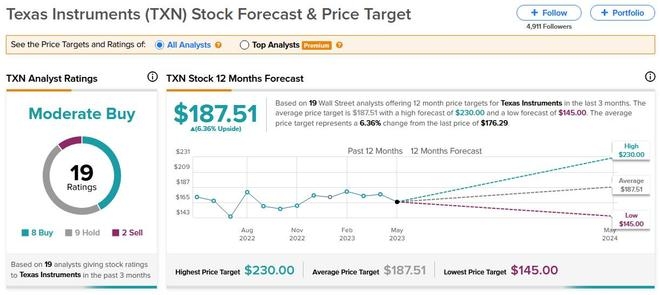

Stock Selection

Selecting the right stocks is crucial for successful investing. Conduct thorough research on individual companies, including their financial statements, management team, and competitive position in the market.

Case Study: Apple

Consider the case of Apple Inc. (AAPL), a leading technology company. Over the past decade, Apple's stock has shown strong performance, delivering substantial returns to investors. By investing in Apple, investors have been able to benefit from the company's innovative products and dominant market position.

Conclusion

Deciding whether it's the right time to invest in US stocks requires careful consideration of various factors, including economic indicators, market sentiment, and sector analysis. By staying informed and diversifying your portfolio, you can make a well-informed decision and potentially achieve long-term investment success. Remember, investing in the stock market always carries some level of risk, so it's crucial to do your homework and consult with a financial advisor if necessary.