The US dollar has long been the global benchmark currency, and its strength or weakness can significantly impact various aspects of the global economy. One of the most notable areas affected by the USD's value is the US stock market. This article delves into the impact of a weak USD on the US stock market, examining the effects on different sectors and providing real-world examples to illustrate these effects.

Understanding a Weak USD

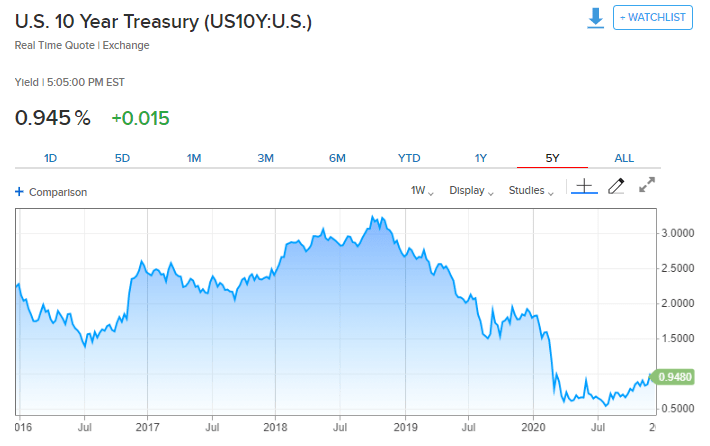

A weak USD refers to a situation where the value of the USD decreases relative to other currencies. This can happen due to several factors, including inflation, economic uncertainty, and changes in interest rates. When the USD weakens, it typically becomes more expensive for foreign investors to purchase US stocks, as they need to exchange more of their own currency for USD.

Impact on Stock Market

1. Foreign Investment

A weak USD can make US stocks more attractive to foreign investors. As the USD weakens, the value of their investments in USD terms increases, potentially leading to higher returns. This influx of foreign capital can drive up stock prices, benefiting companies with significant international exposure.

2. Inflation and Consumer Spending

A weak USD can lead to higher inflation in the US, as imports become more expensive. This can put pressure on consumer spending, which in turn can impact the earnings of companies across various sectors. However, some sectors, such as consumer discretionary and energy, may benefit from higher commodity prices.

3. Corporate Earnings

a. Companies with International Exposure

Companies with significant international exposure can benefit from a weak USD. When the USD weakens, their revenues in foreign currencies become more valuable in USD terms, potentially leading to higher earnings. For example, tech giants like Apple and Microsoft, which generate a significant portion of their revenue from international markets, may see an increase in their USD earnings.

b. Companies with High Debt Levels

On the other hand, companies with high debt levels may face challenges in a weak USD environment. As the USD weakens, the cost of dollar-denominated debt increases, potentially leading to higher interest expenses and reduced profitability.

4. Sector-Specific Impacts

a. Consumer Discretionary

Consumer discretionary sectors, such as retail and leisure, may benefit from a weak USD. As imports become more expensive, domestic consumers may turn to locally produced goods and services, boosting the earnings of these companies.

b. Energy

The energy sector can also benefit from a weak USD. As the USD weakens, the value of oil and other commodities priced in USD increases, potentially leading to higher earnings for energy companies.

5. Case Studies

a. Apple Inc.

Apple Inc., a leading technology company, has seen its USD earnings increase significantly due to its strong international presence. In 2020, the weak USD contributed to a 14% increase in Apple's revenue from international markets, which accounted for approximately 60% of its total revenue.

b. Microsoft Corporation

Microsoft Corporation has also benefited from the weak USD. In 2020, the company's revenue from international markets increased by 17% due to the weaker USD, which accounted for approximately 57% of its total revenue.

In conclusion, a weak USD can have a significant impact on the US stock market, affecting various sectors and companies in different ways. While some companies may benefit from higher international revenues, others may face challenges due to higher debt expenses. Understanding these dynamics can help investors make informed decisions in a weak USD environment.