In the ever-evolving landscape of the energy market, diesel prices play a pivotal role in determining the cost of goods and services. For businesses and consumers alike, staying informed about the latest trends in diesel prices is crucial. This article delves into the US diesel price stock chart, providing a comprehensive analysis of its trends and factors influencing it.

Understanding the Diesel Price Stock Chart

The US diesel price stock chart tracks the historical and current prices of diesel fuel in the United States. This chart is a valuable tool for businesses and investors looking to understand the market dynamics and make informed decisions. By analyzing the chart, one can identify patterns, trends, and potential future movements in diesel prices.

Historical Trends

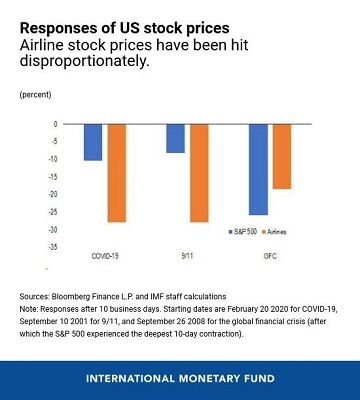

Over the past decade, the US diesel price has experienced significant fluctuations. Several factors, including geopolitical events, supply and demand, and economic conditions, have influenced these price movements. For instance, during the COVID-19 pandemic, the demand for diesel plummeted, leading to a sharp decline in prices. Conversely, geopolitical tensions and supply disruptions have caused prices to soar.

Factors Influencing Diesel Prices

Several key factors contribute to the fluctuations in diesel prices:

- Supply and Demand: The balance between supply and demand is a primary driver of diesel prices. When demand exceeds supply, prices tend to rise. Conversely, an oversupply of diesel can lead to lower prices.

- Geopolitical Events: Tensions in oil-producing regions, such as the Middle East, can disrupt global oil supplies and lead to higher diesel prices.

- Economic Conditions: Economic growth and industrial activity can increase the demand for diesel, thereby pushing up prices.

- Seasonal Factors: In colder regions, the demand for diesel tends to rise during the winter months, leading to higher prices.

Analyzing the Stock Chart

The US diesel price stock chart provides a visual representation of these factors. By examining the chart, one can identify the following trends:

- Seasonal Patterns: The chart often shows a clear seasonal pattern, with higher prices during the winter months and lower prices during the summer.

- Long-Term Trends: Over the long term, diesel prices have generally shown an upward trend, driven by increasing demand and rising oil prices.

- Market Volatility: The chart may also reveal periods of high volatility, particularly during times of geopolitical tension or supply disruptions.

Case Studies

To illustrate the impact of these factors on diesel prices, consider the following case studies:

- 2014 Oil Price Crash: In 2014, the oil price crashed, leading to a significant drop in diesel prices. This decrease in prices had a positive impact on businesses and consumers, reducing the cost of transportation and logistics.

- COVID-19 Pandemic: The COVID-19 pandemic caused a sharp decline in demand for diesel, leading to a significant drop in prices. However, as the economy began to recover, prices started to rise again.

Conclusion

The US diesel price stock chart is a valuable tool for understanding the market dynamics and making informed decisions. By analyzing the chart and considering the factors influencing diesel prices, businesses and investors can better navigate the complex energy market.