Investing in US stocks can be a lucrative opportunity for individuals outside the United States. With the right approach and knowledge, you can gain access to some of the world's most successful and innovative companies. In this article, we'll guide you through the process of investing in US stocks from outside the US, including the necessary steps and considerations.

Understanding the Basics

Before diving into the investment process, it's crucial to understand the basics of investing in US stocks. The US stock market is one of the largest and most liquid in the world, offering a wide range of investment opportunities. Here are some key points to keep in mind:

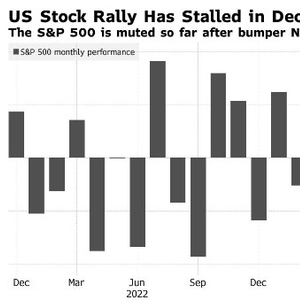

- Stock Market Indices: The S&P 500, Dow Jones Industrial Average, and Nasdaq Composite are popular indices that represent a basket of US stocks.

- Types of Stocks: There are several types of stocks, including common stocks, preferred stocks, and exchange-traded funds (ETFs).

- Dividends: Dividends are payments made by companies to their shareholders from their profits.

Steps to Invest in US Stocks from Outside the US

Open a Brokerage Account: The first step is to open a brokerage account with a reputable brokerage firm. Many online brokers offer international trading services, including TD Ameritrade, E*TRADE, and Charles Schwab.

Choose a Brokerage Firm: When selecting a brokerage firm, consider factors such as fees, customer service, and available investment options. It's also important to ensure that the brokerage firm is regulated and licensed in your country.

Complete the Application Process: You'll need to complete an application, provide identification, and verify your address. Some brokers may require additional documentation, such as a passport or driver's license.

Fund Your Account: Once your account is approved, you'll need to fund it with US dollars. You can do this by transferring funds from your bank account or using a wire transfer.

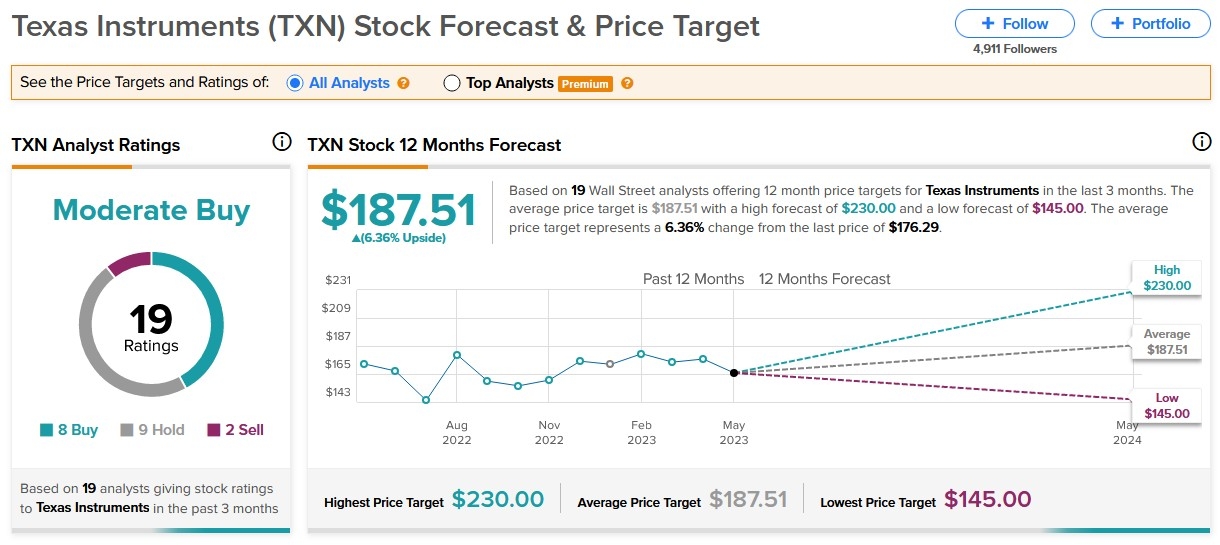

Research and Analyze Stocks: Conduct thorough research and analysis to identify stocks that align with your investment goals and risk tolerance. Consider factors such as the company's financial health, industry trends, and market conditions.

Place Your Order: Once you've identified a stock, you can place an order to buy or sell shares. You can do this through your brokerage account's trading platform.

Monitor Your Investments: Regularly monitor your investments to ensure they align with your goals. Consider using tools and resources provided by your brokerage firm to stay informed about market trends and company news.

Considerations for International Investors

- Currency Conversion: Be aware of currency conversion fees and exchange rates when transferring funds to and from your brokerage account.

- Tax Implications: Consult with a tax professional to understand the tax implications of investing in US stocks from outside the US.

- Regulatory Compliance: Ensure that you comply with all regulatory requirements in your country and the United States.

Case Study: Investing in Apple from India

Suppose you're an investor from India interested in investing in Apple Inc. (AAPL). Here's how you can go about it:

- Open a brokerage account with a firm that offers international trading services.

- Fund your account with US dollars.

- Research Apple's financial health, market position, and growth prospects.

- Place an order to buy Apple shares through your brokerage account.

- Monitor your investment and stay informed about Apple's news and market trends.

By following these steps, you can invest in US stocks from outside the US and potentially benefit from the growth and stability of some of the world's leading companies.