Investing in US stocks can be a lucrative opportunity for Moroccan investors. With the globalized economy and advancements in technology, investing across borders has become more accessible than ever. In this guide, we will walk you through the process of investing in US stocks from Morocco, helping you navigate the world of American equities.

Understanding the Basics

Before diving into the investment process, it is crucial to have a basic understanding of the US stock market. The stock market is a place where shares of public companies are bought and sold. Investors can purchase stocks through brokers, who act as intermediaries between them and the stock exchange.

Choosing a Broker

The first step in investing in US stocks from Morocco is selecting a reliable and reputable broker. There are several brokerage firms that offer international services, making it easier for Moroccan investors to invest in US stocks. Here are some factors to consider when choosing a broker:

- Regulation: Ensure that the broker is regulated by a recognized financial authority, such as the Securities and Exchange Commission (SEC).

- Fees: Compare the fees charged by different brokers, including brokerage fees, transaction fees, and currency conversion fees.

- Platform: Look for a user-friendly trading platform with advanced features and tools to help you make informed investment decisions.

Opening an Account

Once you have chosen a broker, the next step is to open an account. The process is generally straightforward and involves the following steps:

- Provide Identification: Submit your identification documents, such as a passport or national ID card.

- Verify Your Identity: Complete the Know Your Customer (KYC) process to verify your identity and financial status.

- Fund Your Account: Transfer funds from your Moroccan bank account to your brokerage account.

Understanding the Market

The US stock market is home to some of the world's largest and most successful companies. Here are some key points to keep in mind when investing in US stocks:

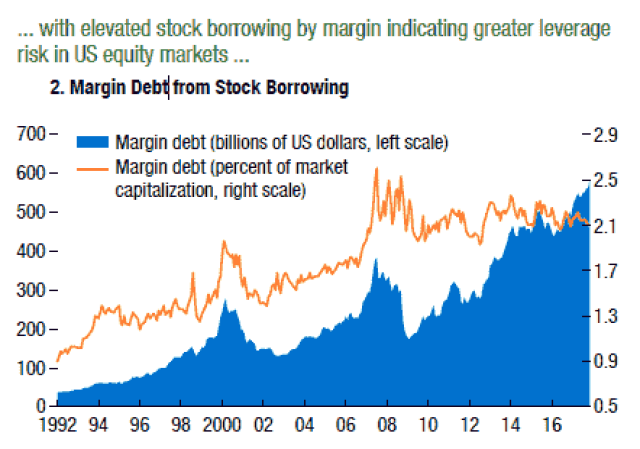

- Diversification: Diversify your portfolio by investing in different sectors and geographic regions to mitigate risk.

- Research: Conduct thorough research on the companies you are interested in investing in. Analyze their financial statements, management team, and market position.

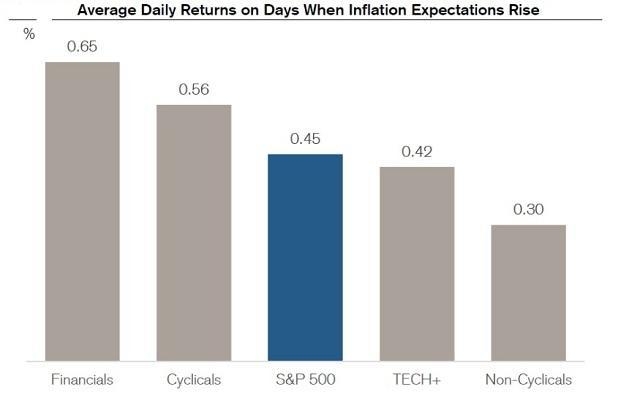

- Market Trends: Stay informed about market trends and economic indicators that may impact your investments.

Executing Trades

Once you have opened an account and conducted your research, it's time to execute trades. Here are some tips for executing trades in the US stock market:

- Use Stop-Loss Orders: Set stop-loss orders to limit potential losses.

- Time Your Trades: Avoid making impulsive decisions based on short-term market fluctuations.

- Monitor Your Portfolio: Regularly review your investments and make adjustments as needed.

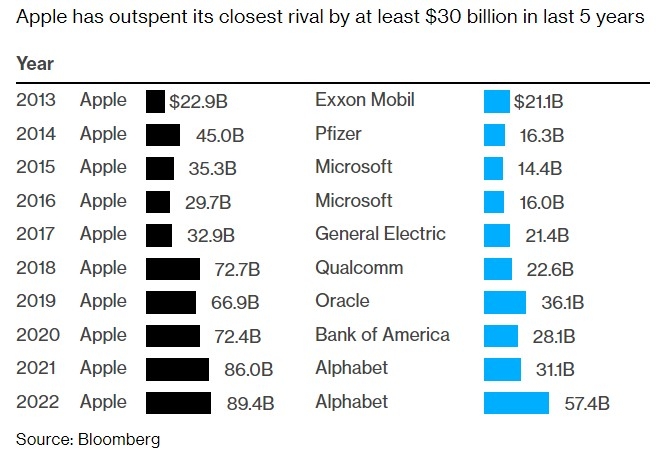

Case Study: Moroccan Investor in Apple

Let's take a look at a hypothetical case study involving a Moroccan investor interested in investing in Apple Inc. (AAPL). After conducting thorough research, the investor decides to invest $10,000 in Apple's stock. Over the next five years, the investor monitors the market and adjusts their portfolio accordingly. By diversifying their investments and staying informed, the investor achieves a significant return on their investment.

Investing in US stocks from Morocco can be a rewarding experience for Moroccan investors. By following these steps and conducting thorough research, you can make informed investment decisions and potentially achieve substantial returns. Remember to choose a reliable broker, understand the market, and stay disciplined in your investment strategy.