Understanding the Stock Market

The stock market is a crucial part of the economy, and keeping a close eye on it is essential for both investors and traders. Monitoring the US stock market involves staying informed about various factors such as market trends, economic indicators, and corporate earnings. This article will guide you through the process of effectively monitoring the US stock market.

Key Tools for Monitoring the Stock Market

Financial News Websites: Websites like CNN Money, CNBC, and Bloomberg provide real-time updates and in-depth analysis of the stock market. They offer news on market trends, economic indicators, and corporate earnings.

Stock Market Apps: Mobile apps such as TD Ameritrade, E*TRADE, and Robinhood allow you to track stocks, receive notifications, and access market data on the go.

Stock Market Tracking Software: Software like TradingView and Thinkorswim offer advanced charting tools, technical analysis, and market data.

Financial Newsletters and Podcasts: Subscribing to newsletters like The Motley Fool or listening to podcasts like The Invested Show can provide valuable insights and advice from financial experts.

Staying Informed about Market Trends

To effectively monitor the stock market, it's crucial to stay informed about market trends. Here are some key trends to watch:

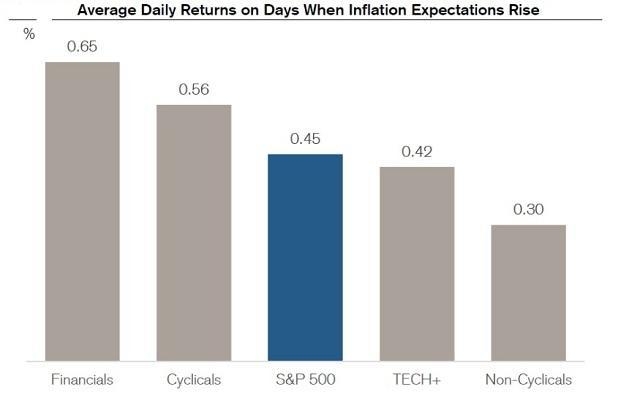

Economic Indicators: Economic indicators like unemployment rates, GDP growth, and inflation rates can impact stock market performance. Keeping an eye on these indicators can help you predict market movements.

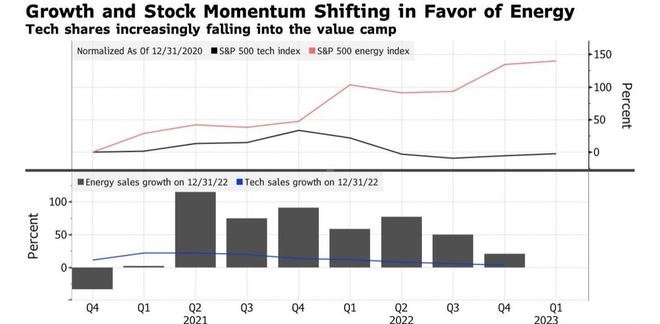

Sector Performance: Different sectors may perform differently at different times. For example, technology stocks may outperform during a tech boom, while financial stocks may do well during a low-interest-rate environment.

Market Sentiment: Market sentiment refers to the overall attitude of investors towards the stock market. Sentiment can be positive, negative, or neutral, and it can influence stock prices.

Analyzing Stocks

Fundamental Analysis: This involves analyzing a company's financial statements, earnings reports, and business model. It helps you determine the intrinsic value of a stock.

Technical Analysis: This involves analyzing historical price and volume data to identify patterns and trends. It helps you predict future price movements.

Comparative Analysis: This involves comparing a company's financials and performance to its peers in the same industry. It helps you assess a company's competitive position.

Case Studies

Apple Inc. (AAPL): In the past few years, Apple has consistently outperformed the market, driven by its strong product pipeline and robust earnings. Monitoring economic indicators and market sentiment can help investors identify opportunities in the stock.

Tesla Inc. (TSLA): Tesla has experienced significant volatility due to its disruptive technology and growth potential. Investors can use technical analysis and market sentiment to make informed decisions.

Conclusion

Monitoring the US stock market requires a combination of tools, knowledge, and analysis. By staying informed about market trends, analyzing stocks, and utilizing the right tools, you can make informed investment decisions. Remember, investing in the stock market carries risks, and it's essential to do your research and consider your financial goals and risk tolerance.