Introduction

The stock market has been a beacon of prosperity for U.S. investors over the past decade, with the S&P 500 Index soaring to record highs. However, as we approach the end of this prosperous era, Goldman Sachs strategists are now predicting that U.S. stocks may be poised to lose their decade-long gains. This article delves into the reasons behind this outlook and what it could mean for investors.

Market Dynamics and Economic Indicators

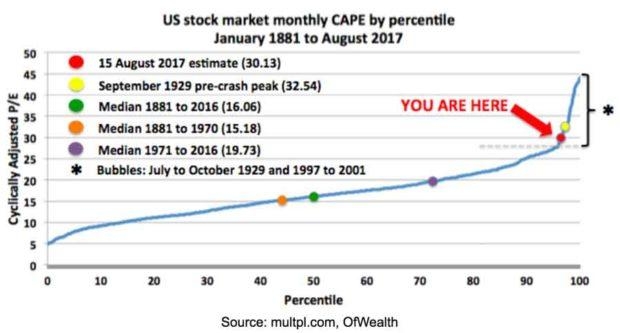

One of the primary reasons for the potential downturn in U.S. stocks is the shifting market dynamics. Over the past decade, the U.S. economy has experienced a period of low-interest rates, which has fueled stock market growth. However, with the Federal Reserve signaling an interest rate hike in the coming months, investors may see a reversal of fortune.

Economic indicators, such as inflation and corporate earnings, have also played a significant role in the stock market's growth. While inflation has remained relatively low, the recent rise in prices has prompted concerns that the Fed may need to accelerate its rate hikes to control inflation. Moreover, with corporate earnings growth slowing, the outlook for stocks may become more uncertain.

Goldman Sachs' Perspective

Goldman Sachs strategists have taken a cautious approach to the market, predicting that U.S. stocks could lose their decade-long gains. According to the firm's research, the S&P 500 Index is likely to see a decline in the near future due to the factors mentioned above.

"We believe that the conditions that have driven U.S. stocks higher over the past decade are beginning to wane," said a Goldman Sachs strategist. "As interest rates rise and economic indicators weaken, we expect to see a slowdown in stock market gains."

Impact on Investors

The potential decline in U.S. stocks could have significant implications for investors. Those who have been heavily invested in the market may need to reevaluate their portfolios and consider diversifying into other asset classes. Additionally, investors should be prepared for increased volatility in the stock market.

Case Studies

To illustrate the potential impact of the market downturn, let's consider a few case studies. For instance, a hypothetical investor who invested

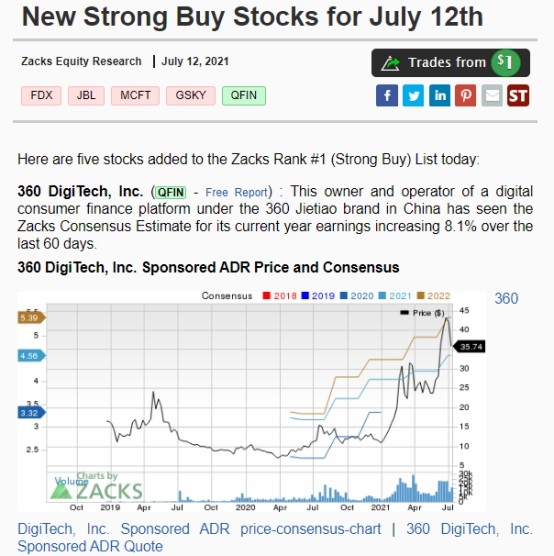

Another example involves a company that has been benefiting from the low-interest-rate environment. As rates rise, this company's borrowing costs may increase, potentially affecting its profitability and stock price.

Conclusion

The potential loss of U.S. stocks' decade-long gains is a concern for investors and market observers alike. With the shifting market dynamics and economic indicators, Goldman Sachs strategists are predicting a downturn in the near future. While this outlook may seem daunting, investors should remain vigilant and adapt their portfolios accordingly to navigate the changing market landscape.