Introduction:

In today's volatile financial market, investors are always on the lookout for reliable sources of income. One such source is monthly dividend-paying US stocks. These companies offer investors a steady stream of income while providing the potential for capital appreciation. This article will delve into the world of monthly dividend-paying US stocks, exploring the benefits, key factors to consider, and some of the top picks in the market.

Understanding Monthly Dividends

Monthly dividends are payments made by companies to their shareholders, typically out of their profits. Unlike quarterly dividends, which are paid out once every three months, monthly dividends provide investors with a more consistent income stream. This can be particularly appealing for those seeking stable and predictable returns.

Benefits of Monthly Dividend-Paying US Stocks

- Steady Income: Monthly dividends offer investors a consistent income stream, which can be a valuable source of supplemental income.

- Potential for Capital Appreciation: Many monthly dividend-paying companies also offer the potential for capital appreciation, as their share prices may increase over time.

- Tax Advantages: Dividends are typically taxed at a lower rate than ordinary income, providing investors with potential tax savings.

- Diversification: Investing in monthly dividend-paying US stocks can help diversify your investment portfolio, reducing your exposure to market volatility.

Key Factors to Consider When Investing in Monthly Dividend-Paying US Stocks

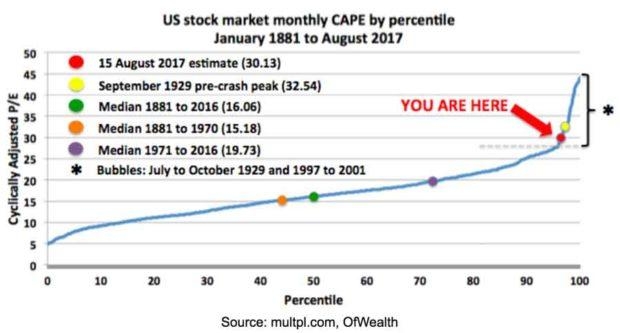

- Dividend Yield: The dividend yield is a key metric to consider when evaluating monthly dividend-paying stocks. It represents the percentage of a company's stock price that is paid out as dividends. A higher dividend yield may indicate a higher potential for income, but it's important to consider the company's financial health and dividend sustainability.

- Dividend Growth: Companies with a history of increasing dividends over time may be more attractive to investors. This indicates that the company is generating strong profits and has a strong financial position.

- Financial Health: It's crucial to evaluate a company's financial health before investing in its monthly dividend-paying stocks. Look for companies with strong balance sheets, stable earnings, and a low debt-to-equity ratio.

- Sector and Industry: Consider the sector and industry in which the company operates. Some sectors, such as utilities and real estate, may offer more stable and predictable dividends.

Top Monthly Dividend-Paying US Stocks

- REITs: Real estate investment trusts (REITs) are a popular choice for monthly dividend-paying investments. They offer high dividend yields and have a history of stable returns. Some top REITs include Realty Income Corporation (O) and Prologis, Inc. (PLD).

- Utilities: Utilities companies are known for their stable and predictable dividends. Some top utilities for monthly dividends include Duke Energy Corporation (DUK) and Southern Company (SO).

- Consumer Goods: Consumer goods companies, such as Procter & Gamble (PG) and Coca-Cola Company (KO), offer consistent dividends and have a strong presence in the market.

- Telecommunications: Telecommunications companies, such as AT&T Inc. (T) and Verizon Communications Inc. (VZ), provide steady dividend payments and are often considered a defensive play during market downturns.

Conclusion:

Monthly dividend-paying US stocks can be a valuable addition to your investment portfolio, offering a steady stream of income and the potential for capital appreciation. By understanding the key factors to consider and evaluating the financial health of the companies, investors can make informed decisions when selecting monthly dividend-paying US stocks. As always, it's important to do thorough research and consult with a financial advisor before making any investment decisions.