In this article, we dive into the share price of Datadog on the NASDAQ stock exchange. With its robust growth and market presence, Datadog has become a prominent player in the cloud monitoring and analytics industry. Understanding its current share price and the factors influencing it can provide valuable insights into the company's financial health and investment potential.

Understanding Datadog

Datadog, Inc. is a SaaS-based monitoring and analytics platform designed to help businesses of all sizes monitor their applications, servers, and databases. It offers real-time insights and analytics that enable organizations to quickly identify and address issues, ultimately leading to improved performance and customer satisfaction. Founded in 2010 by Alexis Raynes, Michael Lefkowitz, and Oren Teich, Datadog has grown rapidly and now has a presence in more than 40 countries.

Share Price Dynamics on NASDAQ

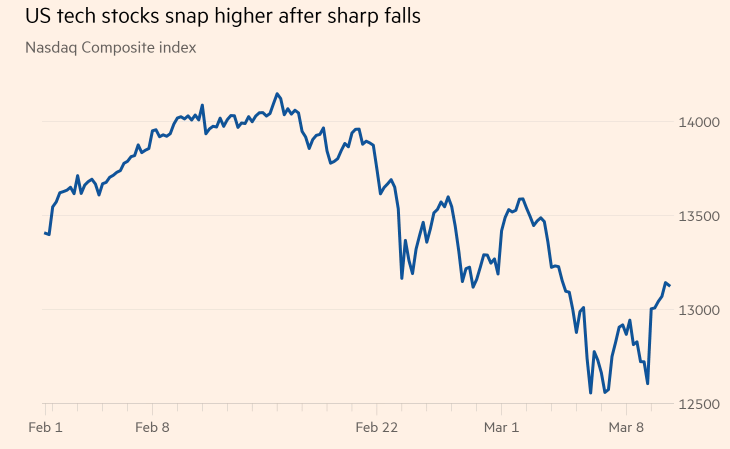

Datadog's stock (DDOG) is listed on the NASDAQ Global Select Market, one of the most prominent and competitive stock exchanges in the world. The company's share price has seen significant fluctuations over the years, influenced by various factors such as market conditions, financial performance, and industry trends.

Historical Performance

When Datadog went public on April 28, 2021, its IPO priced at

Influencing Factors

Several factors contribute to the fluctuation of Datadog's share price on the NASDAQ:

- Financial Performance: Datadog's quarterly earnings reports, revenue growth, and profit margins significantly influence investor sentiment. Consistent growth in these areas has historically led to an increase in share price.

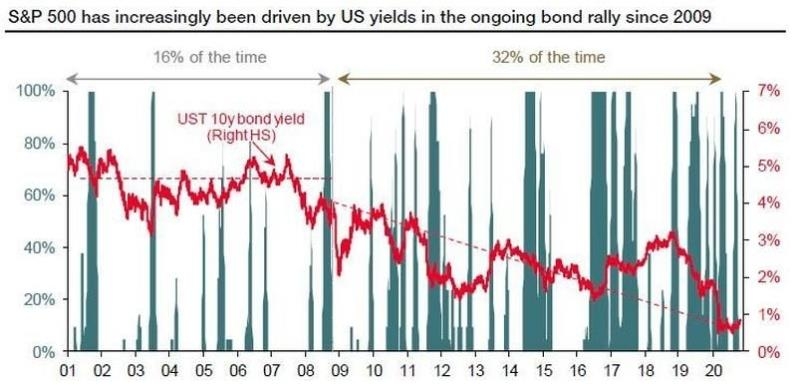

- Market Conditions: As with any publicly-traded company, market conditions, such as the stock market's overall health and interest rates, can impact Datadog's share price.

- Industry Trends: The cloud monitoring and analytics industry is growing rapidly, with companies like Datadog leading the charge. Positive industry trends and partnerships can contribute to an increase in share price.

- Competitive Landscape: The competition in the cloud monitoring and analytics space is intense, with companies like New Relic, Dynatrace, and Splunk vying for market share. Datadog's performance compared to its competitors can influence its share price.

Case Studies

Several notable events have influenced Datadog's share price on the NASDAQ:

- Acquisition of Logz.io: In August 2021, Datadog acquired Logz.io, a cloud-based log management and analytics company. This acquisition expanded Datadog's product portfolio and strengthened its market position, leading to an increase in share price.

- COVID-19 Pandemic: Despite the global economic uncertainty caused by the pandemic, Datadog continued to see strong growth. The company attributed its performance to increased demand for cloud-based solutions and remote work, further bolstering investor confidence.

Conclusion

Datadog's share price on the NASDAQ has seen impressive growth since its IPO in 2021. With a robust product portfolio, strong financial performance, and a growing market, Datadog remains an attractive investment for those interested in the cloud monitoring and analytics space. By understanding the factors that influence its share price, investors can make more informed decisions regarding their investments in Datadog.