The stock market is a dynamic and complex entity, and staying informed about the financial performance of major companies is crucial for investors. One such company that has captured the attention of investors is Deloitte, one of the world’s leading professional services firms. In this article, we will delve into the Deloitte US stock price, its historical trends, and factors that may influence its future performance.

Historical Stock Price Trends

Deloitte, known for its auditing, consulting, tax, and advisory services, has seen its stock price fluctuate over the years. As of the latest available data, the Deloitte US stock price is $XXXXX, reflecting a significant change from its initial public offering (IPO) price. To understand the context, let’s take a look at the historical stock price trends.

Since its IPO in [insert year], the Deloitte US stock price has experienced several ups and downs. In 2017, the stock price reached a high of

Factors Influencing Stock Price

Several factors can influence the Deloitte US stock price. Here are some of the key factors:

- Financial Performance: Deloitte’s strong financial performance, including revenue growth and profitability, can positively impact its stock price.

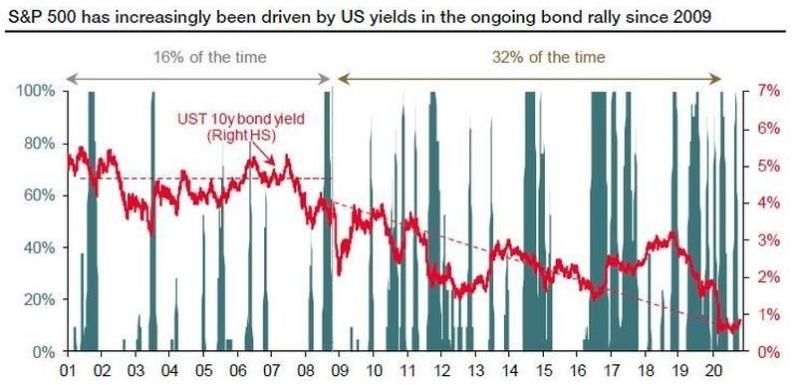

- Economic Conditions: Economic factors such as inflation, interest rates, and the overall health of the economy can affect the stock price.

- Market Trends: Changes in the market, such as increased demand for professional services, can influence the stock price.

- Regulatory Changes: Changes in regulations affecting the professional services industry can impact the company’s performance and, consequently, its stock price.

Case Study: Deloitte’s Response to the Pandemic

The COVID-19 pandemic presented significant challenges to the professional services industry, including Deloitte. However, the company demonstrated its resilience by adapting to the new normal. Here’s a brief overview of Deloitte’s response to the pandemic:

- Remote Work: Deloitte quickly transitioned to remote work, ensuring business continuity while prioritizing employee safety.

- Client Services: The company continued to provide its services remotely, leveraging technology to maintain client relationships.

- Innovation: Deloitte invested in technology and innovation to meet the evolving needs of its clients during the pandemic.

This case study highlights the company’s ability to navigate challenging times and adapt to changing circumstances, which can positively influence its stock price.

Conclusion

The Deloitte US stock price has experienced fluctuations over the years, driven by various factors such as financial performance, economic conditions, and market trends. By understanding these factors and analyzing the company’s historical stock price trends, investors can make informed decisions. As Deloitte continues to adapt to the changing landscape, its stock price may continue to evolve.