The stock market is a dynamic entity that constantly evolves, reflecting the economic pulse of the nation. On July 23, 2025, the US stock market showcased several significant developments that investors should be aware of. This article provides a comprehensive overview of the day's key events, trends, and analysis.

Market Overview:

The US stock market opened on a positive note, with the S&P 500 and the NASDAQ hitting new record highs. The Dow Jones Industrial Average also showed robust growth, reflecting the overall optimism in the market. However, some sectors experienced volatility, leading to mixed results.

Key Developments:

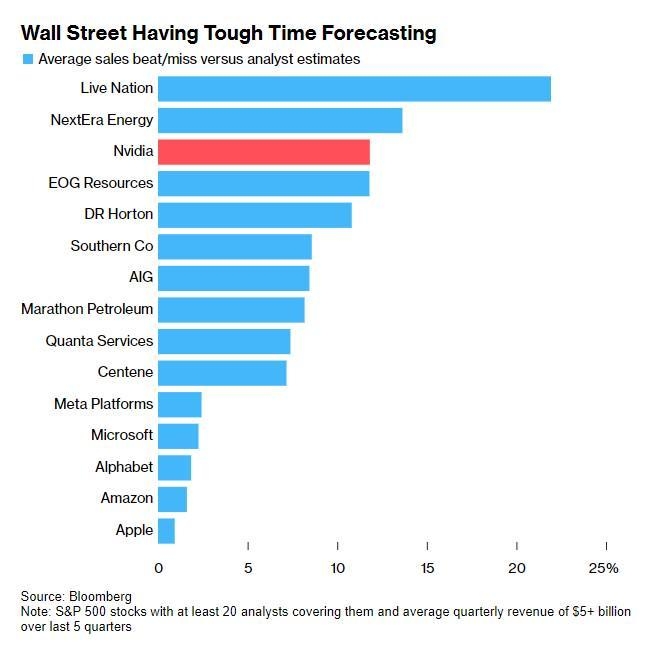

Tech Stocks on the Rise: The technology sector, traditionally a bellwether for the stock market, saw significant gains. Apple Inc. (AAPL) reported better-than-expected earnings, driving its stock price higher. Similarly, Microsoft Corporation (MSFT) and Amazon.com, Inc. (AMZN) reported strong quarterly results, contributing to the overall rise in the tech sector.

Energy Sector Under Pressure: The energy sector faced challenges, primarily due to concerns about global oil supply. Exxon Mobil Corporation (XOM) and Chevron Corporation (CVX) reported lower earnings, leading to a decline in their stock prices. This downward trend was further exacerbated by geopolitical tensions in the Middle East.

Consumer Discretionary Stocks: The consumer discretionary sector, which includes companies like Walmart Inc. (WMT) and Home Depot Inc. (HD), experienced mixed results. While Walmart reported better-than-expected sales, Home Depot faced challenges due to supply chain disruptions.

Financial Stocks: The financial sector, which includes banks and insurance companies, showed modest growth. JPMorgan Chase & Co. (JPM) and Bank of America Corporation (BAC) reported solid earnings, contributing to the overall growth in the sector.

Analysis:

The overall positive sentiment in the stock market can be attributed to several factors. Firstly, the Federal Reserve's decision to keep interest rates unchanged provided a boost to investor confidence. Secondly, the strong earnings reports from major companies, particularly in the technology sector, added to the optimism. However, the volatility in certain sectors, such as energy and consumer discretionary, highlights the need for caution.

Case Study:

A notable case study on July 23, 2025, was the rise of Tesla, Inc. (TSLA). The electric vehicle manufacturer reported a significant increase in sales, driven by strong demand for its new models. This led to a surge in its stock price, showcasing the potential of emerging sectors in the stock market.

Conclusion:

The US stock market on July 23, 2025, showcased a mix of growth and volatility, reflecting the dynamic nature of the market. While technology stocks led the way, sectors like energy and consumer discretionary faced challenges. Investors should remain cautious and stay informed about the latest market trends to make informed decisions.