In recent years, there has been a growing sentiment that the era of American exceptionalism is waning. This shift has significant implications for the stock markets, as investors reassess their strategies and portfolios. This article delves into the reasons behind the waning of US exceptionalism and its potential impact on stock markets.

What is US Exceptionalism?

US exceptionalism refers to the belief that the United States is a unique nation with a distinct destiny. This belief has shaped American foreign policy, economic growth, and cultural influence for decades. However, recent events, including political polarization, economic challenges, and global competition, have eroded this perception.

Reasons for the Waning of US Exceptionalism

Political Polarization: The increasing divide between political parties has led to gridlock in Washington, D.C. This has hindered the passage of critical legislation and policies that could bolster the US economy and maintain its global leadership position.

Economic Challenges: The US faces several economic challenges, including rising inflation, high levels of debt, and a shrinking manufacturing sector. These factors have raised concerns about the long-term sustainability of the US economy.

Global Competition: The rise of China and other emerging economies has challenged the US's global economic dominance. This competition has led to concerns about job losses, trade deficits, and a loss of technological advantage.

Impact on Stock Markets

The waning of US exceptionalism has several potential impacts on stock markets:

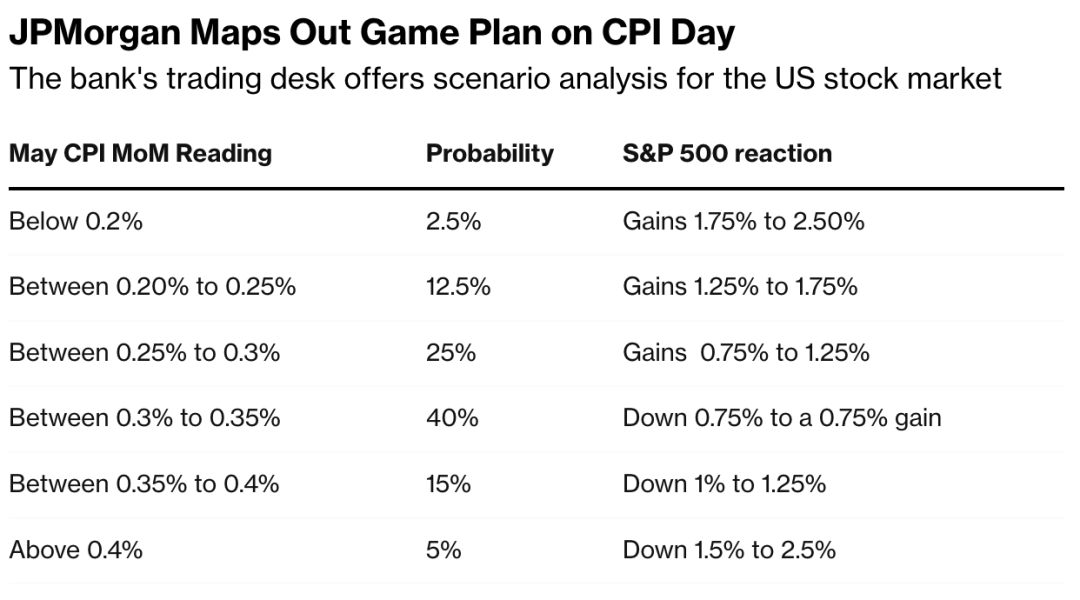

Increased Volatility: As investors reassess their portfolios, there may be increased volatility in the stock markets. This is because investors may be more cautious and uncertain about the future of the US economy.

Shift in Investment Strategies: Investors may shift their focus from growth stocks, which are typically associated with the US, to value stocks, which are more diversified geographically. This shift could benefit companies based in other countries.

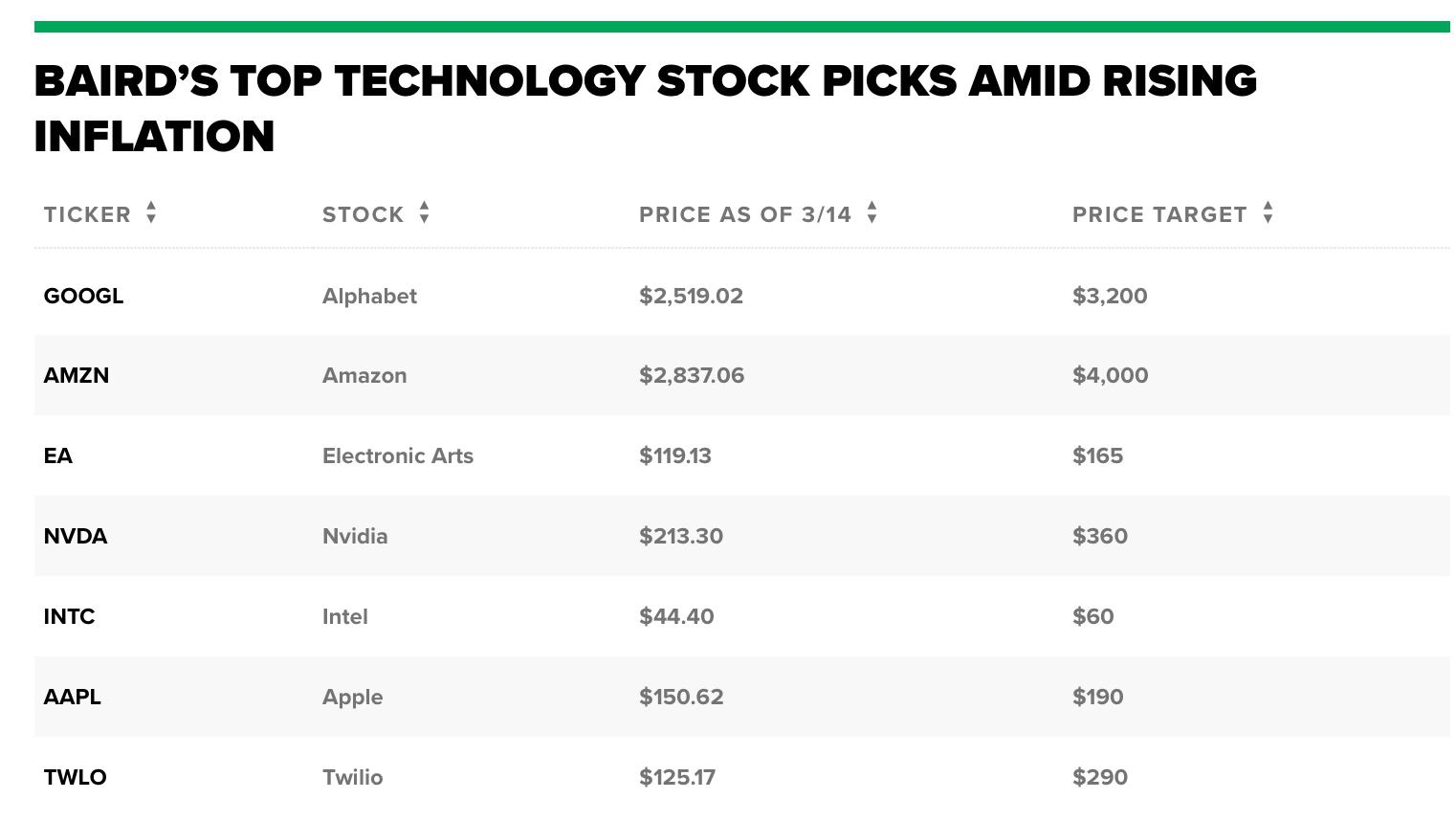

Impact on Tech Stocks: The US has long been the global leader in technology. However, with the rise of China, there is growing competition in this sector. This competition could lead to a decline in the value of US tech stocks.

Case Studies

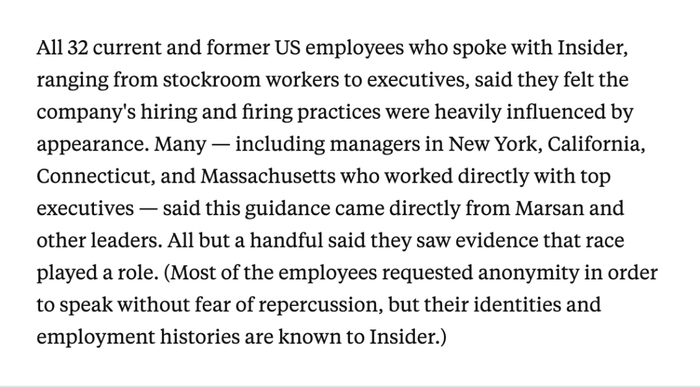

Facebook (Meta): Facebook, now known as Meta, has faced significant challenges in the wake of the waning of US exceptionalism. The company has faced increased scrutiny from regulators and investors over its data privacy practices and business practices.

Apple: Apple, another US tech giant, has also faced challenges. The company has seen its growth放缓 as it faces increased competition from Chinese companies like Huawei.

Conclusion

The waning of US exceptionalism is a complex issue with significant implications for the stock markets. Investors need to be aware of these implications and adjust their strategies accordingly. While the future remains uncertain, it is clear that the era of American exceptionalism is coming to an end, and this will have a lasting impact on the stock markets.