In today's interconnected global market, investors are increasingly looking beyond their borders for investment opportunities. One of the most common questions among investors is whether they can buy US stocks from India. The answer is a resounding yes, and in this article, we will explore the process, benefits, and considerations of investing in US stocks from India.

Understanding the Process

Investing in US stocks from India involves a few key steps. First, you need to open a brokerage account with a reputable online brokerage firm that offers international trading capabilities. Some popular options include TD Ameritrade, E*TRADE, and Fidelity. Once your account is set up, you can fund it with Indian rupees or any other currency accepted by the brokerage firm.

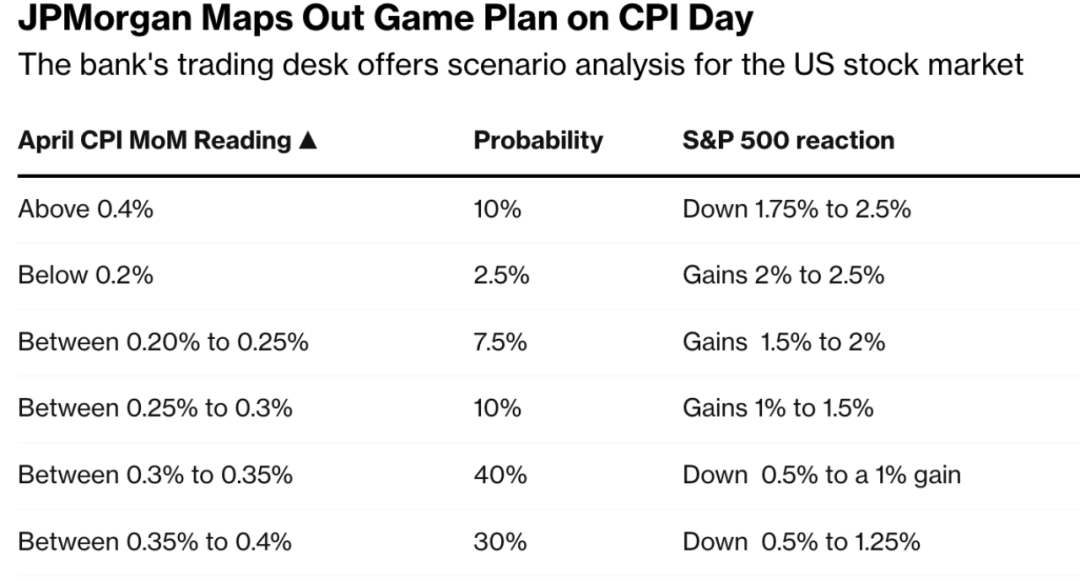

Next, you'll need to research and identify US stocks that align with your investment goals and risk tolerance. This can be done through various online platforms and financial news sources. Once you've identified a stock, you can place a buy order through your brokerage account.

Benefits of Investing in US Stocks from India

There are several benefits to investing in US stocks from India:

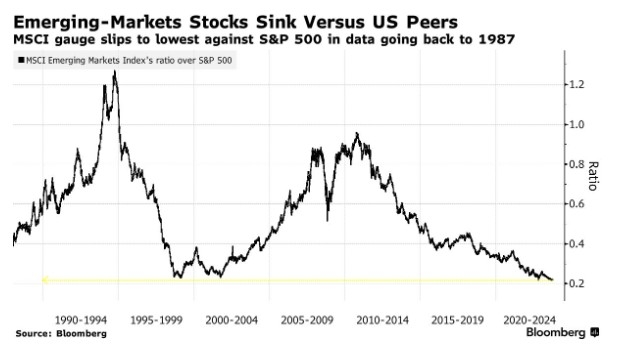

- Diversification: Investing in US stocks allows you to diversify your portfolio beyond the Indian market, reducing your exposure to domestic market risks.

- Access to World-Class Companies: The US stock market is home to some of the world's largest and most successful companies, such as Apple, Microsoft, and Amazon.

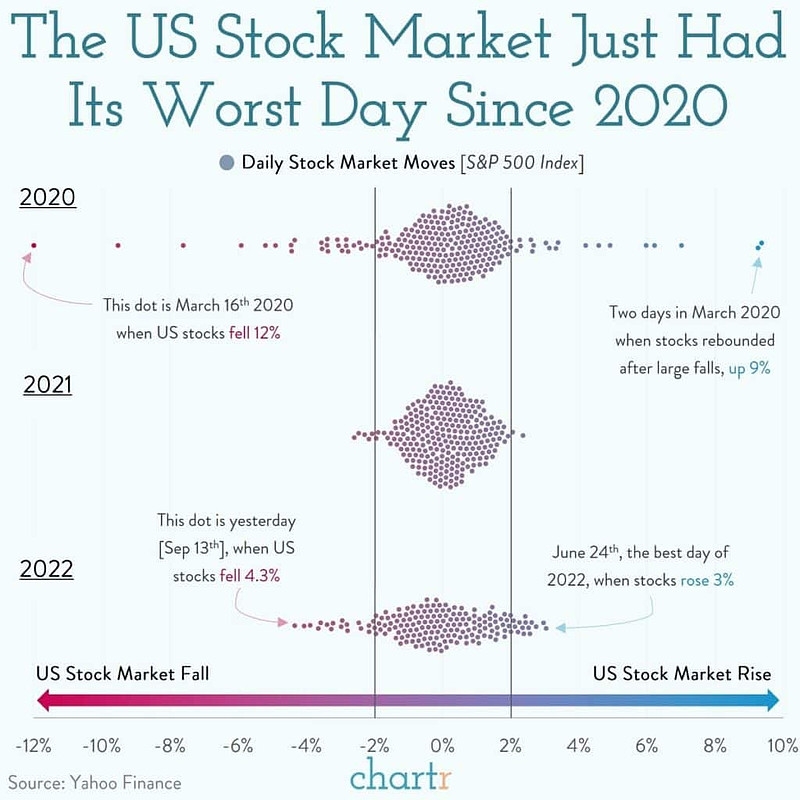

- Potential for Higher Returns: Historically, the US stock market has offered higher returns than the Indian market, making it an attractive option for long-term investors.

- Currency Conversion: Investing in US stocks allows you to benefit from currency conversion, as the returns are typically received in US dollars.

Considerations for Investing in US Stocks from India

While investing in US stocks from India offers numerous benefits, there are also some considerations to keep in mind:

- Currency Risk: The value of your investments can be affected by fluctuations in the exchange rate between the Indian rupee and the US dollar.

- Transaction Costs: There may be additional transaction costs associated with buying and selling US stocks, such as brokerage fees and currency conversion fees.

- Regulatory Differences: It's important to be aware of the regulatory differences between the Indian and US stock markets to ensure compliance with all applicable laws and regulations.

Case Study: Investing in Apple from India

Let's consider a hypothetical scenario where an Indian investor decides to invest in Apple, one of the world's most valuable companies. By opening a brokerage account with a firm that offers international trading capabilities, the investor can easily purchase Apple shares and benefit from the company's growth and success.

Over the past five years, Apple's stock has seen significant growth, offering a strong return on investment for investors. By diversifying their portfolio with US stocks like Apple, Indian investors can potentially achieve higher returns and reduce their exposure to domestic market risks.

Conclusion

Investing in US stocks from India is a viable and attractive option for investors looking to diversify their portfolios and access world-class companies. By understanding the process, benefits, and considerations, investors can make informed decisions and potentially achieve higher returns.