As we step into the new year, investors are eager to understand the outlook for the US stock market in 2024. The stock market is a vital indicator of the overall economic health and investor sentiment, making it crucial for investors to stay informed. This article will provide a comprehensive overview of the key factors that could influence the US stock market in 2024, including economic indicators, market trends, and potential risks.

Economic Indicators to Watch

One of the most significant factors affecting the stock market is the economic indicators. In 2024, investors should keep an eye on the following indicators:

- GDP Growth: The growth rate of the Gross Domestic Product (GDP) is a key measure of economic health. A strong GDP growth rate suggests a healthy economy, which is generally positive for stocks.

- Inflation: Inflation can have a significant impact on the stock market. High inflation can erode purchasing power and lead to lower corporate profits, while low inflation can stimulate economic growth.

- Unemployment Rate: The unemployment rate is another important economic indicator. A low unemployment rate suggests a strong labor market, which can boost consumer spending and corporate profits.

Market Trends to Monitor

Several market trends are likely to shape the US stock market in 2024:

- Technology Stocks: Technology stocks have been a major driver of the stock market's growth over the past decade. In 2024, investors should monitor the performance of major tech companies like Apple, Microsoft, and Google.

- Energy Stocks: The energy sector is poised for growth due to increasing demand for oil and natural gas. Companies like ExxonMobil and Chevron are likely to benefit from this trend.

- Healthcare Stocks: The healthcare sector is expected to grow as the population ages and healthcare costs rise. Companies like Johnson & Johnson and Pfizer are well-positioned to benefit from this trend.

Potential Risks

While there are many opportunities in the US stock market in 2024, there are also potential risks to consider:

- Global Economic Slowdown: A slowdown in the global economy could negatively impact the US stock market. Factors such as trade tensions and geopolitical events could contribute to a global economic slowdown.

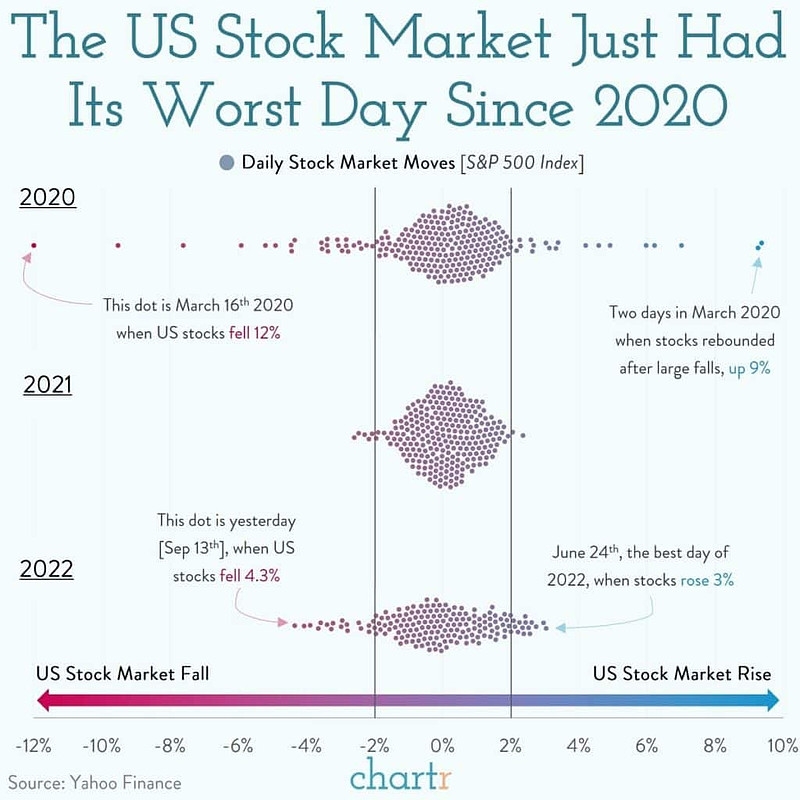

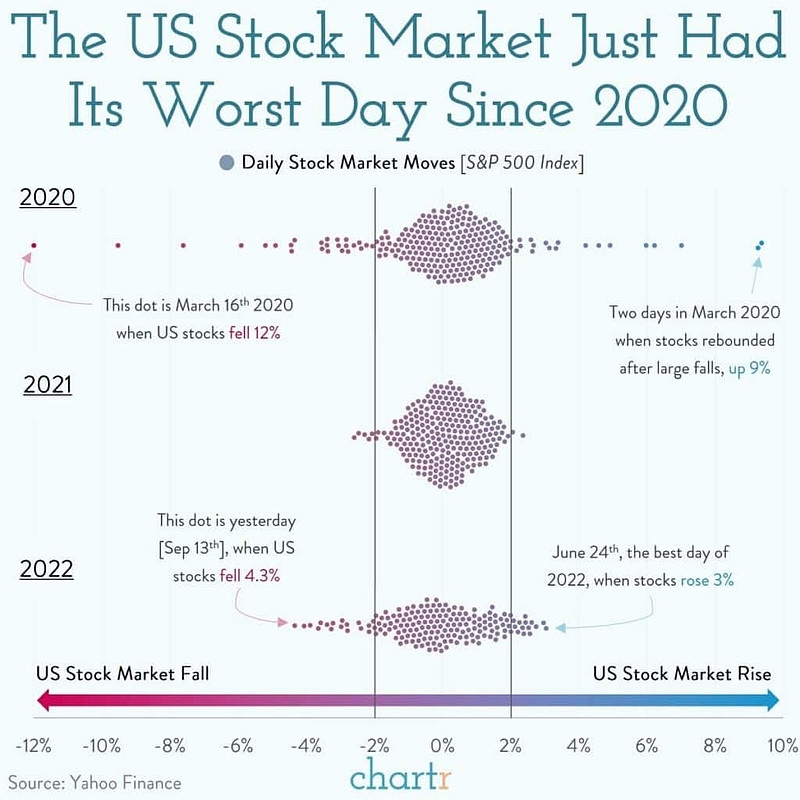

- Market Volatility: The stock market can be volatile, and 2024 may be no exception. Investors should be prepared for periods of market uncertainty and volatility.

- Corporate Earnings: Corporate earnings are a key driver of stock prices. If companies report lower-than-expected earnings, it could lead to a decline in stock prices.

Case Study: Amazon (AMZN)

To illustrate the potential impact of market trends and risks on individual stocks, let's take a look at Amazon (AMZN). Amazon is a leading e-commerce company that has seen significant growth over the past decade. In 2024, Amazon is likely to benefit from the increasing demand for online shopping, particularly as the population continues to adopt remote work and online learning.

However, Amazon also faces potential risks. For example, if there is a global economic slowdown, consumer spending may decline, which could negatively impact Amazon's sales. Additionally, if trade tensions escalate, it could lead to higher shipping costs and reduced profits.

In conclusion, the US stock market in 2024 presents both opportunities and risks. By monitoring economic indicators, market trends, and potential risks, investors can make informed decisions and navigate the market effectively.