Investing in the United States stock market can be a wise decision for investors seeking long-term growth and stability. With a diverse range of industries and companies, the US stock market offers numerous benefits that can help investors achieve their financial goals. In this article, we will explore the key advantages of investing in US stocks, including market stability, growth potential, and diversification opportunities.

Market Stability

One of the primary benefits of investing in US stocks is the market's stability. The US stock market is one of the most mature and well-regulated markets in the world, with a long history of providing investors with a secure investment environment. This stability is due to several factors, including:

- Regulatory Oversight: The US Securities and Exchange Commission (SEC) ensures that companies adhere to strict reporting and disclosure requirements, which helps protect investors from fraudulent activities.

- Diversification: The US stock market is home to a wide range of industries and companies, which helps to mitigate the risk of investing in a single stock or sector.

- Economic Strength: The US economy is one of the strongest in the world, with a robust financial system and a stable political environment.

Growth Potential

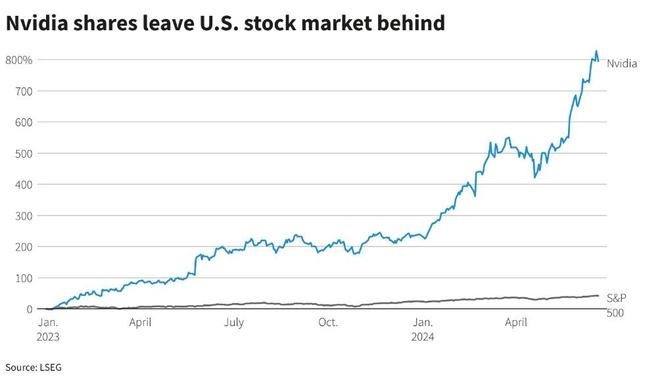

The US stock market is known for its high growth potential, particularly in industries such as technology, healthcare, and consumer goods. Investing in US stocks can provide investors with exposure to some of the world's most innovative and successful companies. Some key factors contributing to the growth potential of US stocks include:

- Innovation: The US is a global leader in innovation, with numerous companies at the forefront of technological advancements and breakthroughs.

- Strong Consumer Base: The US has a large and affluent consumer base, which provides a steady demand for goods and services.

- Access to Capital: The US stock market offers companies access to capital for expansion and growth, which can lead to increased shareholder value.

Diversification Opportunities

Investing in US stocks allows investors to diversify their portfolios, which can help to reduce risk and increase returns. By investing in a variety of sectors and companies, investors can minimize the impact of market fluctuations and economic downturns. Some ways to diversify a portfolio include:

- Sector Diversification: Investing in different sectors, such as technology, healthcare, and financials, can help to spread risk and increase returns.

- Geographic Diversification: Investing in companies from different regions and countries can further diversify a portfolio and provide exposure to different economic conditions.

- Asset Class Diversification: Combining stocks with other asset classes, such as bonds and real estate, can help to balance a portfolio and reduce risk.

Case Studies

To illustrate the benefits of investing in US stocks, let's consider a few case studies:

- Apple Inc.: As one of the largest companies in the world, Apple has consistently delivered strong returns for investors. Since its initial public offering (IPO) in 1980, Apple's stock has returned over 50,000%.

- Amazon.com Inc.: Amazon has revolutionized the retail industry and has become one of the most valuable companies in the world. Since its IPO in 1997, Amazon's stock has returned over 30,000%.

- Tesla, Inc.: Tesla has become a leader in the electric vehicle (EV) market and has seen significant growth in recent years. Since its IPO in 2010, Tesla's stock has returned over 1,000%.

In conclusion, investing in US stocks offers numerous benefits, including market stability, growth potential, and diversification opportunities. By understanding the advantages of investing in the US stock market, investors can make informed decisions and achieve their financial goals.