Introduction:

Market Overview: The US stock market has experienced a rollercoaster ride over the past few years, with various factors influencing its performance. In October 2025, the market is characterized by the following key aspects:

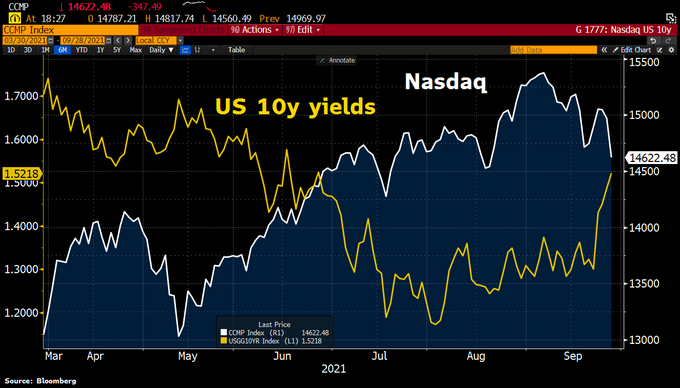

Economic Indicators: The US economy is expected to grow at a moderate pace, driven by factors such as low unemployment rates, strong consumer spending, and a robust manufacturing sector. However, inflation remains a concern, with the Federal Reserve continuing to raise interest rates to control it.

Geopolitical Events: Geopolitical tensions, particularly in Eastern Europe and the Middle East, have raised concerns about global stability. While these events have not had a significant impact on the US stock market, they remain a potential risk factor.

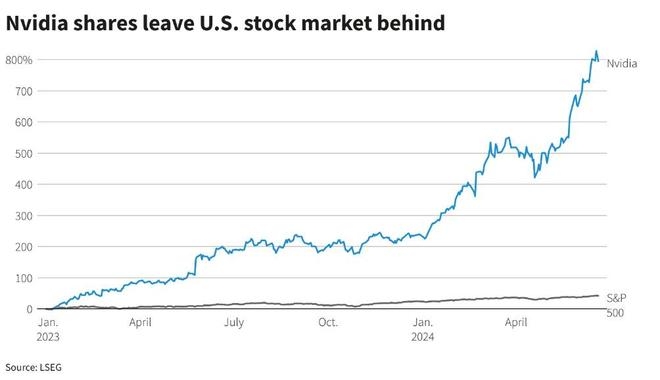

Technological Advancements: The technology sector remains a major driver of the US stock market, with companies like Apple, Microsoft, and Amazon leading the pack. Innovations in artificial intelligence, 5G technology, and cloud computing are expected to continue driving growth in this sector.

Sector Analysis:

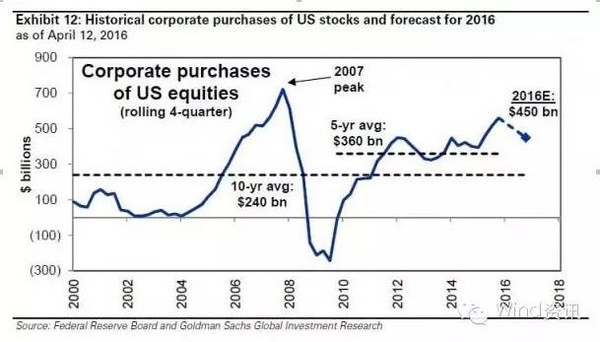

Technology: As mentioned earlier, the technology sector continues to dominate the US stock market. Companies like Apple and Microsoft have seen strong growth, driven by high demand for their products and services. Tesla has also been a significant performer, with its focus on electric vehicles and renewable energy.

Healthcare: The healthcare sector has emerged as a major growth area, driven by advancements in biotechnology and pharmaceuticals. Companies like Moderna and Regeneron have seen significant gains, with their focus on developing new treatments and vaccines.

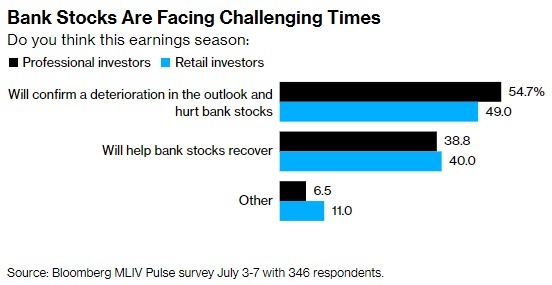

Financials: The financial sector has experienced a steady recovery, with banks and insurance companies posting strong earnings. The rise in interest rates has provided a boost to the sector, with companies like JPMorgan Chase and Bank of America leading the pack.

Individual Stock Analysis:

Apple (AAPL): Apple remains a dominant force in the technology sector, with its iPhone, iPad, and Mac products commanding high demand. The company's strong financial performance and innovative products make it a solid investment choice.

Tesla (TSLA): Tesla has been a major standout in the technology sector, with its focus on electric vehicles and renewable energy. The company's strong growth potential and innovative approach have attracted investors, making it a popular stock among retail and institutional investors.

Moderna (MRNA): Moderna has seen significant growth, driven by its success in developing mRNA vaccines, including the COVID-19 vaccine. The company's focus on developing new treatments for various diseases makes it an attractive investment opportunity.

Conclusion: As we navigate the current US stock market conditions in October 2025, it is essential to stay informed about economic indicators, geopolitical events, and technological advancements. By analyzing key sectors and individual stocks, investors can make informed decisions and capitalize on potential opportunities. However, it is crucial to conduct thorough research and consult with a financial advisor before making any investment decisions.