The US stock exchange is a cornerstone of the global financial market, offering investors a platform to buy and sell shares of publicly traded companies. This article delves into the intricacies of the US stock exchange, covering its history, key exchanges, trading procedures, and the impact it has on the global economy.

History of the US Stock Exchange

The roots of the US stock exchange can be traced back to the early 18th century. The first organized stock exchange, the New York Stock Exchange (NYSE), was established in 1792. Since then, the US stock exchange has evolved into a sophisticated and dynamic market, attracting investors from all over the world.

Key Exchanges

The United States hosts several major stock exchanges, each with its unique characteristics and trading procedures. The NYSE is the oldest and most well-known exchange, followed by the NASDAQ, which is known for its technology and biotechnology stocks.

Trading Procedures

Trading on the US stock exchange is conducted through a series of electronic and manual processes. Here's a brief overview:

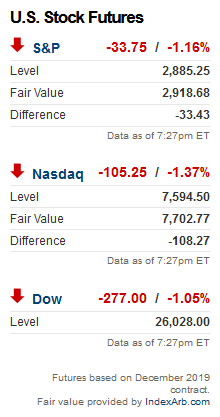

- Opening and Closing: The trading day typically begins at 9:30 AM and ends at 4:00 PM Eastern Time.

- Order Types: Investors can place various types of orders, including market orders, limit orders, and stop orders.

- Execution: Orders are executed through an automated matching system that connects buyers and sellers.

Impact on the Global Economy

The US stock exchange plays a crucial role in the global economy. It serves as a barometer for the health of the US economy and influences global markets. Here are some key impacts:

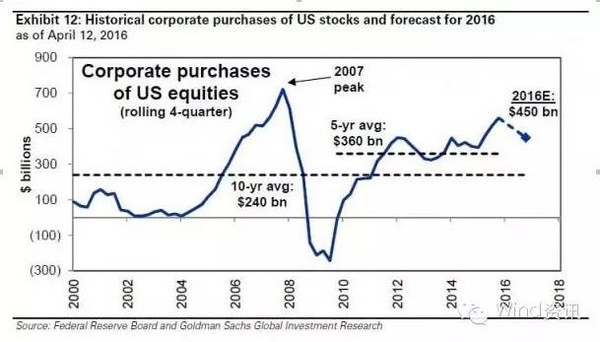

- Investment Opportunities: The US stock exchange offers investors a wide range of investment opportunities, from blue-chip companies to emerging startups.

- Job Creation: The stock exchange supports job creation by providing capital for businesses to grow and expand.

- Economic Growth: The stock exchange contributes to economic growth by promoting investment and innovation.

Case Studies

To illustrate the impact of the US stock exchange, let's look at a few case studies:

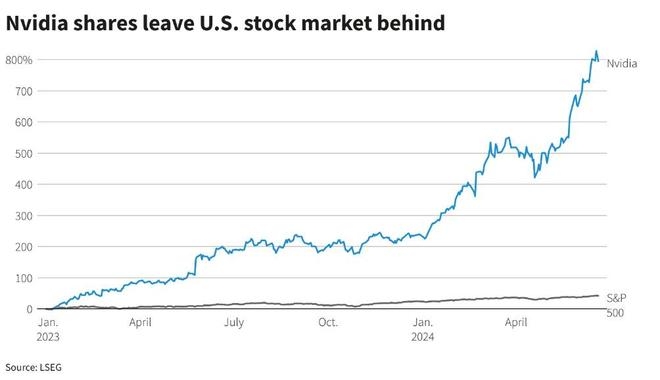

- Apple Inc. (AAPL): Apple, a NASDAQ-listed company, has become one of the most valuable companies in the world. Its stock has seen significant growth over the years, offering investors substantial returns.

- Tesla Inc. (TSLA): Tesla, another NASDAQ-listed company, has revolutionized the automotive industry. Its stock has experienced dramatic fluctuations, reflecting the company's rapid growth and challenges.

Conclusion

The US stock exchange is a vital component of the global financial market, offering investors a diverse range of investment opportunities. Its history, trading procedures, and impact on the global economy make it a fascinating subject for anyone interested in finance and investment.