Investing in the United States has always been an attractive option for international investors. However, one aspect of investing that often catches investors off guard is the foreigner buy US stock tax. This tax can significantly impact the returns on your investments, so it's crucial to understand how it works.

What is the Foreigner Buy US Stock Tax?

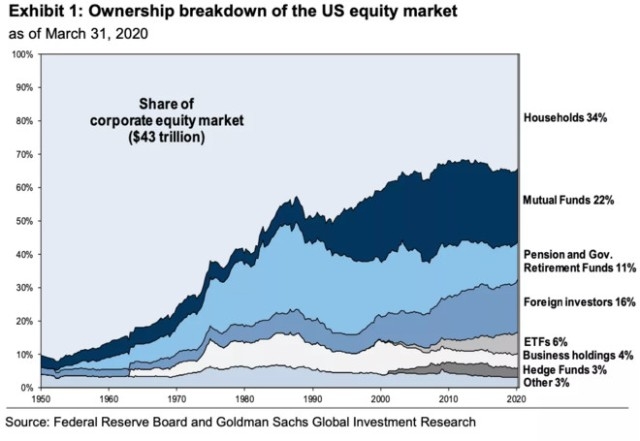

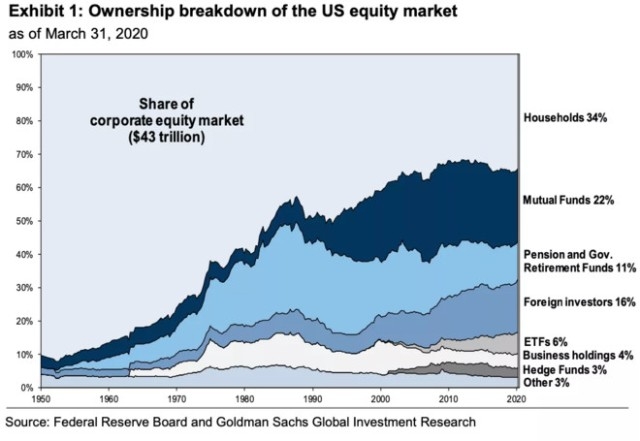

The foreigner buy US stock tax refers to the tax that non-US citizens and residents must pay when they purchase shares of US stocks or exchange-traded funds (ETFs). This tax is levied by the United States government and is designed to ensure that foreign investors contribute their fair share to the American economy.

How Does the Tax Work?

The foreigner buy US stock tax is calculated based on a percentage of the total value of the stock or ETF purchased. The current tax rate is 30%, although certain treaties between the United States and other countries may reduce this rate. The tax is withheld at the time of purchase and must be paid to the IRS.

Implications for Foreign Investors

The foreigner buy US stock tax can have several implications for foreign investors:

Reduced Returns: The tax can significantly reduce the returns on your investments, especially if you are investing in a highly taxed asset class. This is because the tax is withheld at the time of purchase, effectively reducing the amount of capital you have available for investment.

Reporting Requirements: Foreign investors must report their US stock investments to the IRS using Form 8938, which can be a complex and time-consuming process.

Double Taxation: If you are a resident of a country with a tax treaty with the United States, you may be subject to double taxation on your US stock investments. This means you will pay taxes both in the United States and in your home country.

Case Studies

Let's consider a hypothetical example to illustrate the impact of the foreigner buy US stock tax. Imagine a foreign investor from Canada purchases

Alternatives for Foreign Investors

To mitigate the impact of the foreigner buy US stock tax, foreign investors can consider the following alternatives:

Tax-Advantaged Accounts: Some tax-advantaged accounts, such as individual retirement accounts (IRAs) or 401(k)s, may offer tax benefits for US stock investments.

Diversification: Investing in a diversified portfolio can help mitigate the impact of the tax on individual stocks or ETFs.

Professional Advice: Consulting with a financial advisor or tax professional can help you navigate the complexities of investing in the United States and minimize the tax burden.

In conclusion, the foreigner buy US stock tax is an important consideration for international investors. Understanding the implications of this tax can help you make informed investment decisions and maximize your returns.