In the ever-evolving global financial landscape, investors are constantly seeking opportunities to diversify their portfolios. One popular debate among investors revolves around Indian stocks versus US stocks. Both markets offer unique advantages and challenges, making it crucial for investors to understand the differences and similarities between them. This article delves into a comprehensive analysis of Indian stocks versus US stocks, highlighting key factors to consider.

Market Size and Growth

One of the primary differences between Indian and US stocks is the market size and growth potential. The US stock market is the largest in the world, boasting a market capitalization of over

However, it's important to note that the Indian stock market has been growing at a much faster pace compared to the US. Over the past decade, the Indian stock market has delivered annual returns of around 10-12%, whereas the US stock market has returned around 7-8%. This indicates that the Indian stock market has significant growth potential, especially considering the country's rapidly growing population and increasing middle class.

Economic Factors

Economic factors play a crucial role in shaping the performance of stock markets. The US economy is considered one of the most stable and developed in the world. It boasts a diversified economy, strong infrastructure, and a well-established financial system. This stability has contributed to the consistent performance of US stocks over the years.

On the other hand, the Indian economy is characterized by its emerging nature. While it faces challenges such as high inflation and a fluctuating currency, it also offers immense potential for growth. The Indian government has been implementing various reforms to promote economic development, which could lead to higher stock market returns in the long run.

Market Volatility

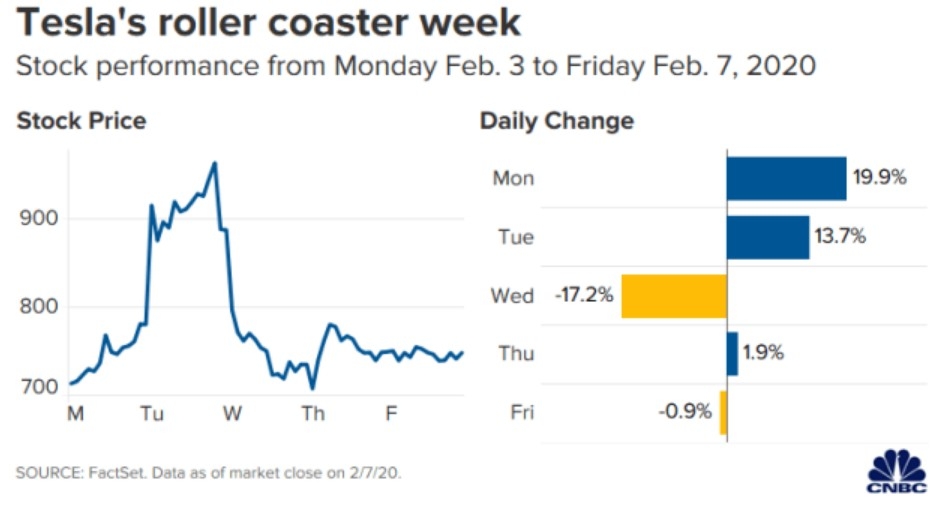

Another significant difference between Indian and US stocks is the level of market volatility. The US stock market is known for its stability, with lower volatility compared to the Indian market. This stability is attributed to the well-established regulatory framework and a mature financial system.

In contrast, the Indian stock market is more volatile, often influenced by domestic political and economic factors. This volatility can create opportunities for investors with a higher risk tolerance, but it also poses a greater risk of capital loss.

Dividends and Yield

Dividends and yield are important factors for income-focused investors. The US stock market offers a wide range of dividend-paying stocks, with many blue-chip companies providing consistent dividend yields. This makes the US market an attractive option for investors seeking regular income.

The Indian stock market also offers dividend-paying stocks, but the yields are generally lower compared to the US. However, the potential for capital appreciation in the Indian market can offset the lower dividend yields.

Conclusion

In conclusion, both Indian and US stocks offer unique opportunities and challenges for investors. The US stock market is characterized by stability, a well-established financial system, and consistent performance, while the Indian stock market offers significant growth potential, albeit with higher volatility.

Investors should carefully consider their risk tolerance, investment goals, and market conditions before deciding between Indian and US stocks. A well-diversified portfolio that includes investments in both markets can help maximize returns and mitigate risks.