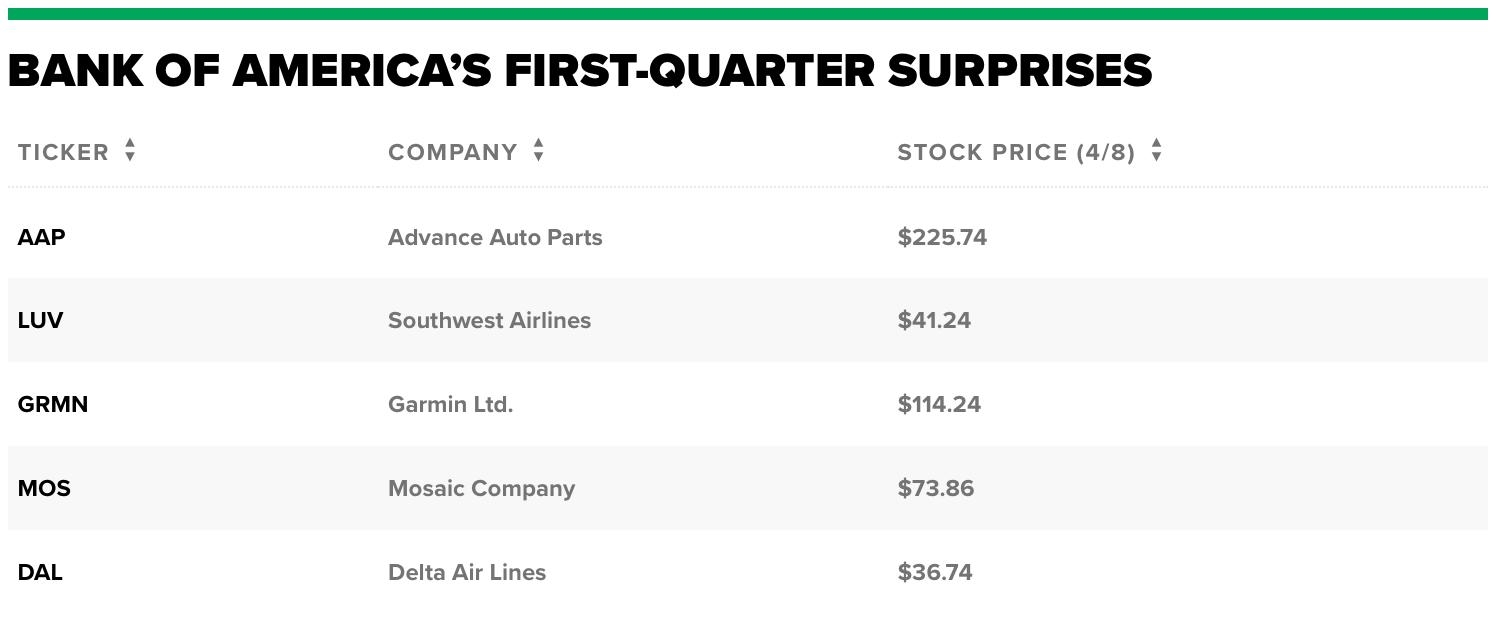

In the dynamic world of aviation, Delta Air Lines has established itself as a key player in the United States. As such, the performance of Delta's stocks is a topic of interest for many investors and industry watchers. This article delves into the factors influencing Delta's stock prices, recent trends, and future prospects.

Historical Performance

Delta Air Lines has seen significant growth over the years, reflecting the company's ability to adapt to the ever-changing aviation landscape. Historically, the airline has outperformed its competitors, leading to an increase in its stock price. This performance can be attributed to several factors, including effective cost management, strategic partnerships, and a focus on customer satisfaction.

Recent Trends

In recent years, Delta's stock has experienced a rollercoaster ride, influenced by various economic and industry-specific factors. The COVID-19 pandemic has had a profound impact on the aviation industry, leading to a sharp decline in passenger numbers and, consequently, a drop in Delta's stock price. However, as vaccinations become more widespread and travel restrictions ease, the airline industry is expected to recover.

Factors Influencing Stock Prices

Several factors contribute to the fluctuation of Delta's stock prices:

- Economic Conditions: The state of the global economy significantly impacts the aviation industry. During periods of economic growth, demand for air travel tends to rise, leading to an increase in Delta's stock price.

- Fuel Prices: As one of the largest expenses for airlines, fuel prices have a direct impact on Delta's profitability. A decrease in fuel prices can lead to higher profits and, subsequently, a rise in stock prices.

- Industry Competition: The level of competition within the aviation industry also affects Delta's stock. Increased competition can lead to lower profit margins, while a reduction in competition can boost stock prices.

- Regulatory Changes: Changes in government regulations can have a significant impact on the aviation industry. For instance, stricter emissions standards or increased taxes can lead to higher operating costs for Delta.

Future Prospects

Looking ahead, Delta Air Lines has several opportunities for growth:

- Expansion into New Markets: Delta can explore new routes and destinations to tap into growing markets and increase its passenger base.

- Investment in Technology: Investing in technology can improve operational efficiency, reduce costs, and enhance customer experience.

- Partnerships and Alliances: Forming strategic partnerships and alliances can provide Delta with access to additional routes and markets.

Case Study: Delta's Acquisition of Air France-KLM

In 2019, Delta Air Lines announced its intention to acquire a 20% stake in Air France-KLM, Europe's largest airline. This move was aimed at strengthening Delta's presence in the transatlantic market and increasing its global connectivity. The acquisition has since been completed, and it has had a positive impact on Delta's stock price.

Conclusion

Delta Air Lines has a strong track record of performance and is well-positioned to navigate the challenges and opportunities in the aviation industry. While the stock price has been volatile in recent years, the company's focus on cost management, customer satisfaction, and strategic partnerships has positioned it for long-term success. As the aviation industry continues to recover from the COVID-19 pandemic, Delta's stock is expected to perform well, making it an attractive investment opportunity for investors.