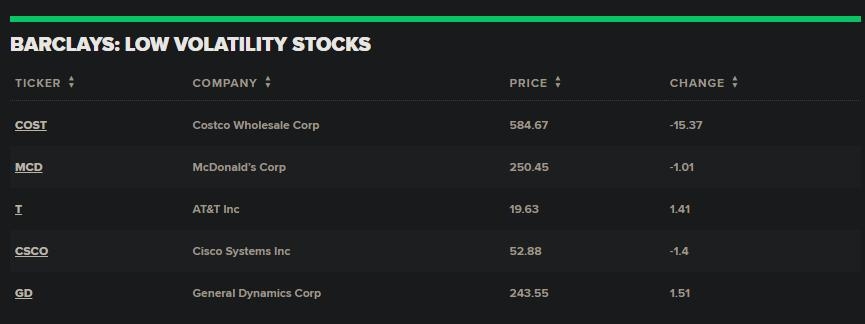

In the ever-evolving landscape of the stock market, investors are constantly seeking opportunities that offer stability and potential growth. As we look ahead to 2025, one investment strategy that stands out is focusing on low volatility US stocks. This article delves into the rationale behind this approach, highlights key sectors to consider, and provides insights on how to effectively implement this strategy.

Understanding Low Volatility Stocks

Low volatility stocks are those that exhibit less price fluctuation compared to the broader market. These companies often have strong fundamentals, stable earnings, and a history of consistent performance. The rationale behind investing in low volatility stocks is simple: they provide a level of security and peace of mind, especially during turbulent market conditions.

Why Invest in Low Volatility US Stocks in 2025?

1. Economic Stability

As we move towards 2025, the global economy is expected to continue its recovery from the COVID-19 pandemic. Investing in low volatility US stocks can offer a buffer against economic uncertainties and market volatility.

2. Diversification

Diversification is a key principle in investment strategies. By including low volatility stocks in your portfolio, you can reduce the overall risk and enhance the stability of your investments.

3. Income Generation

Many low volatility stocks offer a steady stream of dividends, providing investors with a reliable income source. This can be particularly beneficial for retirees or those seeking to generate passive income.

Key Sectors to Consider

1. Utilities

Utilities companies are known for their stable earnings and reliable dividends. These companies provide essential services like electricity, gas, and water, making them less susceptible to economic fluctuations.

2. Consumer Staples

Consumer staples companies produce goods that are in high demand regardless of the economic cycle. Examples include food and beverage companies, personal care products, and household goods.

3. Healthcare

The healthcare sector is another area to consider for low volatility investments. Companies in this sector often have strong fundamentals and a steady revenue stream, making them attractive for long-term investors.

Implementing the Low Volatility Strategy

To effectively implement the low volatility strategy, consider the following steps:

- Research and Analysis: Conduct thorough research on potential low volatility stocks, analyzing their financial statements, dividend history, and market trends.

- Diversification: Allocate your investments across different sectors and industries to reduce risk.

- Regular Review: Monitor your portfolio regularly to ensure it aligns with your investment goals and adjust as needed.

Case Study: Procter & Gamble (PG)

One example of a low volatility US stock is Procter & Gamble (PG), a consumer staples company. Over the past decade, PG has demonstrated consistent performance, with a strong dividend yield and low volatility. By investing in PG, investors can benefit from a stable and reliable investment opportunity.

In conclusion, investing in low volatility US stocks in 2025 can be a strategic approach to achieve stability and potential growth. By focusing on sectors like utilities, consumer staples, and healthcare, and implementing a well-diversified portfolio, investors can navigate the ever-changing market landscape with confidence.