In the vast landscape of the American financial sector, US regional bank stocks have gained significant attention. These banks, often overshadowed by their larger counterparts, play a crucial role in driving economic growth and supporting local communities. This article delves into the intricacies of regional bank stocks, their importance, and the factors investors should consider when making investment decisions.

The Significance of US Regional Bank Stocks

Regional banks, as the name suggests, operate within specific geographic areas, providing essential financial services to local businesses and individuals. They are instrumental in fostering economic development and stability at the community level. Here are some key reasons why regional bank stocks are worth considering:

- Community Focus: Unlike large national banks, regional banks prioritize local needs, ensuring that they understand and cater to the unique requirements of their customers.

- Economic Growth: By providing loans and financial services to local businesses, regional banks contribute to job creation and economic prosperity.

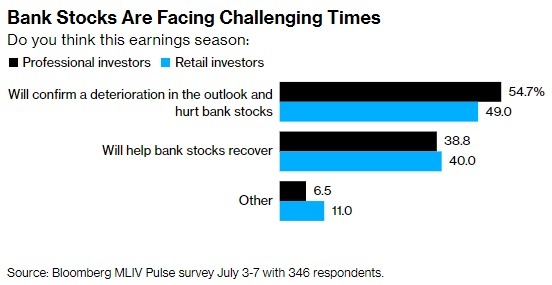

- Stable Performance: Historically, regional banks have demonstrated resilience and stability, often outperforming their larger counterparts during economic downturns.

Factors to Consider When Investing in US Regional Bank Stocks

Investing in regional bank stocks requires a thorough understanding of various factors. Here are some key considerations:

- Economic Conditions: The performance of regional banks is closely tied to the local economy. Investors should analyze the economic health of the region in which the bank operates.

- Credit Quality: The quality of loans a bank has on its books is crucial. A higher percentage of loans in the performing category indicates a healthier bank.

- Profitability: Look for banks with strong profitability metrics, such as return on assets (ROA) and return on equity (ROE).

- Regulatory Environment: The regulatory landscape can significantly impact regional banks. Stay informed about any changes that could affect the industry.

Case Studies: Successful Investments in US Regional Bank Stocks

Several successful investments in US regional bank stocks highlight the potential for growth and profitability. Here are a few examples:

- First Horizon National Corporation (FHN): This regional bank, operating in the Southeastern United States, has seen significant growth over the years. Its focus on community banking and strong credit quality have contributed to its success.

- PNC Financial Services Group (PNC): PNC, while not a traditional regional bank, operates in several states and has a strong presence in the Mid-Atlantic region. Its diverse business model and commitment to innovation have propelled its growth.

- SunTrust Banks, Inc. (STI): SunTrust, now part of BB&T, has a solid track record of profitability and strong customer relationships. Its focus on customer service and community engagement has been a key driver of its success.

Conclusion

Investing in US regional bank stocks can be a rewarding endeavor. By understanding the factors that drive their performance and staying informed about the local economy, investors can make informed decisions. As always, it is crucial to conduct thorough research and consult with a financial advisor before making any investment decisions.