In the fast-paced world of finance, the stock market doesn't just operate during regular trading hours. The concept of US stock after hours trading has become increasingly important for investors looking to gain an edge. This article delves into what after hours trading is, its benefits, and how it impacts the broader market.

What is US Stock After Hours Trading?

US stock after hours trading refers to the buying and selling of stocks outside of the regular trading hours, which typically run from 9:30 AM to 4:00 PM Eastern Time. This extended trading period allows investors to trade stocks before the market opens or after it closes. It is facilitated through electronic communication networks (ECNs) and alternative trading systems (ATSs).

Benefits of After Hours Trading

Access to Global Markets: After hours trading allows investors to participate in global markets that operate outside of regular U.S. trading hours. This can be particularly beneficial for those looking to invest in companies based in other countries.

Immediate Execution: Investors can execute trades immediately, without having to wait for the market to open. This can be crucial in fast-moving markets where prices can change rapidly.

Price Discovery: After hours trading can help in the discovery of fair prices for stocks. When the market is closed, investors can react to news and events that may not have been fully reflected in the closing price.

Risk Management: Investors can manage their risk by adjusting their positions before the market opens or closes. This can help them avoid being caught off guard by sudden market movements.

How After Hours Trading Impacts the Market

US stock after hours trading can have a significant impact on the broader market. Here's how:

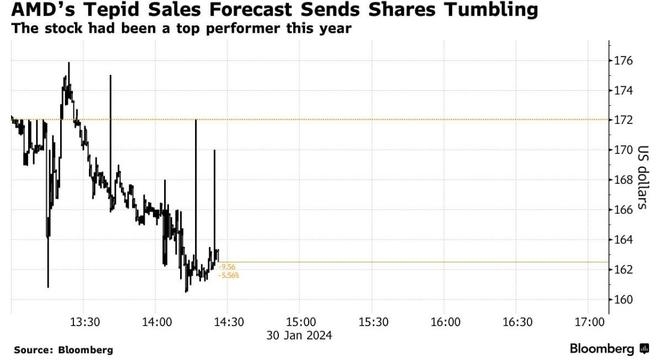

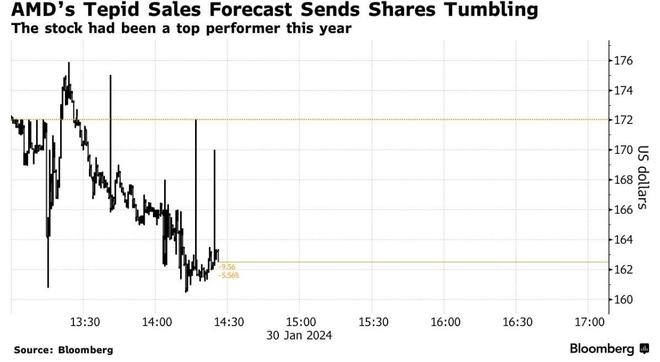

Price Impact: Large orders placed during after hours trading can influence the opening price of stocks. This can lead to volatility in the morning session.

Market Sentiment: After hours trading can influence market sentiment. If a stock has a strong after hours move, it can set the tone for the next day's trading.

News and Events: After hours trading provides a platform for the release of important news and events that can impact stocks. This can lead to immediate reactions in the market.

Case Study: Apple Inc.

A notable example of the impact of after hours trading is the case of Apple Inc. In 2020, the company announced a significant revenue forecast cut after hours. This led to a sharp decline in the stock price the next day, showcasing how after hours trading can influence market movements.

Conclusion

US stock after hours trading is a vital component of the modern financial landscape. It offers investors the opportunity to trade outside of regular hours, manage risk, and participate in global markets. Understanding its dynamics can help investors make informed decisions and stay ahead of market trends.