In the ever-evolving world of financial markets, understanding the dynamics of stock futures is crucial for investors looking to capitalize on market trends. One such futures contract that has gained significant attention is the US Steel stock futures. This article delves into the intricacies of US Steel stock futures, providing investors with a comprehensive guide to help them make informed decisions.

Understanding US Steel Stock Futures

US Steel stock futures are financial instruments that allow investors to speculate on the future price of US Steel Corporation (NYSE: X) shares. These futures contracts are traded on various exchanges, including the Chicago Mercantile Exchange (CME) and the New York Mercantile Exchange (NYMEX). By purchasing these futures, investors can gain exposure to the stock without owning the actual shares.

Key Features of US Steel Stock Futures

Leverage: One of the primary advantages of trading futures is leverage. Investors can control a large amount of US Steel stock with a relatively small amount of capital. This allows for significant gains, but it also increases the risk of substantial losses.

Hedging: US Steel stock futures can be used to hedge against potential losses in the underlying stock. For example, if an investor holds a significant position in US Steel and is concerned about a potential decline in the stock price, they can purchase futures contracts to offset their risk.

Liquidity: US Steel stock futures are highly liquid, making it easy for investors to enter and exit positions quickly. This liquidity is especially important during times of market volatility.

Factors Influencing US Steel Stock Futures

Several factors can influence the price of US Steel stock futures:

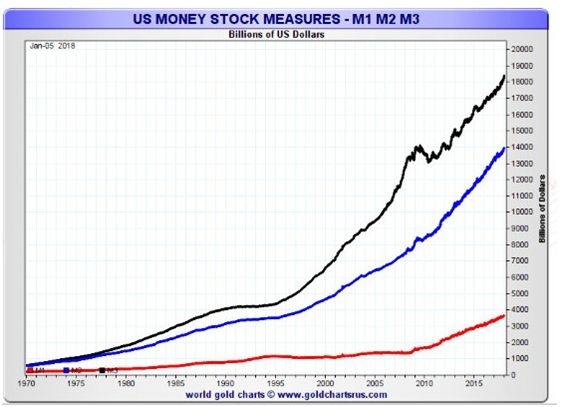

Economic Indicators: Economic indicators such as GDP growth, employment rates, and inflation can impact the demand for steel and, consequently, the price of US Steel stock futures.

Commodity Prices: Steel is a commodity, and its price is influenced by the cost of raw materials such as iron ore and coal. Changes in these commodity prices can directly affect the price of US Steel stock futures.

Company Performance: The financial performance of US Steel, including its earnings reports and dividend payments, can significantly impact the price of its stock futures.

Case Studies

To illustrate the impact of these factors on US Steel stock futures, let's consider two case studies:

Economic Indicators: In 2018, the US economy was experiencing strong growth, leading to increased demand for steel. This resulted in a rise in the price of US Steel stock futures.

Commodity Prices: In 2019, the price of iron ore, a key raw material for steel production, surged. This increase in commodity prices contributed to a rise in the price of US Steel stock futures.

Conclusion

US Steel stock futures offer investors a unique opportunity to speculate on the future price of US Steel Corporation shares. By understanding the key features, factors influencing the price, and utilizing hedging strategies, investors can effectively navigate the complexities of this financial instrument. However, it is crucial to conduct thorough research and stay informed about market trends to make informed decisions.