In today's fast-paced energy market, understanding the trends and patterns of US crude oil stocks is crucial for investors and businesses alike. This article delves into the intricacies of the US crude oil stock graph, offering a comprehensive analysis of its historical trends, current status, and future projections.

Historical Trends

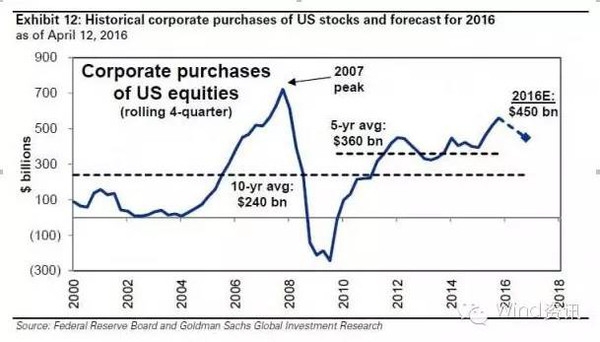

To grasp the significance of the current US crude oil stock graph, it is essential to examine its historical trends. Over the past few decades, the US has experienced various fluctuations in its crude oil stock levels. These fluctuations can be attributed to a range of factors, including global demand, production levels, and geopolitical events.

In the early 2000s, the US crude oil stock graph showed a steady decline, primarily due to increased domestic consumption and limited production. However, this trend reversed in the mid-2010s with the advent of hydraulic fracturing, also known as "fracking," which led to a surge in US crude oil production.

Current Status

As of the latest data, the US crude oil stock graph reflects a complex scenario. On one hand, the country has reached record-high stock levels, surpassing those seen before the 2008 financial crisis. This surge can be attributed to the ongoing increase in US crude oil production, driven by the thriving shale industry.

On the other hand, the stock levels have been fluctuating, influenced by various factors such as global oil demand, geopolitical tensions, and changes in refining capacity. For instance, the COVID-19 pandemic caused a significant drop in global oil demand, leading to a decrease in US crude oil stock levels. However, as the world economy recovered, demand for oil began to rise, resulting in a gradual increase in stock levels.

Future Projections

Predicting the future trajectory of the US crude oil stock graph is challenging due to the numerous variables involved. However, some key factors can help us make educated guesses about the future.

Firstly, the ongoing growth of the US shale industry is expected to continue, contributing to higher crude oil production. Secondly, geopolitical tensions, such as those in the Middle East, can impact global oil supply and, consequently, US stock levels. Lastly, technological advancements in energy efficiency and renewable energy sources may influence the demand for oil in the long term.

Case Study: The 2020 Oil Price Crash

One notable case study is the 2020 oil price crash, which resulted from a perfect storm of factors. The pandemic led to a sharp decline in global oil demand, while Saudi Arabia and Russia engaged in a price war, flooding the market with oil. This situation caused US crude oil stock levels to surge, reaching record-highs.

This case study highlights the volatility of the energy market and the importance of monitoring the US crude oil stock graph closely. By understanding the factors that contribute to stock levels, businesses and investors can better position themselves to navigate the ever-changing landscape.

In conclusion, the US crude oil stock graph is a vital tool for anyone looking to understand the energy market. By examining historical trends, current status, and future projections, we can gain valuable insights into the complex world of oil stocks.