In the dynamic world of corporate finance, one of the most debated topics is the phenomenon of companies buying back their own stock. This practice, known as stock buybacks, has seen a surge in popularity among US corporations. But what does this mean for investors, the economy, and the companies themselves? In this article, we delve into the intricacies of stock buybacks, their implications, and their impact on the business landscape.

Understanding Stock Buybacks

At its core, a stock buyback occurs when a company purchases its own shares from the market. These shares are then retired or canceled, reducing the number of outstanding shares. The rationale behind this move is often to increase the value of the remaining shares, potentially benefiting existing shareholders.

Why Do Companies Engage in Stock Buybacks?

Several reasons motivate companies to engage in stock buybacks:

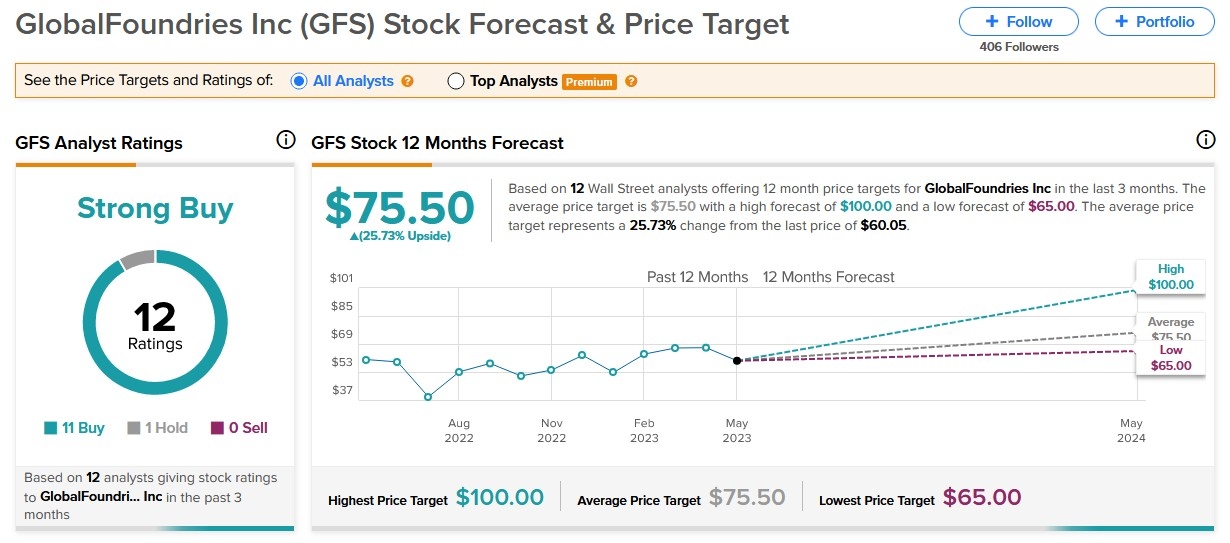

- Enhance Shareholder Value: By reducing the number of outstanding shares, companies can boost the earnings per share (EPS), making the company more attractive to investors.

- Signal Confidence: A stock buyback can signal to the market that company management believes in the company's future prospects.

- Increase Return on Equity (ROE): As the number of outstanding shares decreases, the company's ROE improves, reflecting the profitability of the business.

The Impact of Stock Buybacks

While stock buybacks can be beneficial for shareholders, their impact is not always positive. Here are some key points to consider:

- Market Manipulation Concerns: Some critics argue that stock buybacks can be used to manipulate stock prices, benefiting insiders and executives.

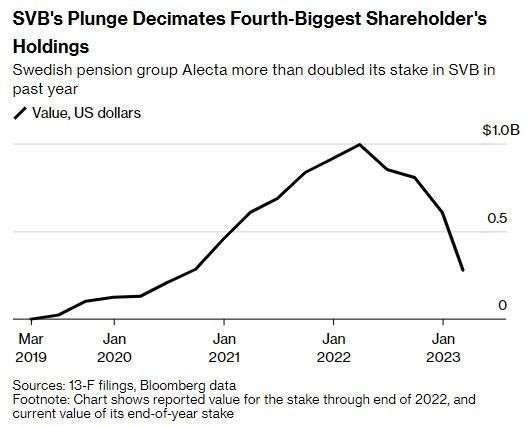

- Investment in Growth: Companies may choose to reinvest their capital in growth opportunities rather than buying back stock, potentially leading to long-term benefits.

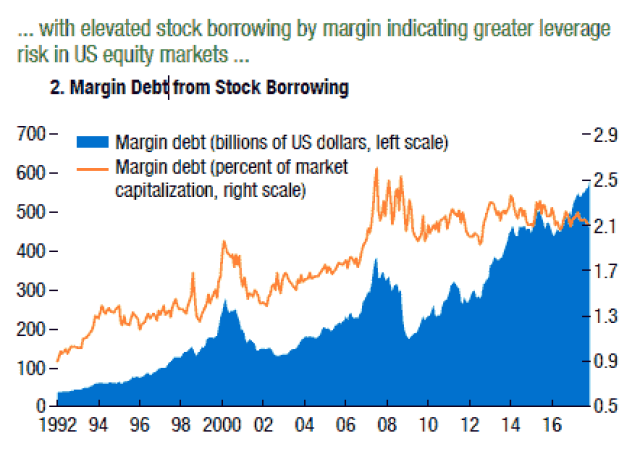

- Debt Levels: In some cases, companies may fund stock buybacks through debt, increasing their financial leverage and potentially raising concerns about their financial stability.

Case Studies: The Pros and Cons of Stock Buybacks

To illustrate the potential impact of stock buybacks, let's consider two contrasting examples:

- Apple Inc.: Apple has been a leading proponent of stock buybacks, spending billions of dollars to repurchase shares over the years. This strategy has helped increase the company's EPS and make it one of the most valuable companies in the world.

- Tesla, Inc.: In contrast, Tesla has faced criticism for its stock buyback activity. Some argue that the company's focus on stock buybacks has detracted from its investment in R&D and expansion into new markets.

Conclusion

Stock buybacks are a complex issue with both potential benefits and drawbacks. While they can enhance shareholder value and signal confidence in a company's future, they may also raise concerns about market manipulation and investment in growth opportunities. As with any financial strategy, it's crucial to consider the context and the long-term implications before drawing conclusions about the effectiveness of stock buybacks.