Investing in stocks is a popular way to grow wealth, but with so many options available, it can be challenging to decide where to invest. Two of the most prominent markets are the United Kingdom and the United States. In this article, we will compare UK and US stocks, highlighting the key differences and similarities to help you make an informed decision.

Market Size and Liquidity

One of the first things to consider when comparing UK and US stocks is the market size and liquidity. The United States is home to the world's largest stock market, the New York Stock Exchange (NYSE), followed by the NASDAQ. These exchanges offer a vast array of investment opportunities, including large-cap, mid-cap, and small-cap companies.

In contrast, the UK's stock market is smaller, with the London Stock Exchange (LSE) being the primary exchange. While the UK market offers a diverse range of companies, it may not have the same level of liquidity as the US market.

Industry Representation

The UK and US stock markets also differ in terms of industry representation. The US market is well-diversified, with a strong presence in technology, healthcare, and consumer discretionary sectors. The UK market, on the other hand, has a greater concentration in financial services, mining, and energy sectors.

For investors looking to diversify their portfolios, the US market may offer more opportunities, especially in emerging sectors such as renewable energy and biotechnology.

Dividends and Yield

Dividends are a significant source of income for many investors. In general, US stocks tend to offer higher dividend yields compared to UK stocks. This is due to several factors, including the maturity of the US market and the tax advantages of dividends in the US.

However, it's important to note that some UK stocks also offer attractive dividend yields, particularly in sectors such as utilities and real estate.

Regulation and Taxation

The regulatory and taxation environments also play a crucial role in determining the attractiveness of UK and US stocks. The US has a more stringent regulatory framework, which can provide investors with greater protection. However, this also means that companies listed on US exchanges may face higher compliance costs.

In terms of taxation, the UK and US have different tax systems that can impact investment returns. It's essential to consider the tax implications of investing in both markets, especially for investors with a global tax footprint.

Historical Performance

When comparing UK and US stocks, it's worth looking at historical performance. Over the long term, both markets have delivered strong returns. However, the US market has generally outperformed the UK market, particularly during periods of economic growth and technological innovation.

Case Studies

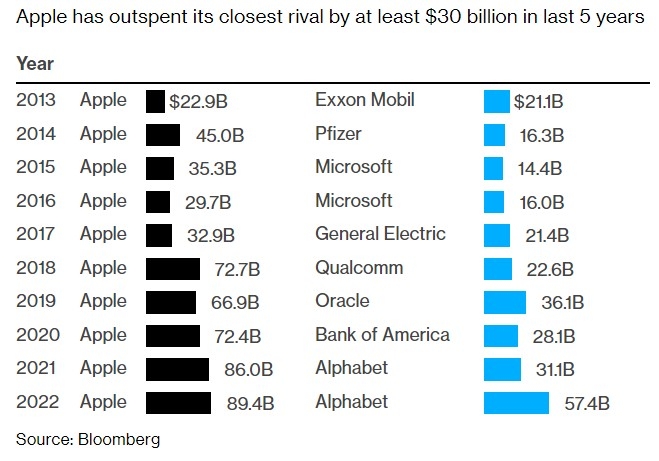

To illustrate the differences between UK and US stocks, let's consider two companies: British multinational pharmaceutical company GlaxoSmithKline (GSK) and American tech giant Apple Inc.

GSK, listed on the LSE, is a well-established company with a strong presence in the healthcare sector. It offers a steady dividend yield and has a diversified product portfolio, which makes it a popular choice for income investors.

Apple, listed on the NASDAQ, is a leader in the technology sector. It has a high growth potential and offers a substantial dividend yield. While Apple's stock is more volatile than GSK's, it has historically delivered superior returns.

In conclusion, when choosing between UK and US stocks, investors should consider factors such as market size, liquidity, industry representation, dividends, regulation, taxation, and historical performance. By conducting thorough research and understanding the unique characteristics of each market, investors can make informed decisions that align with their investment goals and risk tolerance.