In the dynamic world of the stock market, identifying top momentum stocks is crucial for investors seeking significant returns. The term "top momentum stocks" refers to those companies that have shown a rapid increase in price and are expected to continue their upward trend. This article delves into the recent trends of top momentum stocks in the US market, providing valuable insights for investors.

Understanding Momentum Stocks

Momentum stocks are those that have gained significant popularity and have seen a rapid increase in their share price. These stocks are often associated with high growth potential and are usually favored by active traders and short-term investors. They often outperform the market during bull markets and can offer substantial returns.

Recent Trends in Top Momentum Stocks

Technology Sector: The technology sector has been a major driver of momentum stocks in recent years. Companies like Apple, Amazon, and Tesla have consistently shown strong growth and have been at the forefront of momentum stocks.

Biotechnology and Pharmaceuticals: The biotechnology and pharmaceutical sector has also seen significant momentum, driven by the ongoing pandemic and the increasing demand for innovative treatments and vaccines. Companies like Moderna and Regeneron have been among the top momentum stocks in this sector.

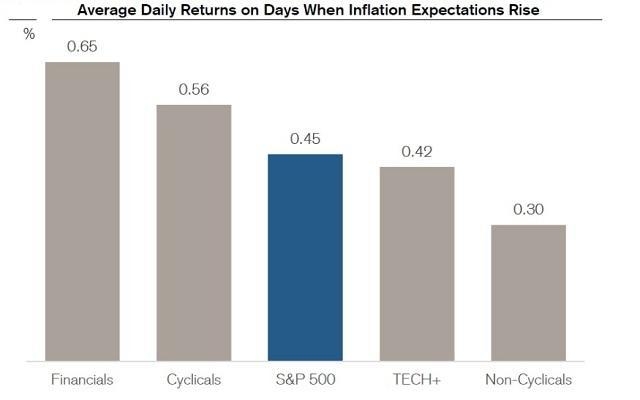

Financial Sector: The financial sector has also seen a surge in momentum stocks, particularly in the banking and fintech sectors. Companies like Goldman Sachs and PayPal have been among the top performers.

Case Studies:

Tesla: Tesla has been a prime example of a momentum stock. The company's electric vehicles and renewable energy products have gained significant traction, leading to a surge in its share price.

Moderna: Moderna's COVID-19 vaccine has been a game-changer, leading to a significant increase in its share price and making it a top momentum stock.

Factors to Consider When Investing in Momentum Stocks

Fundamental Analysis: While momentum stocks are often driven by market sentiment, it is crucial to conduct fundamental analysis to ensure the long-term viability of the company.

Technical Analysis: Technical analysis can help identify patterns and trends in the stock price, providing valuable insights for investors.

Market Sentiment: Understanding market sentiment is crucial when investing in momentum stocks. It is important to stay updated with the latest news and trends in the market.

Conclusion

Investing in top momentum stocks can offer significant returns, but it is crucial to conduct thorough research and stay informed about the latest trends. By understanding the factors that drive momentum stocks and conducting a comprehensive analysis, investors can make informed decisions and maximize their returns.