The trade war has been a significant source of uncertainty in the global market, and the United States stock market has not been immune to its impact. As tensions escalate between the US and other major economies, investors are increasingly concerned about the potential repercussions on the stock market. This article delves into the effects of the trade war on the US stock market, providing insights into the current situation and potential future developments.

Understanding the Trade War

The trade war refers to the ongoing conflict between the United States and other major economies, primarily China, over trade policies. The US government has imposed tariffs on various Chinese goods, leading to retaliatory measures from China. This has created a ripple effect, affecting global trade and investment flows.

Impact on US Stock Market

The trade war has had a significant impact on the US stock market. Here are some key effects:

- Stock Market Volatility: The trade war has led to increased volatility in the stock market. Investors are uncertain about the future, leading to frequent ups and downs in stock prices.

- Sector-Specific Impact: Certain sectors have been more affected than others. For example, technology stocks, which are heavily exposed to China, have seen significant declines.

- Weakening of the Dollar: The trade war has weakened the US dollar, which can have a negative impact on US stocks, as they are often priced in dollars.

Case Studies

One notable example is the impact of the trade war on Apple Inc. As a major player in the technology sector, Apple has a significant presence in China. The imposition of tariffs on Chinese goods has led to increased costs for Apple, affecting its profitability. As a result, Apple's stock price has seen a decline.

Future Outlook

The future of the US stock market in the context of the trade war remains uncertain. However, there are several factors to consider:

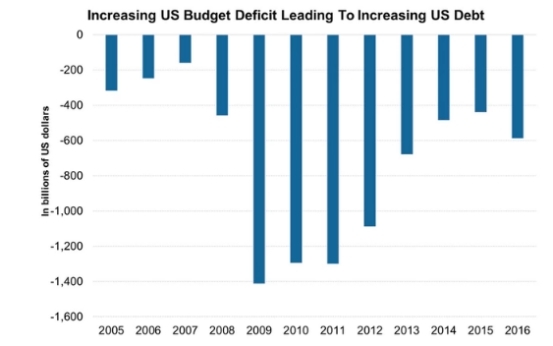

- Economic Growth: The trade war could lead to a slowdown in global economic growth, which could have a negative impact on the stock market.

- Policy Changes: Both the US and China have the potential to implement policies to ease tensions, which could positively impact the stock market.

- Investor Sentiment: The sentiment of investors plays a crucial role in determining stock market movements. As such, any positive news regarding the trade war could lead to a rally in the stock market.

In conclusion, the trade war has had a significant impact on the US stock market, leading to increased volatility and sector-specific effects. The future remains uncertain, but investors should remain vigilant and stay informed about the latest developments in the trade war and its implications for the stock market.