Introduction: The recent attack by the United States on Iran has sent shockwaves through the global economy, particularly the stock market. In this article, we delve into the impact of the US attack on Iran on the stock market, exploring the immediate aftermath and potential long-term consequences.

Immediate Aftermath: The attack on Iran triggered a sharp decline in the stock market, with major indices experiencing significant drops. This was primarily due to the uncertainty surrounding the conflict and its potential to escalate into a full-scale war. Investors, worried about the economic impact of a prolonged conflict, sold off stocks, leading to a widespread sell-off.

Key Indices: The S&P 500, the Dow Jones Industrial Average, and the NASDAQ all saw substantial declines in the immediate aftermath of the attack. The S&P 500 fell by over 1%, while the Dow Jones Industrial Average and the NASDAQ experienced similar declines. These declines were driven by concerns about rising oil prices, increased geopolitical tensions, and the potential for a global economic slowdown.

Impact on Oil Prices: One of the most significant consequences of the attack on Iran was the surge in oil prices. As Iran is a major oil producer, the attack raised concerns about supply disruptions and the potential for higher oil prices. This, in turn, led to increased inflationary pressures and fears of a global economic slowdown.

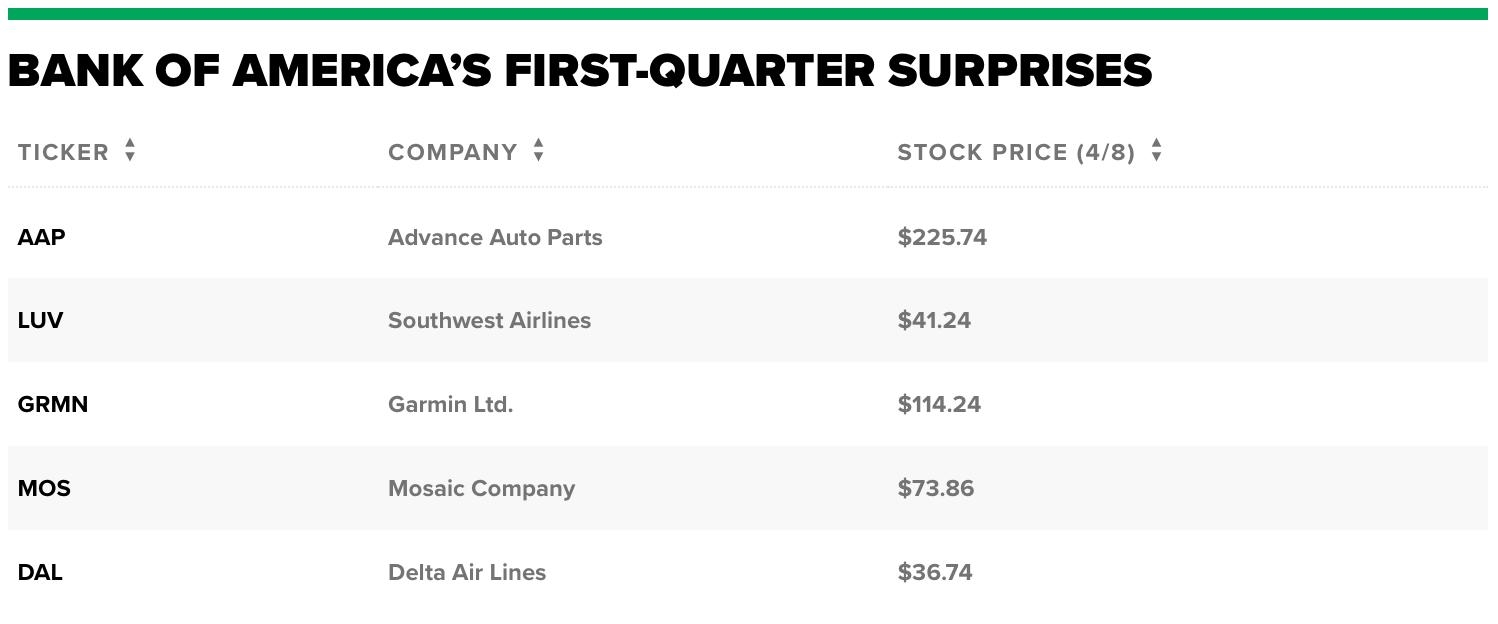

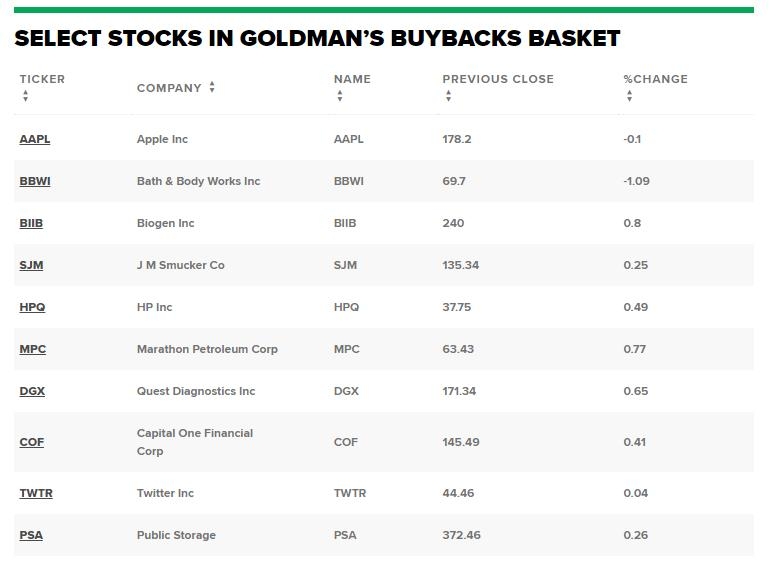

Sector Impact: The attack on Iran had a varied impact on different sectors of the stock market. The energy sector, which includes oil and gas companies, saw a surge in stock prices as investors anticipated higher oil prices. However, other sectors, such as technology and consumer discretionary, experienced significant declines as investors sought safer investments.

Long-Term Consequences: While the immediate aftermath of the attack on Iran saw a sharp decline in the stock market, the long-term consequences remain uncertain. Here are some potential long-term consequences:

Escalation of Conflict: If the conflict between the US and Iran escalates into a full-scale war, it could have severe economic consequences. This could lead to higher oil prices, increased inflation, and a global economic slowdown.

Geopolitical Tensions: The attack on Iran has raised geopolitical tensions in the region, potentially leading to further conflicts and instability. This could have a negative impact on the stock market, as investors remain cautious and risk-averse.

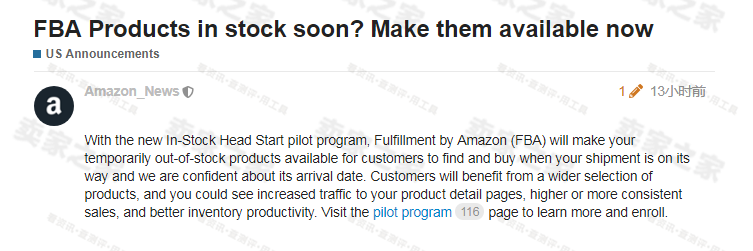

Supply Chain Disruptions: If the conflict leads to supply chain disruptions, it could impact various sectors, including technology, automotive, and consumer goods. This could lead to lower stock prices and a broader economic slowdown.

Case Study: OPEC+ Decision In response to the attack on Iran, the Organization of the Petroleum Exporting Countries (OPEC) and its allies, known as OPEC+, decided to increase oil production. This decision aimed to stabilize oil prices and mitigate the impact of supply disruptions. However, the market reaction to this decision was mixed, with some investors remaining concerned about the potential for higher oil prices and increased geopolitical tensions.

Conclusion: The attack on Iran by the United States has had a significant impact on the stock market, with immediate declines and long-term uncertainties. While the energy sector has seen a surge in stock prices, other sectors have experienced significant declines. As the situation unfolds, investors remain cautious and risk-averse, with the potential for further market volatility.