Introduction: Investing in dividend stocks can be a smart way to generate consistent income and benefit from the growth of the companies you invest in. With the U.S. stock market being one of the most robust and diverse in the world, finding the best dividend stocks can be a challenging task. In this article, we will explore some of the top dividend stocks in the U.S. and provide insights into why they are considered the best in the market.

ExxonMobil (XOM) ExxonMobil is one of the largest oil and gas companies in the world, and it has been consistently paying dividends since 1882. The company has a strong track record of increasing its dividends over the years, making it a reliable investment for income seekers. With a dividend yield of around 4.4%, ExxonMobil offers investors a stable and growing source of income.

Johnson & Johnson (JNJ) Johnson & Johnson is a diversified healthcare company that has been paying dividends since 1895. The company operates in various segments, including consumer healthcare, pharmaceuticals, and medical devices. With a dividend yield of approximately 3.1%, Johnson & Johnson offers investors a steady stream of income and the potential for capital appreciation.

Procter & Gamble (PG) Procter & Gamble is a consumer goods giant that produces products ranging from Tide detergent to Gillette razors. The company has a long history of paying dividends and has increased its dividend for 64 consecutive years. With a dividend yield of about 2.6%, Procter & Gamble is a solid investment for income seekers and those looking for long-term capital appreciation.

Philip Morris International (PM) Philip Morris International is a tobacco company that produces cigarettes and other tobacco products worldwide. Despite the controversial nature of the industry, Philip Morris has a strong track record of paying dividends and has increased its dividend for 44 consecutive years. With a dividend yield of approximately 5.6%, Philip Morris is a high-yielding stock that can provide investors with substantial income.

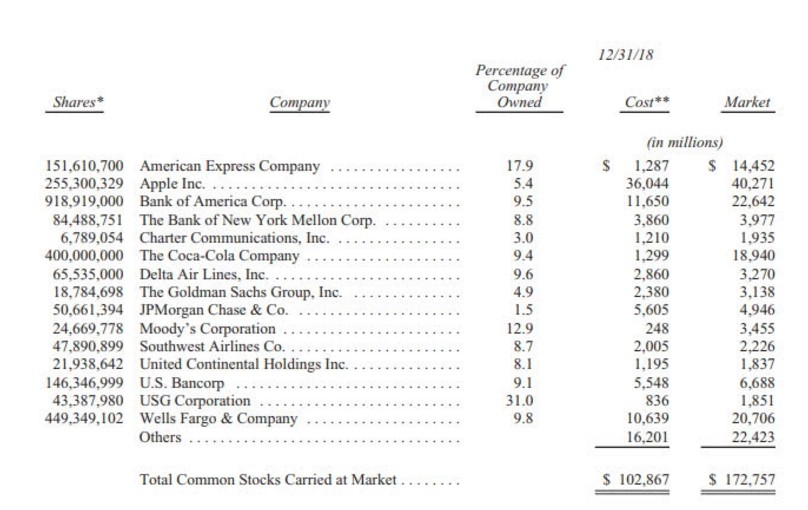

Coca-Cola (KO)

Coca-Cola is one of the most iconic brands in the world, and it has been paying dividends since 1893. The company operates in over 200 countries and offers a wide range of beverages, including soft drinks, teas, and coffees. With a dividend yield of around 3.2%, Coca-Cola is a reliable source of income and potential capital appreciation.

Conclusion: Investing in dividend stocks can be a wise decision for investors looking to generate consistent income and benefit from the growth of the companies they invest in. The aforementioned stocks are just a few examples of the best dividend stocks in the U.S. Investors should conduct thorough research and consider their own financial goals and risk tolerance before making any investment decisions.