Are you considering investing in US stocks but unsure whether now is the right time? The stock market is unpredictable and can be overwhelming, but with the right information and strategy, you can make informed decisions. In this article, we'll explore the factors that can help you determine if it's a good time to buy US stocks.

1. Economic Indicators

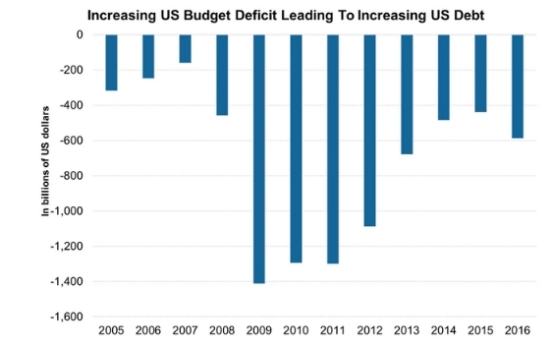

One of the first things to consider when deciding whether to buy US stocks is the economic indicators. Key indicators include:

- GDP Growth: A growing GDP suggests a healthy economy, which can lead to increased corporate profits and stock prices.

- Interest Rates: Low interest rates can make stocks more attractive as fixed-income investments become less appealing.

- Inflation: Moderate inflation can be a sign of a strong economy, but high inflation can erode stock values.

2. Market Trends

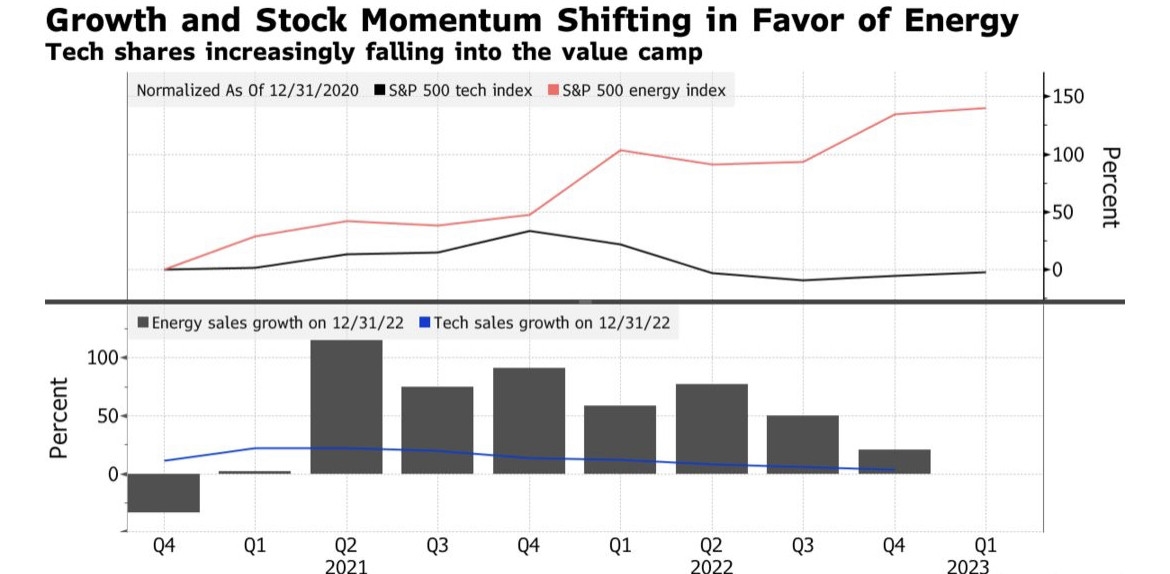

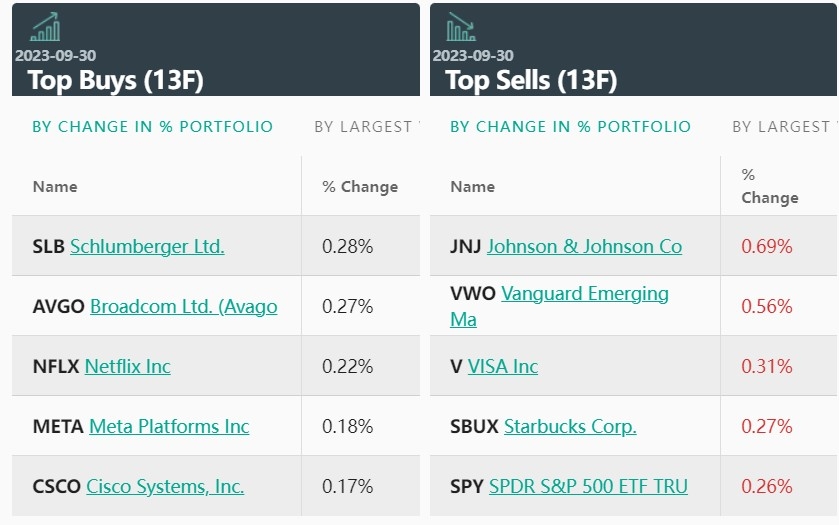

Understanding the current market trends can also provide valuable insights. Here are a few key trends to consider:

- Sector Performance: Some sectors may be performing better than others due to various factors such as technological advancements or regulatory changes.

- Market Valuations: Overvalued markets can be risky, while undervalued markets may present good opportunities for long-term investors.

- Market Sentiment: Sentiment can fluctuate significantly, and it's essential to stay informed and make decisions based on data rather than emotions.

3. Company Fundamentals

Analyzing the fundamentals of individual companies is crucial before investing. Key factors to consider include:

- Earnings: Companies with strong earnings growth are often more attractive to investors.

- Dividends: Dividend-paying stocks can provide income and stability.

- Debt Levels: Companies with high debt levels may be riskier investments.

4. Risk Tolerance

Your risk tolerance plays a significant role in your investment decisions. Consider the following:

- Long-Term vs. Short-Term Investing: Long-term investors may be more comfortable with volatile markets, while short-term investors may prefer more stable investments.

- Asset Allocation: Diversifying your portfolio can help manage risk and improve your chances of success.

5. Case Studies

Let's look at a couple of case studies to illustrate the potential of US stocks:

- Apple Inc.: Over the past decade, Apple's stock has seen significant growth, making it a solid investment for long-term investors.

- Tesla Inc.: Tesla's stock has experienced extreme volatility, offering both high-risk and high-reward opportunities.

Conclusion

Determining whether it's a good time to buy US stocks requires a thorough analysis of economic indicators, market trends, company fundamentals, and your risk tolerance. While the stock market can be unpredictable, armed with the right information and strategy, you can make informed decisions and potentially achieve financial success. Remember to stay informed, remain patient, and invest for the long term.