In today's interconnected global economy, the movements of stock markets in one country can have significant implications for investors worldwide. One such market that has garnered attention is Japan's stock market. But how does Japan stock affect us, specifically in the United States? Let's delve into this topic to understand the interplay between these two markets.

Understanding the Japanese Stock Market

Japan's stock market, known as the Tokyo Stock Exchange (TSE), is one of the largest and most influential in the world. It is home to numerous multinational corporations (MNCs) and plays a crucial role in the global financial landscape. The Nikkei 225, a widely followed index representing the top 225 companies listed on the TSE, is a barometer of Japan's economic health.

Impact on U.S. Investors

Several ways in which the Japanese stock market can affect U.S. investors are:

Portfolio Diversification: Investing in Japanese stocks can help U.S. investors diversify their portfolios. Japan's market has a different sector composition and economic cycle compared to the U.S., which can reduce overall portfolio risk.

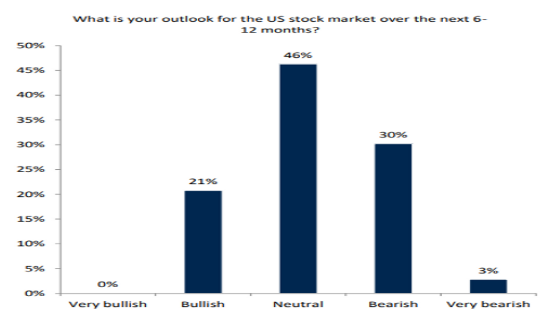

Economic Indicators: The performance of the Japanese stock market can serve as an economic indicator. When the Nikkei 225 is performing well, it often suggests a strong economy, which can be a positive sign for global markets, including the U.S.

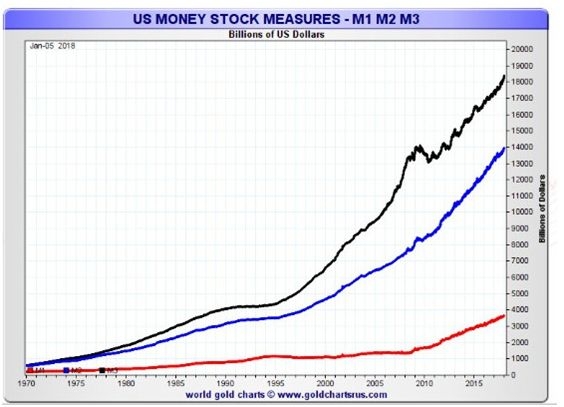

Currency Fluctuations: The Japanese yen (JPY) and the U.S. dollar (USD) often move inversely. When the yen strengthens, Japanese stocks can become more expensive for U.S. investors. Conversely, a weaker yen can make Japanese stocks more attractive.

MNCs Presence: Many U.S. companies have significant operations in Japan, making them directly impacted by the Japanese stock market. Changes in the stock prices of these companies can have a direct impact on U.S. investors' portfolios.

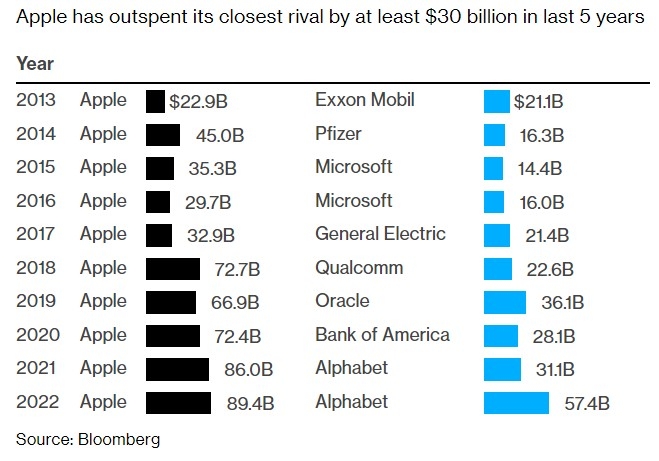

Case Study: Apple Inc.

A prime example of a U.S. company affected by the Japanese stock market is Apple Inc. Apple's manufacturing operations in Japan are significant, and any fluctuations in the Nikkei 225 can impact its supply chain and production costs. Additionally, Apple's shares are listed on the TSE, making it a direct participant in the Japanese stock market.

Conclusion

In conclusion, the Japanese stock market has a significant impact on U.S. investors. From portfolio diversification to economic indicators and currency fluctuations, the interplay between these two markets is undeniable. As such, it is crucial for U.S. investors to stay informed about the Japanese stock market and its potential implications for their investments.