On September 11, 2001, the world witnessed a tragic day when the United States experienced the worst terrorist attack in its history. The attacks on the World Trade Center in New York City, the Pentagon in Washington D.C., and the subsequent crash of United Airlines Flight 93 in Pennsylvania left thousands dead and the nation in shock. The event had a profound impact on various aspects of American life, including the stock market. This article explores how 9/11 affected the US stock market and the long-term repercussions it had on the financial sector.

Immediate Impact on the Stock Market

The day of the attacks, the stock market was forced to shut down. The New York Stock Exchange (NYSE) and the NASDAQ were closed for the first time since 1933, following a recommendation from the president of the United States. This unprecedented closure was a response to the widespread chaos and uncertainty following the attacks.

When the markets reopened on September 17, the impact was immediate and severe. The Dow Jones Industrial Average (DJIA) plummeted by 7.1%, marking the largest one-day point drop in its history. The NASDAQ and the S&P 500 also experienced significant declines. The market's reaction was driven by a combination of fear, uncertainty, and the realization that the economy would face significant challenges in the aftermath of the attacks.

Long-Term Repercussions

The long-term repercussions of 9/11 on the stock market were multifaceted. Here are some key points to consider:

1. Increased Government Spending and Debt

The attacks led to a significant increase in government spending on defense and homeland security. This increase in spending contributed to a rise in the national debt, which in turn affected investor sentiment and market performance.

2. Shift in Investment Trends

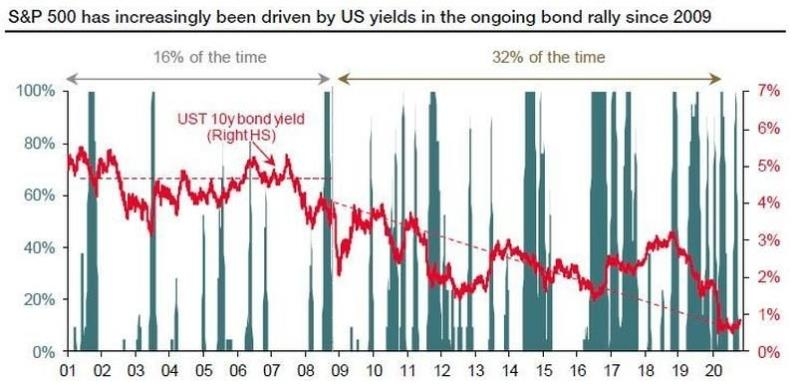

The attacks prompted a shift in investment trends, with investors increasingly focusing on sectors such as technology, healthcare, and defense. This shift was driven by the belief that these sectors would be less affected by geopolitical events and economic downturns.

3. Impact on Insurance and Real Estate

The attacks had a significant impact on the insurance and real estate industries. The insurance industry faced substantial claims due to property damage and the loss of life, leading to increased premiums and higher costs for businesses and individuals. The real estate market also experienced a downturn, with lower demand for commercial and residential properties in the aftermath of the attacks.

4. Long-Term Economic Consequences

The long-term economic consequences of 9/11 were significant. The attacks led to a recession in 2001, with GDP growth slowing and unemployment rising. This recession was compounded by the burst of the dot-com bubble in 2000 and the subsequent economic downturn.

Case Studies

One notable case study is the impact of 9/11 on the airline industry. The attacks led to a significant decline in passenger traffic, resulting in a loss of billions of dollars for airlines. This, in turn, affected the stock prices of major airlines, with many experiencing significant declines in market value.

Another case study is the impact of 9/11 on the financial sector. The attacks led to a loss of confidence in the financial markets, with investors selling off stocks in droves. This selling pressure contributed to the bear market that followed the attacks, with the DJIA falling by nearly 30% from its peak in 2000 to its trough in 2002.

In conclusion, 9/11 had a profound impact on the US stock market, both in the immediate aftermath of the attacks and in the long term. The event prompted a shift in investment trends, increased government spending and debt, and led to significant economic challenges for the nation. While the stock market has recovered from the attacks, the scars of 9/11 are still evident in the financial sector today.