The European Union Referendum of 2016, also known as Brexit, was a landmark event that not only reshaped the political and economic landscape of the United Kingdom but also had profound implications on global financial markets, including the US stock market. This article delves into the impact of Brexit on the US stock market, providing insights and analyzing the aftermath.

The referendum on whether the UK should remain a member of the European Union was a contentious issue that sparked intense debate among citizens and investors alike. The results of the referendum, which led to the UK’s departure from the EU, were a significant shock to the markets. In the wake of this decision, many investors feared a possible recession and a deterioration in global economic growth.

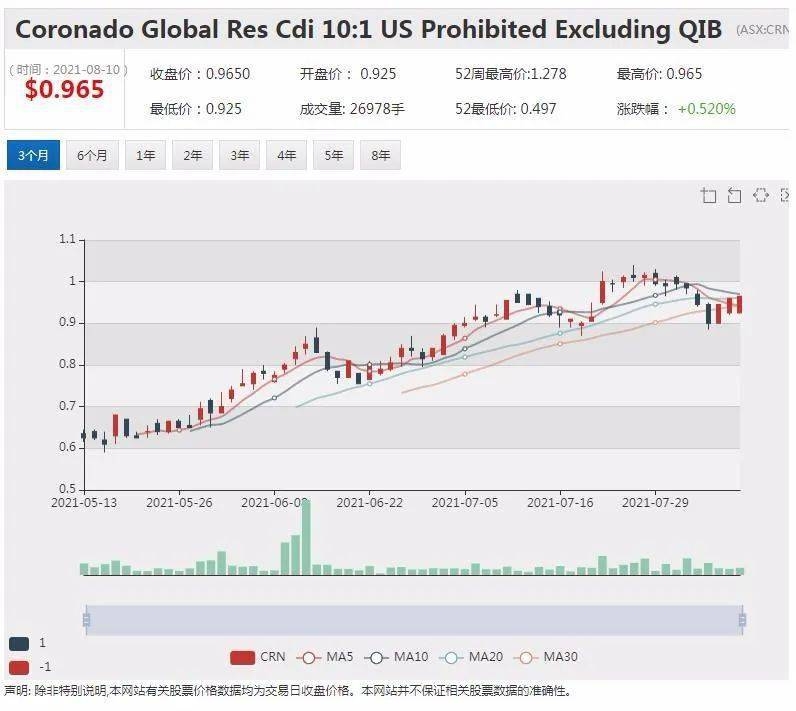

The immediate aftermath of the referendum saw the FTSE 100 index and the GBP plummet, indicating widespread panic and uncertainty among investors. This panic also spilled over to the US stock market, with indices such as the S&P 500 and the Dow Jones Industrial Average experiencing volatile movements in the short term. Brexit-induced uncertainty led to a spike in volatility, as investors grappled with the potential consequences of the UK leaving the EU.

One of the key concerns post-Brexit was the potential trade disruptions. The UK, being a major exporter and importer, relied heavily on trade with the EU. Investors worried about tariffs, customs checks, and supply chain disruptions that could arise from a no-deal Brexit scenario. However, the actual impact on trade was less severe than initially feared, as the UK and the EU eventually reached a transition agreement.

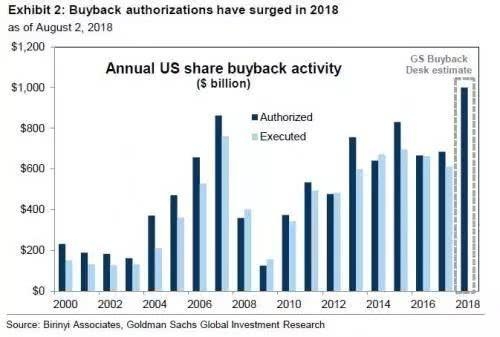

Another crucial factor that influenced the US stock market was the monetary policy of both the UK and the EU post-Brexit. The Bank of England and the European Central Bank implemented easing measures to counteract the potential economic downturn. These measures, such as interest rate cuts and quantitative easing, were aimed at stabilizing the economy and preventing a recession.

Despite the initial uncertainty, the US stock market showed resilience and eventually recovered. Many investors saw the UK’s departure from the EU as a short-term event that would have a limited impact on the global economy. The S&P 500 and the Dow Jones Industrial Average hit new all-time highs in the following years, indicating a strong recovery from the initial Brexit-induced volatility.

One notable case that illustrates the impact of Brexit on the US stock market is the performance of technology stocks. Despite the overall uncertainty, companies such as Facebook, Amazon, and Google continued to grow and achieve significant success. This trend highlights the resilience of the tech industry and its ability to weather economic uncertainties.

In conclusion, the impact of Brexit on the US stock market was a complex issue. While the initial reaction was characterized by volatility and uncertainty, the market ultimately demonstrated resilience and recovery. The lesson from this experience is the importance of diversifying investments and staying focused on long-term strategies, rather than reacting to short-term fluctuations in the market.

By understanding the impact of events like Brexit on the US stock market, investors can better prepare for potential challenges and make informed decisions about their investment portfolios.