In the ever-evolving tobacco industry, smokeless tobacco products have carved out a niche for themselves. As investors look to capitalize on this segment, understanding the stock price of companies like Us Smokeless Tobacco becomes crucial. This article delves into the factors influencing the stock price, the company's performance, and potential investment opportunities.

Market Dynamics and Stock Price Trends

The stock price of Us Smokeless Tobacco is influenced by various market dynamics. Economic factors, such as interest rates and inflation, play a significant role. Industry trends, including consumer preferences and regulatory changes, also have a profound impact.

Historically, the stock price has seen fluctuations in line with these factors. For instance, during periods of economic uncertainty, investors often seek safe-haven investments, leading to a decrease in tobacco stock prices. Conversely, during economic upswings, investors may be more willing to take on risk, driving up stock prices.

Company Performance and Financial Metrics

Us Smokeless Tobacco's financial performance is a key driver of its stock price. Key financial metrics, such as revenue growth, profitability, and debt levels, are closely monitored by investors.

Revenue Growth: The company's revenue growth rate is a crucial indicator of its success. A consistent increase in revenue suggests strong market demand and effective business strategies.

Profitability: Profit margins are a reflection of the company's ability to manage costs and generate profits. Higher profitability can lead to increased investor confidence and a higher stock price.

Debt Levels: High debt levels can be a red flag for investors, as they may indicate financial risk. Conversely, low debt levels can be seen as a positive sign, indicating financial stability.

Regulatory Environment and Consumer Trends

The regulatory environment and consumer trends significantly impact the stock price of Us Smokeless Tobacco. Regulatory changes, such as increased taxation or stricter advertising restrictions, can have a negative impact on the company's profitability.

Consumer Trends: Consumer preferences are shifting towards healthier alternatives, including smokeless tobacco products. Companies that adapt to these trends and offer innovative products are more likely to see a positive impact on their stock price.

Case Study: Altria Group Inc.

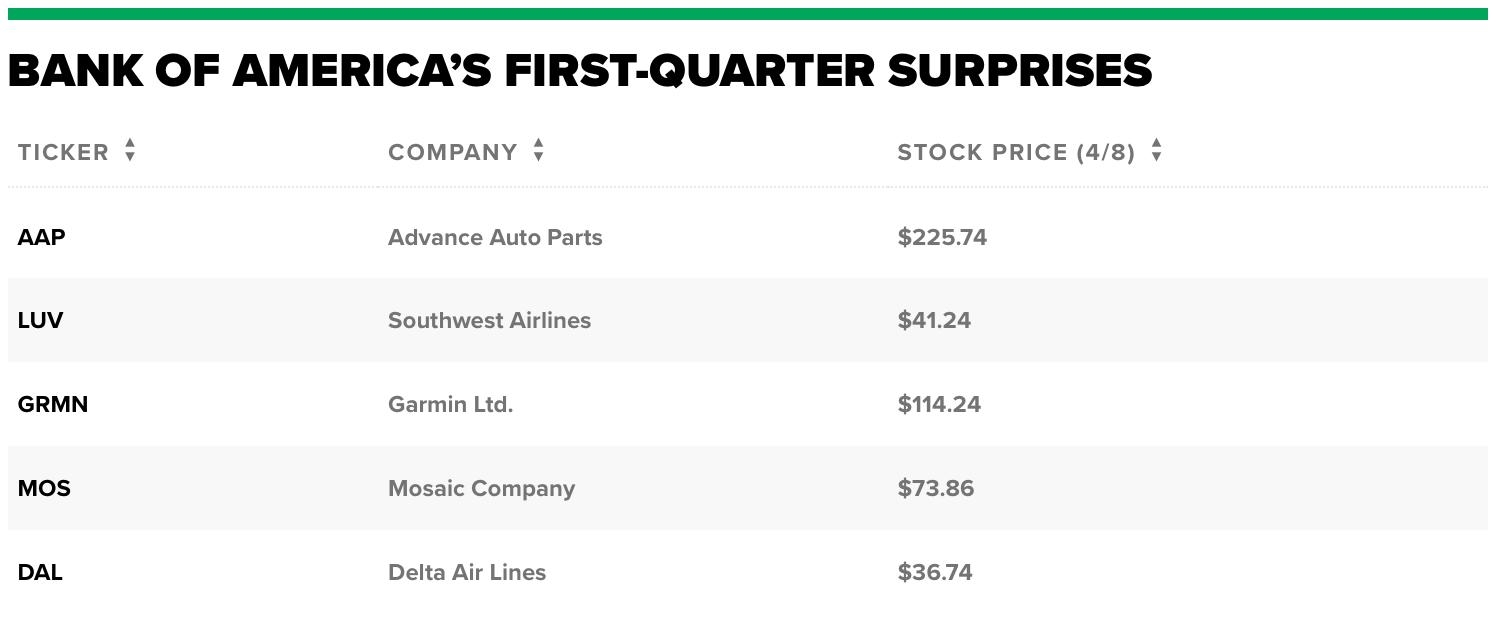

A notable example is Altria Group Inc., which owns Us Smokeless Tobacco. In 2019, Altria's stock price experienced a significant increase following the announcement of a strategic partnership with Philip Morris International. This partnership aimed to develop and commercialize new smokeless tobacco products, leading to increased investor confidence and a higher stock price.

Conclusion

Understanding the Us Smokeless Tobacco company stock price requires a comprehensive analysis of market dynamics, company performance, regulatory environment, and consumer trends. By considering these factors, investors can make informed decisions and potentially capitalize on opportunities in the smokeless tobacco industry.