In today's globalized world, the US International Stock Index has become an essential tool for investors seeking to diversify their portfolios. This index provides a snapshot of the global stock market, offering insights into the performance of companies listed on American exchanges and those with significant international exposure. This article aims to provide a comprehensive guide to the US International Stock Index, covering its history, components, and significance for investors.

What is the US International Stock Index?

The US International Stock Index is a benchmark that tracks the performance of U.S.-listed companies with significant international exposure. It includes companies from various sectors, including technology, healthcare, consumer goods, and financial services. This index provides a comprehensive view of the global stock market, allowing investors to gauge the overall health of the global economy and identify emerging trends.

The History of the US International Stock Index

The US International Stock Index has a rich history, with its roots dating back to the late 20th century. It was initially developed to provide investors with a better understanding of the global stock market and to enable them to make informed investment decisions. Over the years, the index has evolved to include more companies and sectors, making it an invaluable tool for global investors.

Components of the US International Stock Index

The US International Stock Index is composed of companies from various sectors, including technology, healthcare, consumer goods, and financial services. Some of the notable companies included in this index are Apple, Microsoft, Johnson & Johnson, Procter & Gamble, and Visa. These companies have significant international exposure and are considered leaders in their respective industries.

Significance of the US International Stock Index

The US International Stock Index is significant for several reasons. Firstly, it allows investors to gain exposure to the global stock market without having to invest directly in foreign markets. This can be particularly beneficial for investors who may not have the time or expertise to navigate foreign markets. Secondly, the index provides a comprehensive view of the global economy, allowing investors to identify emerging trends and opportunities. Lastly, the index can be used as a benchmark to compare the performance of a specific stock or sector against the broader market.

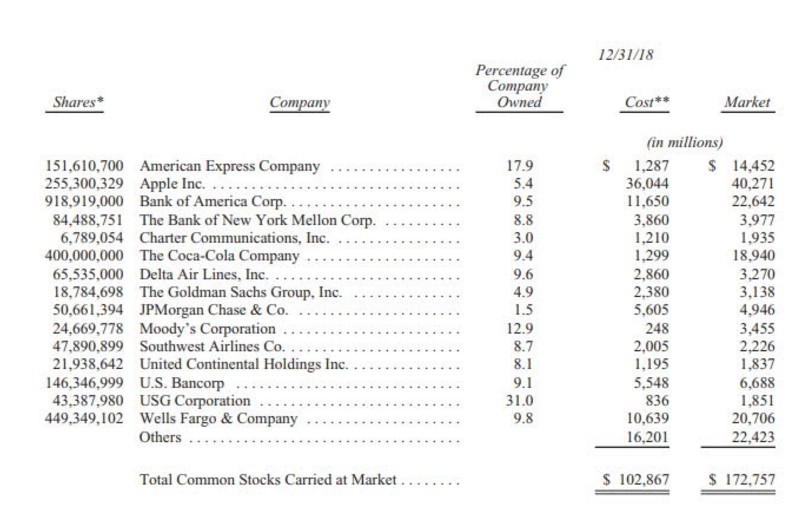

Case Study: Apple Inc.

To illustrate the importance of the US International Stock Index, let's consider the case of Apple Inc. Apple is a leading technology company with significant international exposure. Over the years, Apple has been a major component of the US International Stock Index. Its inclusion in the index has allowed investors to gain exposure to the global technology sector, which has been a major driver of economic growth.

Conclusion

The US International Stock Index is a vital tool for investors seeking to diversify their portfolios and gain exposure to the global stock market. By tracking the performance of U.S.-listed companies with significant international exposure, this index provides valuable insights into the global economy and helps investors make informed investment decisions. Whether you are a seasoned investor or just starting out, understanding the US International Stock Index is crucial for navigating the complex global stock market.