In the vast landscape of the stock market, the large cap total US stock index stands as a beacon for investors seeking stability and growth. This index, which tracks the performance of the largest companies in the United States, offers a comprehensive view of the market's health and potential. In this article, we delve into what the large cap total US stock index represents, its significance, and how it can guide investors in making informed decisions.

What is the Large Cap Total US Stock Index?

The large cap total US stock index, often referred to as the S&P 500, is a widely followed benchmark that measures the performance of the top 500 companies listed on U.S. exchanges. These companies are selected based on their market capitalization, which is the total value of their outstanding shares. The index includes a diverse range of industries, ensuring a comprehensive representation of the U.S. economy.

Significance of the Large Cap Total US Stock Index

The large cap total US stock index holds significant importance for several reasons:

- Market Stability: The index includes only the largest and most stable companies, making it a reliable indicator of market stability. Investors often use the index to gauge the overall health of the stock market.

- Economic Indicator: The performance of the large cap total US stock index reflects the broader economic trends in the United States. When the index is rising, it suggests a strong economy, and vice versa.

- Investment Strategy: Investors use the large cap total US stock index as a benchmark for their investment strategies. By comparing the performance of their portfolios to the index, they can assess their investment returns and adjust their strategies accordingly.

How to Invest in the Large Cap Total US Stock Index

Investors can invest in the large cap total US stock index in several ways:

- Index Funds: Investors can purchase index funds that track the performance of the S&P 500. These funds offer a cost-effective and diversified way to invest in the index.

- ETFs: Exchange-traded funds (ETFs) that track the large cap total US stock index provide investors with the flexibility to buy and sell shares throughout the trading day.

- Stocks: Investors can also purchase individual stocks from the companies included in the index.

Case Studies

To illustrate the impact of the large cap total US stock index, let's consider two case studies:

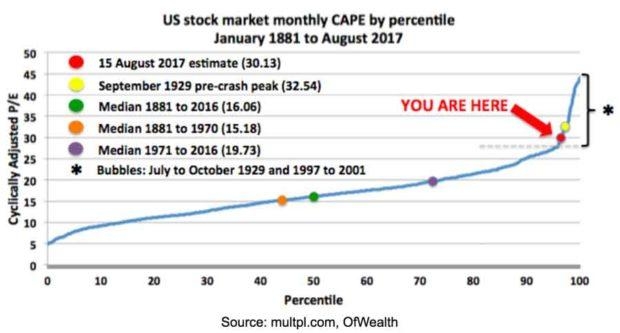

- Case Study 1: During the dot-com bubble in the late 1990s, the large cap total US stock index reached record highs. However, when the bubble burst, the index experienced a significant decline. This example highlights the importance of understanding market trends and risks.

- Case Study 2: In the aftermath of the 2008 financial crisis, the large cap total US stock index faced significant challenges. However, it eventually recovered and reached new highs, demonstrating the resilience of the U.S. stock market.

Conclusion

The large cap total US stock index, or S&P 500, is a vital tool for investors seeking stability and growth. By understanding its significance and how to invest in it, investors can make informed decisions and navigate the complex world of the stock market.