In the ever-evolving world of finance, the United States stands as a prime destination for stock speculations. As investors seek to capitalize on market trends and economic shifts, the U.S. stock market offers a plethora of opportunities. However, it is crucial to understand the risks involved and navigate the complexities of the market effectively. This article delves into the dynamics of U.S. stock speculations, highlighting key factors, potential risks, and strategies for successful investments.

Understanding Stock Speculations

Stock speculation refers to the practice of buying and selling stocks with the expectation of making a profit from short-term price fluctuations. It involves analyzing market trends, economic indicators, and company fundamentals to predict future stock movements. While it can be a lucrative endeavor, it also comes with its fair share of risks.

Key Factors Influencing U.S. Stock Speculations

Economic Indicators: Economic indicators such as GDP growth, unemployment rates, and inflation play a crucial role in shaping stock market trends. Understanding these indicators can help investors make informed decisions.

Political Stability: The political climate in the U.S. significantly impacts the stock market. Stability and favorable policies can lead to increased investor confidence and higher stock prices.

Technological Advancements: The U.S. is a leader in technological innovation, and advancements in technology can drive stock prices of related companies higher.

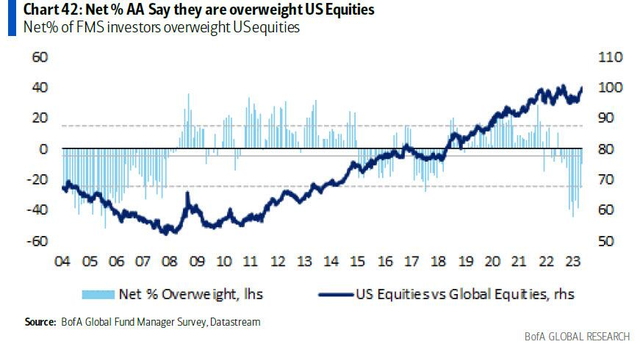

Market Sentiment: Investor sentiment can drive stock prices. Factors such as news, rumors, and market trends can influence investor psychology and lead to rapid price movements.

Opportunities in U.S. Stock Speculations

Diverse Market: The U.S. stock market offers a wide range of investment opportunities, including large-cap, mid-cap, and small-cap companies across various sectors.

Access to Information: The U.S. is home to some of the most advanced financial markets, providing investors with access to real-time data, research, and analysis.

Regulatory Framework: The U.S. has a robust regulatory framework that protects investors and ensures fair trading practices.

Risks Involved in U.S. Stock Speculations

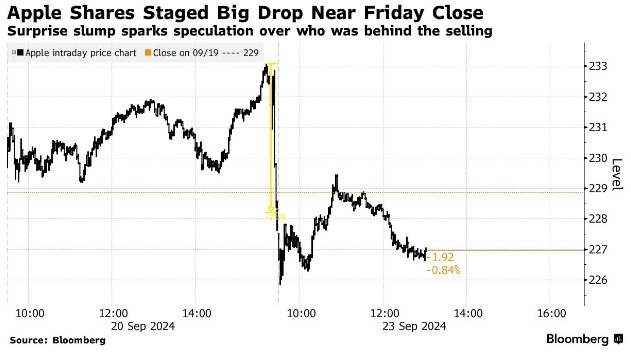

Market Volatility: The stock market can be highly volatile, leading to significant price fluctuations and potential losses.

Economic Uncertainties: Economic downturns, geopolitical tensions, and other unforeseen events can impact stock prices.

High Costs: Stock speculations involve various costs, including brokerage fees, transaction fees, and taxes.

Strategies for Successful U.S. Stock Speculations

Research and Analysis: Conduct thorough research and analysis of companies, sectors, and market trends before making investment decisions.

Risk Management: Implement risk management strategies, such as diversification and setting stop-loss orders, to protect your investments.

Stay Informed: Stay updated with the latest market news, economic indicators, and company developments.

Continuous Learning: The stock market is constantly evolving, so it is essential to keep learning and adapting your strategies.

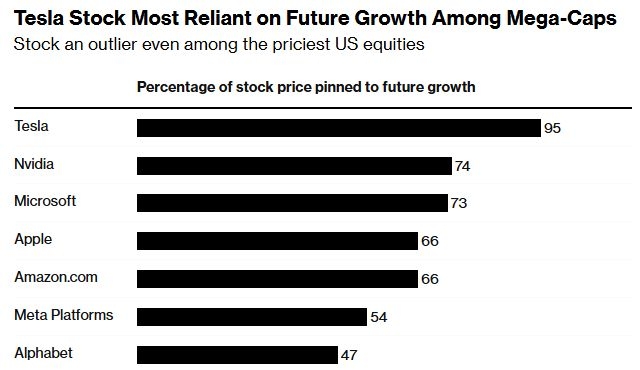

Case Study: Tesla Inc.

Tesla Inc. is a prime example of a stock that has experienced significant volatility and growth. As a leader in electric vehicles and renewable energy, Tesla has seen its stock price soar in recent years. However, it has also faced challenges, including regulatory issues and competition. Investors who stayed informed and adapted their strategies accordingly have been able to capitalize on Tesla's growth.

In conclusion, U.S. stock speculations offer exciting opportunities for investors. However, it is crucial to understand the risks involved and navigate the market with a well-defined strategy. By conducting thorough research, managing risks, and staying informed, investors can increase their chances of success in the U.S. stock market.