Introduction

As we delve into the first month of 2025, the US stock market continues to evolve, reflecting the dynamic nature of global economic and political landscapes. This article provides a comprehensive analysis of the US stock market in January 2025, focusing on key trends, market performance, and potential investment opportunities.

Market Performance

The US stock market opened the year with a strong performance, driven by several factors. The S&P 500, a widely followed index, recorded a significant increase, reflecting the overall optimism in the market. The tech sector, particularly, saw robust growth, with major players like Apple and Microsoft leading the charge.

Trends to Watch

Economic Indicators: The US economy has shown signs of resilience, with low unemployment rates and strong consumer spending. However, concerns about inflation and rising interest rates remain. Investors should closely monitor economic indicators such as GDP growth, consumer confidence, and inflation data.

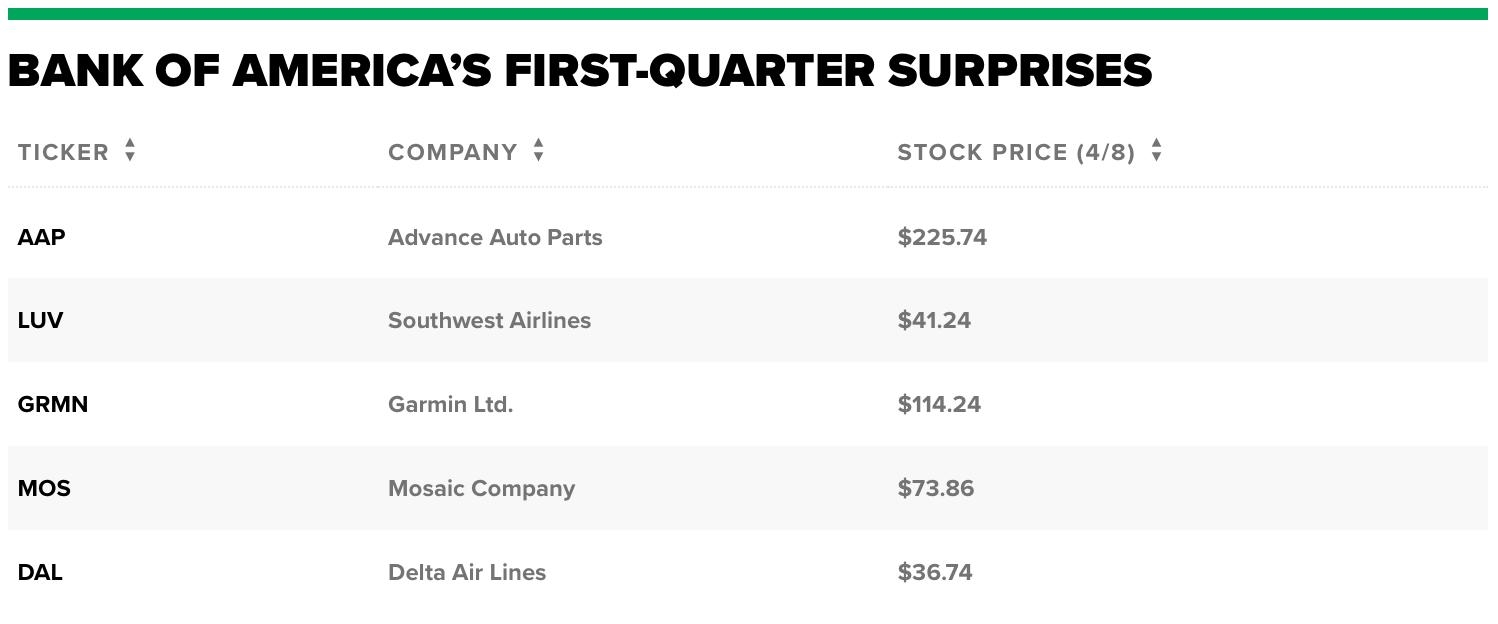

Corporate Earnings: The earnings season for the first quarter of 2025 is expected to be crucial. Companies are expected to report strong earnings, driven by robust revenue growth and cost-cutting measures. However, investors should be cautious about companies that might face challenges due to supply chain disruptions or rising input costs.

Sector Performance: The tech sector has been a major driver of market growth, but investors should also consider other sectors such as healthcare, consumer discretionary, and financials. These sectors have shown potential for growth, driven by factors such as technological advancements, increased consumer spending, and regulatory changes.

Investment Opportunities

Tech Stocks: Companies like Apple, Microsoft, and Amazon continue to dominate the tech sector. These companies have strong fundamentals, including robust revenue growth, strong balance sheets, and innovative products. Investors should consider investing in these companies for long-term growth.

Healthcare Stocks: The healthcare sector has shown potential for growth, driven by factors such as an aging population, increasing healthcare spending, and technological advancements. Companies like Johnson & Johnson and Pfizer are well-positioned to benefit from these trends.

Green Energy Stocks: The shift towards renewable energy and sustainability has created numerous investment opportunities. Companies involved in renewable energy, such as Tesla and SolarEdge, are expected to benefit from increasing government incentives and consumer demand.

Case Studies

Apple: Apple's strong performance in January 2025 can be attributed to its robust product lineup, including the iPhone 15 and the Apple Watch Series 8. The company's focus on innovation and customer satisfaction has helped it maintain its market leadership position.

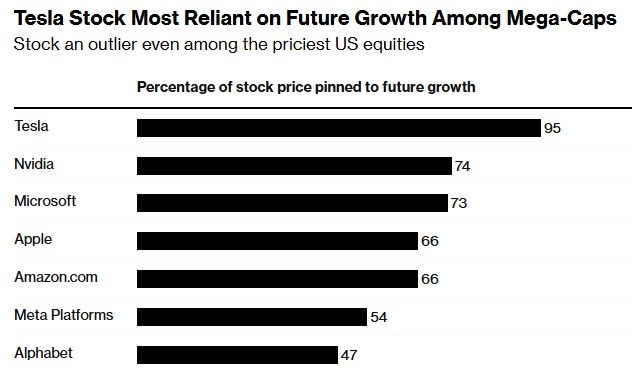

Tesla: Tesla's continued growth in the electric vehicle market has been a key driver of its stock performance. The company's expansion into new markets and the introduction of new models have contributed to its strong growth trajectory.

Conclusion

The US stock market in January 2025 presents a mix of opportunities and challenges. Investors should focus on companies with strong fundamentals, innovative products, and the potential to benefit from long-term trends. By carefully analyzing market trends and economic indicators, investors can make informed decisions and capitalize on the opportunities available in the US stock market.