The stock market is a dynamic entity, constantly evolving with market trends, economic indicators, and global events. As investors, staying informed about the latest developments is crucial to making well-informed decisions. One of the key tools that traders and investors use to stay ahead of the curve is US stock futures. In this article, we will provide you with an update on the current state of US stock futures, highlighting the latest trends, factors influencing them, and potential risks and opportunities.

Understanding US Stock Futures

US stock futures are financial contracts that allow investors to speculate on the future price of a stock or a basket of stocks. They are often used as a barometer of investor sentiment and market expectations. By trading futures, investors can gain exposure to the stock market without owning the actual shares.

Current Trends in US Stock Futures

As of the latest update, several key trends have been observed in the US stock futures market:

- Rising Stock Prices: The S&P 500 futures have been trading at record highs, reflecting strong investor optimism and confidence in the US economy.

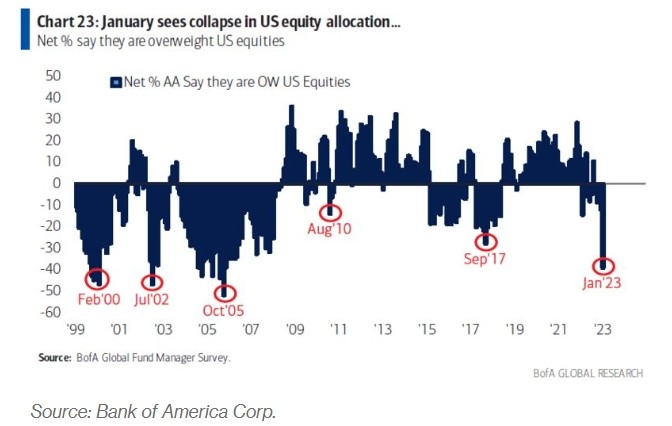

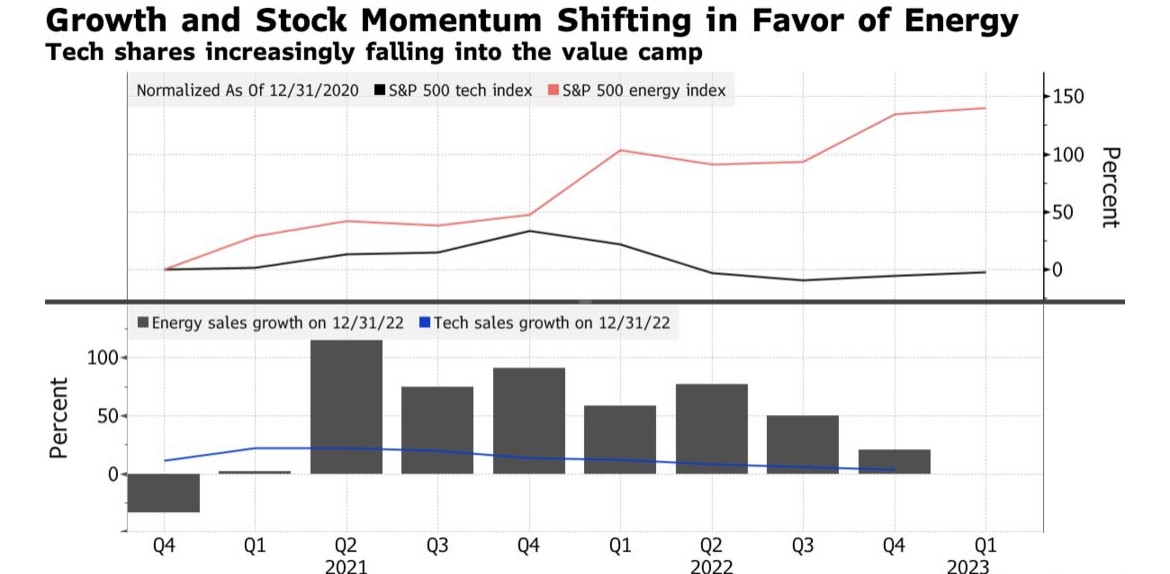

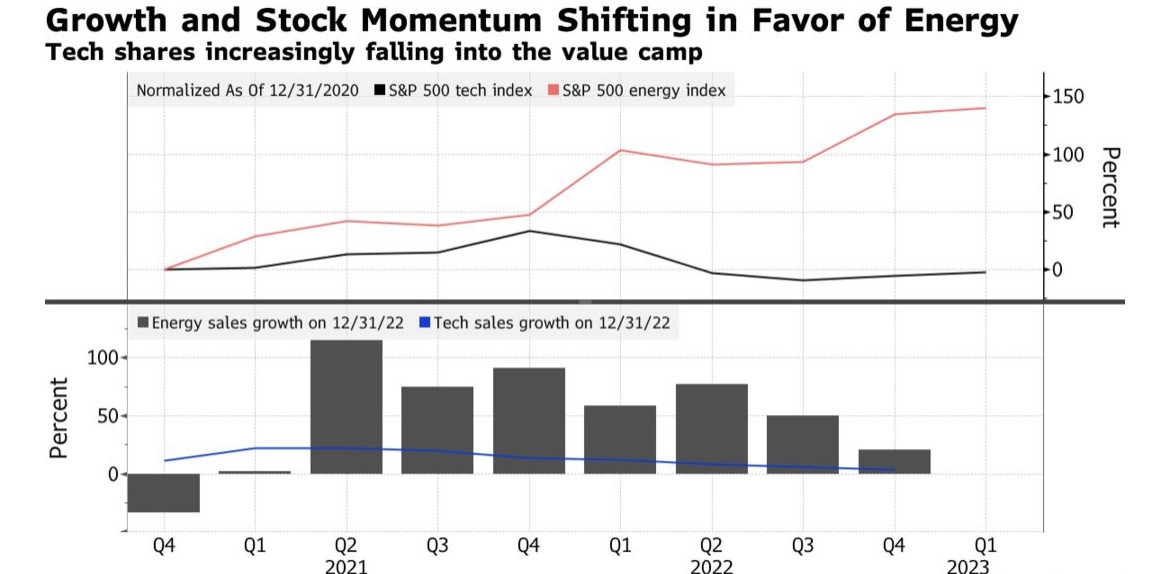

- Sector Rotation: Investors have been rotating out of tech stocks and into sectors such as energy, financials, and consumer discretionary, seeking higher growth and value opportunities.

- Inflation Concerns: The rise in inflation has been a significant concern for investors, leading to increased volatility in stock futures.

Factors Influencing US Stock Futures

Several factors can influence the movement of US stock futures:

- Economic Indicators: Economic indicators such as GDP growth, unemployment rates, and inflation data can significantly impact investor sentiment and futures prices.

- Monetary Policy: The Federal Reserve's monetary policy decisions, including interest rate changes and quantitative easing programs, can have a profound effect on stock futures.

- Political Events: Political events, such as elections and policy changes, can create uncertainty and volatility in the stock market.

Case Studies:

- Tesla (TSLA): The stock of Tesla has been a major driver of the S&P 500 futures, with significant volatility driven by the company's earnings reports, production updates, and CEO Elon Musk's tweets.

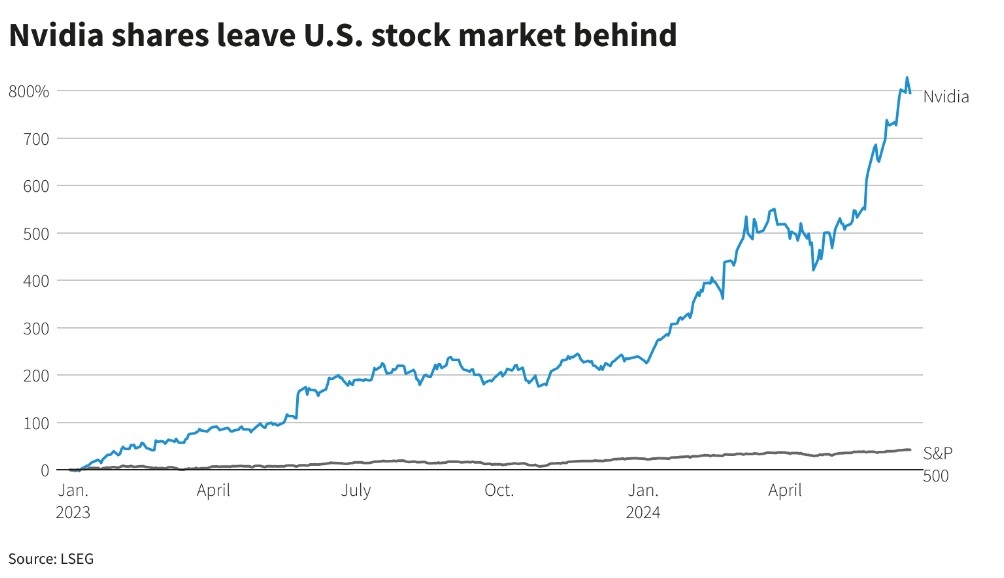

- NVIDIA (NVDA): The chipmaker's stock has seen strong performance, leading to increased demand for tech-related futures. However, concerns about supply chain disruptions and global shortages have also created volatility.

Risks and Opportunities

While US stock futures offer opportunities for profit, they also come with significant risks:

- Market Volatility: The stock market is prone to sudden and unpredictable movements, which can lead to significant losses for investors.

- Liquidity Risk: Some futures contracts may have limited liquidity, making it difficult to exit positions at desired prices.

- Interest Rate Risk: Changes in interest rates can impact the value of futures contracts, especially for longer-term contracts.

Conclusion

Staying informed about the latest trends and factors influencing US stock futures is crucial for investors and traders. By understanding the current market dynamics and potential risks, you can make more informed decisions and maximize your returns. Remember to always conduct thorough research and consider seeking professional advice before making investment decisions.