Introduction

The US steel industry has always been a cornerstone of the American economy, and US Steel (X) has been at the forefront of this industry for over a century. But what does the current stock value of US Steel tell us about its future prospects? In this article, we delve into the factors that influence US Steel's stock value and offer insights into what investors should be looking for.

Historical Stock Performance

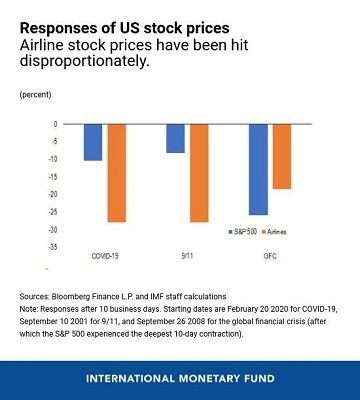

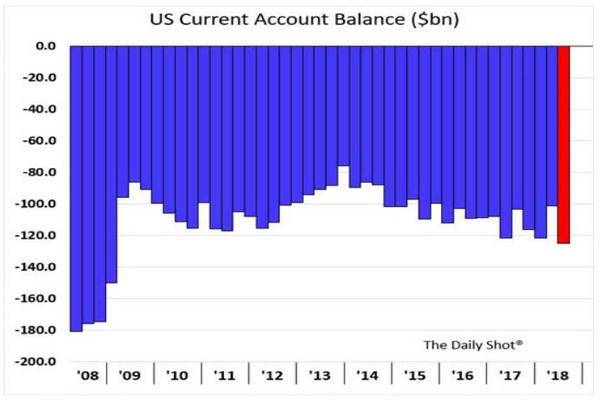

Over the years, the stock price of US Steel has been volatile, reflecting the ups and downs of the steel industry. Historically, the company has experienced periods of significant growth, followed by downturns due to economic cycles and industry-specific challenges. For instance, during the early 2000s, the stock saw substantial growth as demand for steel surged, driven by the construction boom in the United States. However, the stock took a nosedive during the 2008 financial crisis, as the construction industry contracted.

Current Stock Value

As of the time of writing, the stock price of US Steel (X) is around $24 per share. This value is influenced by a variety of factors, including:

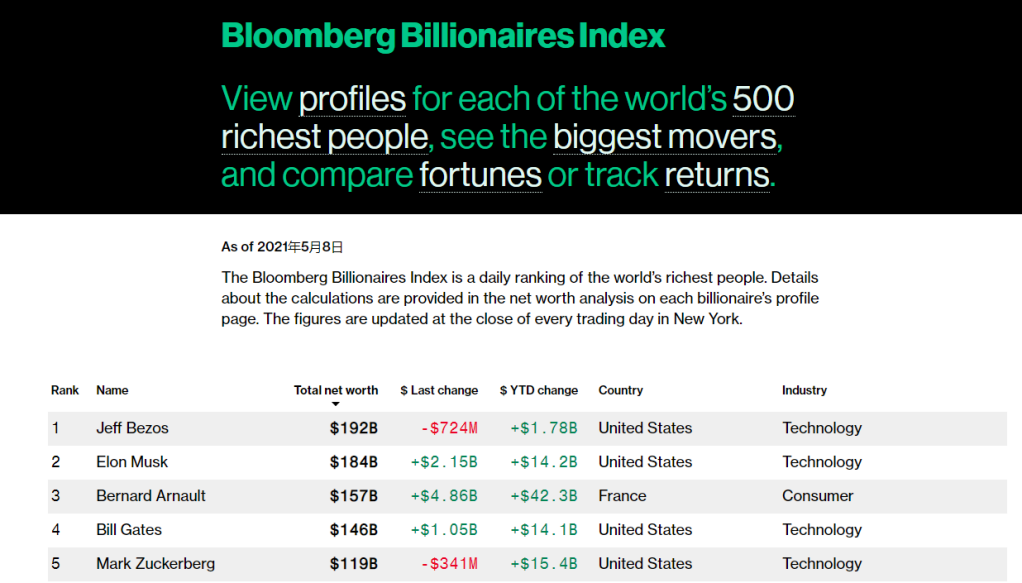

Economic Conditions: The health of the economy plays a crucial role in determining the demand for steel. In times of economic growth, steel demand tends to rise, pushing up the stock value. Conversely, during economic downturns, steel demand falls, negatively impacting the stock value.

Industry Supply and Demand: The supply and demand dynamics within the steel industry also affect US Steel's stock value. If there is an oversupply of steel, prices may drop, negatively impacting the company's earnings. On the other hand, if demand outstrips supply, prices may rise, leading to higher earnings and a higher stock value.

Competition: The level of competition within the steel industry is another crucial factor. With numerous steel producers around the world, US Steel must compete on price, quality, and innovation to maintain its market share. Increased competition can lead to lower margins and a lower stock value.

Regulatory Environment: The regulatory environment also plays a role in determining US Steel's stock value. For instance, tariffs and trade policies can impact the cost of steel imports and, subsequently, the company's earnings.

Future Prospects

Looking ahead, the future of US Steel's stock value depends on several factors:

Economic Growth: If the global economy continues to grow, the demand for steel is likely to rise, positively impacting the company's stock value.

Industry Consolidation: The steel industry has been witnessing consolidation, with larger players acquiring smaller ones. This trend could lead to increased market power and higher prices for steel, potentially boosting US Steel's earnings and stock value.

Technological Innovation: Investing in new technologies can help US Steel reduce costs and improve efficiency, leading to higher profitability and a higher stock value.

Environmental Initiatives: As the world moves towards sustainable practices, companies that invest in environmentally friendly technologies and processes are likely to benefit. US Steel's commitment to sustainability could play a role in determining its future stock value.

Conclusion

Understanding the factors that influence the stock value of US Steel is crucial for investors looking to invest in the company. By considering economic conditions, industry dynamics, competition, and the regulatory environment, investors can gain valuable insights into the future prospects of US Steel and make informed investment decisions.