Are you an Australian investor looking to diversify your portfolio? Trading U.S. stocks can be a great way to achieve this. The U.S. stock market is one of the largest and most liquid in the world, offering a wide range of investment opportunities. In this guide, we'll explore how to trade U.S. stocks from Australia, the benefits of doing so, and some tips to help you get started.

Understanding the U.S. Stock Market

The U.S. stock market is made up of several exchanges, the most notable being the New York Stock Exchange (NYSE) and the NASDAQ. These exchanges list stocks from a wide variety of industries, including technology, healthcare, finance, and consumer goods. By trading U.S. stocks, Australian investors can gain access to some of the world's most successful and innovative companies.

How to Trade U.S. Stocks from Australia

Trading U.S. stocks from Australia is relatively straightforward, but there are a few key steps to follow:

Open a Brokerage Account: The first step is to open a brokerage account with a firm that offers access to U.S. stocks. Many Australian brokers offer this service, but it's important to choose one that is reputable and has a good track record.

Understand the Risks: Trading U.S. stocks involves the same risks as trading any other stocks. It's important to do your research and understand the potential risks before investing.

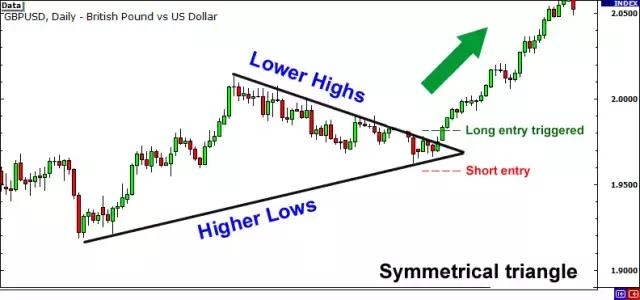

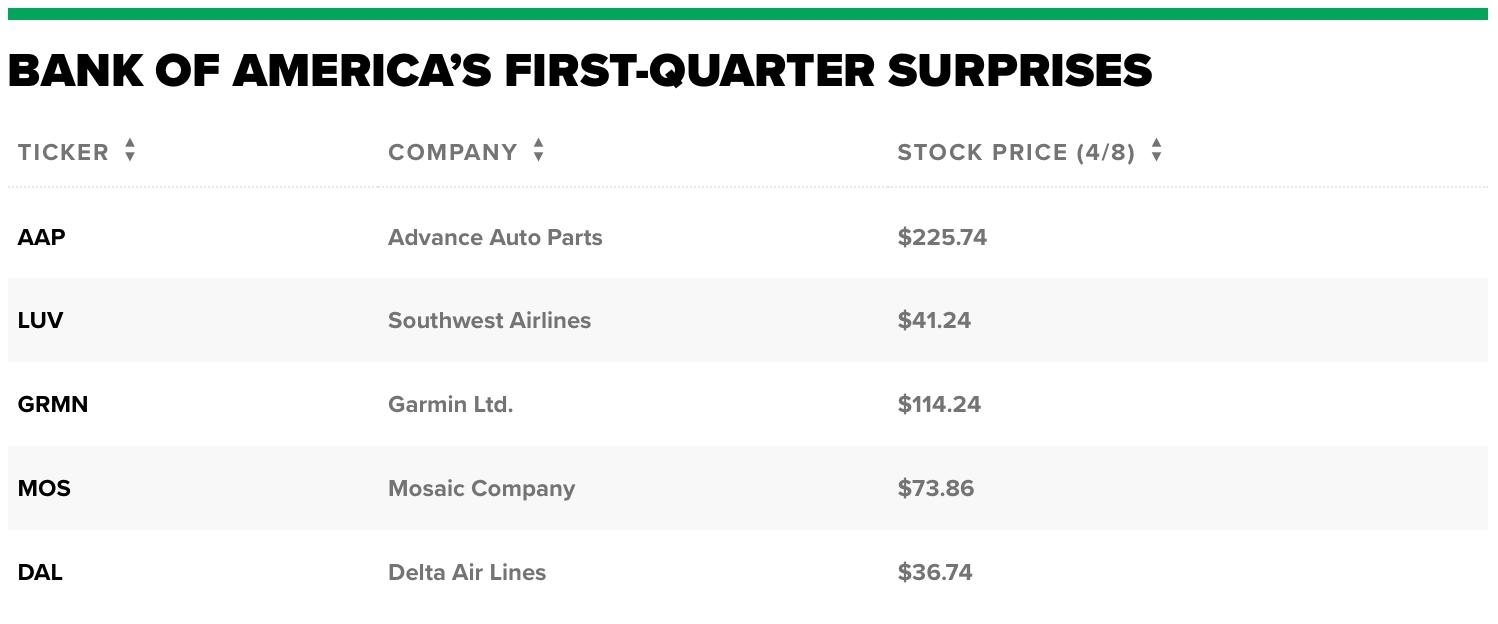

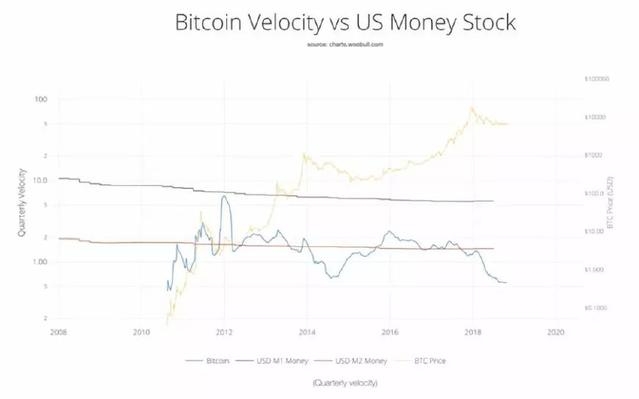

Research and Analyze: Before making any investment decisions, it's crucial to research and analyze the companies you're interested in. This includes looking at their financial statements, market trends, and competitive landscape.

Place Your Trade: Once you've done your research, you can place your trade through your brokerage account. Most brokers offer a variety of order types, including market orders, limit orders, and stop orders.

Benefits of Trading U.S. Stocks from Australia

There are several benefits to trading U.S. stocks from Australia:

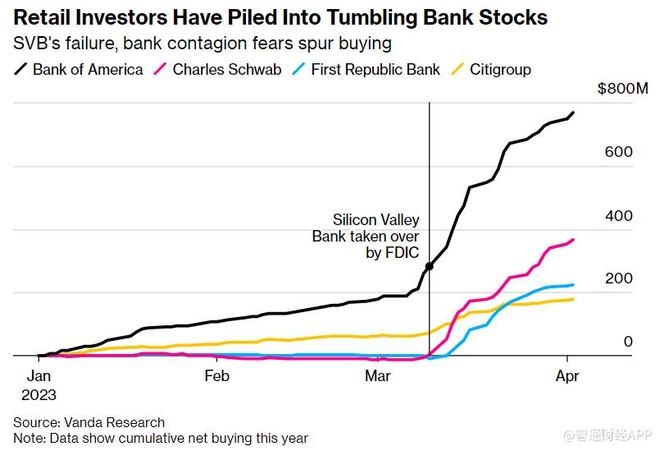

Diversification: The U.S. stock market offers a wide range of investment opportunities, allowing you to diversify your portfolio and reduce your risk.

Access to World-Class Companies: By trading U.S. stocks, you can invest in some of the world's most successful and innovative companies.

Potential for Higher Returns: The U.S. stock market has historically offered higher returns than many other markets.

Tips for Trading U.S. Stocks from Australia

Here are some tips to help you get started trading U.S. stocks from Australia:

Start Small: If you're new to trading, it's a good idea to start small and gradually increase your investment as you become more comfortable.

Stay Informed: Keep up-to-date with market news and developments, as this can have a significant impact on stock prices.

Use Stop-Loss Orders: A stop-loss order can help protect your investment by automatically selling a stock if it falls below a certain price.

Consider Using a Robo-Advisor: A robo-advisor can help automate your investment strategy and provide personalized advice based on your risk tolerance and investment goals.

Case Study: Investing in U.S. Tech Stocks

One of the most popular sectors in the U.S. stock market is technology. Companies like Apple, Google, and Microsoft are among the largest and most successful in the world. An Australian investor looking to invest in U.S. tech stocks could consider investing in a technology ETF, which offers exposure to a basket of tech stocks.

In conclusion, trading U.S. stocks from Australia can be a great way to diversify your portfolio and gain access to world-class companies. By following these steps and tips, you can get started on your journey to investing in U.S. stocks.