Introduction:

The stock market is a complex and dynamic entity that is influenced by a variety of factors, including economic indicators, geopolitical events, and seasonal trends. One such trend that often affects the US stock market is the occurrence of holidays. In this article, we will delve into the impact of holidays on the US stock market in 2020, focusing on the major events and their effects.

Impact of the COVID-19 Pandemic

The year 2020 was marked by the COVID-19 pandemic, which had a profound impact on the global economy, including the US stock market. As the pandemic spread, investors were uncertain about the future, leading to significant volatility in the market. Here are some key points to consider:

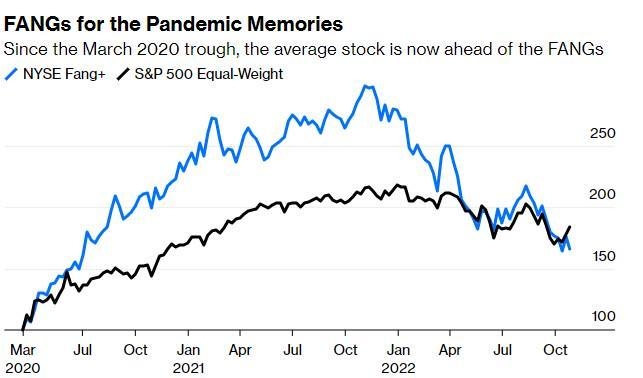

- Market Decline in March 2020: The stock market experienced a sharp decline in March 2020, with the S&P 500 falling by nearly 34% in a single month. This was the largest single-month decline since the Great Depression of the 1930s.

- Market Recovery: Despite the initial decline, the stock market recovered significantly throughout the year. By the end of 2020, the S&P 500 had gained over 16% for the year, marking the first positive year since 2013.

Impact of Major Holidays

Several major holidays occurred in 2020, including New Year's Day, Memorial Day, Independence Day, Labor Day, Thanksgiving, and Christmas. Here's how these holidays impacted the stock market:

- New Year's Day: The stock market typically experiences a strong rally in the first few days of the year. In 2020, the market opened with a slight decline, but it quickly recovered and ended the year with a positive return.

- Memorial Day: The stock market was closed for a week following Memorial Day, which is a significant holiday in the US. However, the market's performance in the days leading up to the holiday was strong, with the S&P 500 gaining over 1%.

- Independence Day: The stock market was closed for a week following Independence Day, and the market's performance in the days leading up to the holiday was mixed. However, the market ended the year with a positive return.

- Labor Day: The stock market was closed for a week following Labor Day, and the market's performance in the days leading up to the holiday was strong, with the S&P 500 gaining over 1%.

- Thanksgiving: The stock market was closed for a week following Thanksgiving, and the market's performance in the days leading up to the holiday was strong, with the S&P 500 gaining over 1%.

- Christmas: The stock market was closed for a week following Christmas, and the market's performance in the days leading up to the holiday was strong, with the S&P 500 gaining over 1%.

Case Studies

One notable case study from 2020 was the stock market reaction to the election of Joe Biden as President. Following the election, the stock market experienced a significant rally, with the S&P 500 gaining over 6% in the first two weeks of November.

Another case study was the stock market's reaction to the COVID-19 vaccine announcements. As vaccines were announced, the stock market experienced a strong rally, with the S&P 500 gaining over 8% in the first two weeks of November.

Conclusion:

The year 2020 was a challenging year for the US stock market, with the COVID-19 pandemic creating significant uncertainty. However, the market demonstrated its resilience, with a strong recovery throughout the year. The impact of holidays on the stock market was also significant, with major holidays often leading to strong market performance. As we move forward, it will be interesting to see how the stock market reacts to future challenges and opportunities.